All eyes will be on the Federal Reserve meeting next week. A triple-barreled rate increase is essentially locked in, so traders will put more emphasis on Powell’s commentary and the upcoming GDP report that will reveal whether America is in a technical recession. Over in Europe, there’s another round of inflation data coming up, although the euro might care more about the unfolding political crisis in Italy.

Summer Fed hike

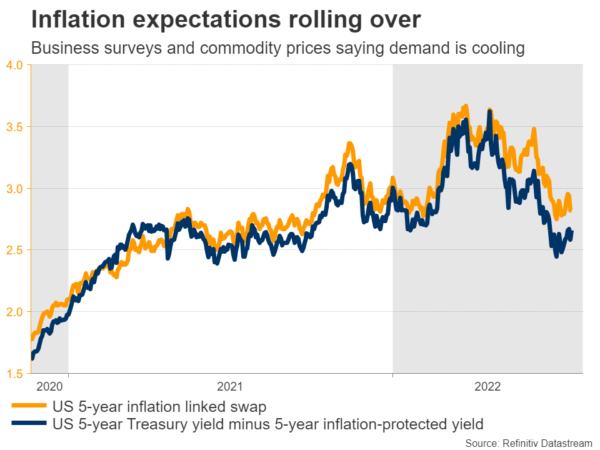

There has been a tremendous shift in global markets recently. Inflation worries have taken a back seat, replaced by concerns around economic growth. While incoming data has been resilient, business surveys increasingly suggest demand is losing power as consumers tighten their belts.

This has been mirrored in commodity prices, with everything from metals to food to energy cooling off. And with shipping costs declining as supply disruptions finally ease, inflation expectations have started to roll over. Market participants are essentially saying the inflation problem will be cured, but mainly because demand will suffer.

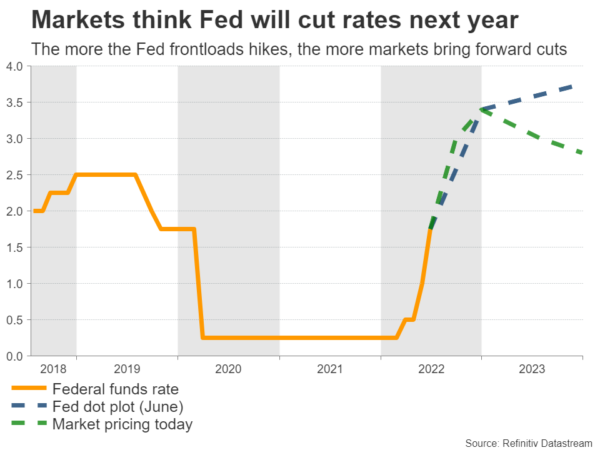

In this light, the Fed decision on Wednesday will be crucial. A rate increase of 75 basis points is already fully priced into money markets, with a chance of around 15% for an even bigger 100bps move. Admittedly though, that doesn’t seem very realistic as even arch-hawks like Waller did not support such an aggressive move.

With the data pulse weakening and investors screaming that inflation is about to lose its punch, there’s no real reason to strike so hard. And since this is one of the smaller meetings without new economic forecasts, the focus will be entirely on Chairman Powell’s press conference. The burning question is what would it take for the Fed to slow down – would a downturn be enough?

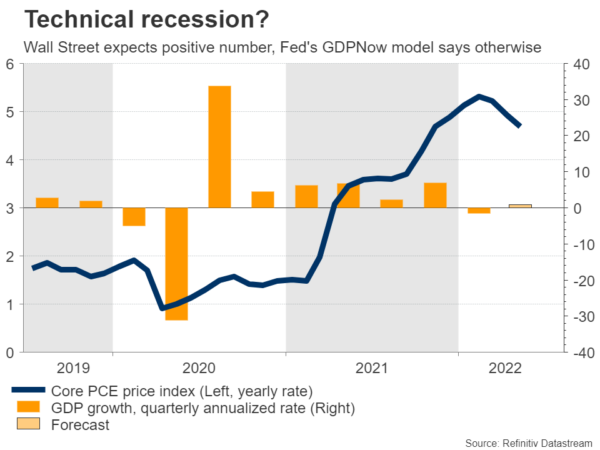

We’ll find out whether the economy is already in recession on Thursday, when the preliminary GDP numbers for Q2 are released. The economy contracted last quarter and another negative print would meet the definition of a technical recession. Wall Street economists expect a positive number, while in contrast, the Atlanta Fed GDPNow model points to a 1.6% decline.

As for the dollar, it has gone on a rampage lately, obliterating every other major currency. The greenback finds itself in a unique position, able to benefit both from nerves around a global recession and from concerns that rampant inflation could keep the Fed on its warpath. It has been the ultimate all-weather currency and this dynamic is unlikely to change until the growth outlook for the rest of the world improves.

There’s also a flurry of data releases scheduled for Friday, including the core PCE price index.

Euro on shaky legs

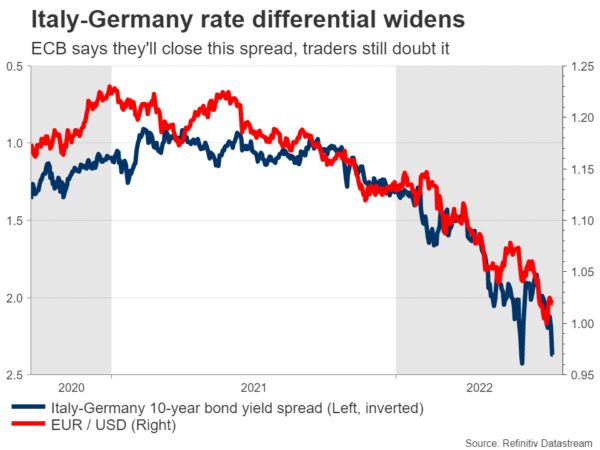

Across the Atlantic ocean, the Eurozone’s inflation stats for July will hit the markets on Friday, alongside the first estimate of GDP for Q2. The European Central Bank raised interest rates by more than expected this week, and still the euro could not muster enough strength to rally.

The euro’s nightmare keeps getting worse as the energy crisis has put the squeeze on consumers and higher borrowing costs will only add to recessionary risks. Traders have started to sense that Europe will be at the epicenter of any global recession, and the latest business surveys unfortunately confirm that.

New business orders have been falling for three months now and the rate of loss has accelerated lately, which suggests the Eurozone economy is likely to contract in the third quarter. On top of everything, political risks are back on the menu with a leadership crisis brewing in Italy.

Mario Draghi’s government has collapsed and the nation is headed for early elections in September. Opinion polls suggest a coalition of Eurosceptic far-right forces will be victorious, which could reignite fears around a sovereign debt crisis in an economy where public debt is running at 150% of GDP, testing the power of the ECB’s new anti-fragmentation tool.

Yen awaits key data

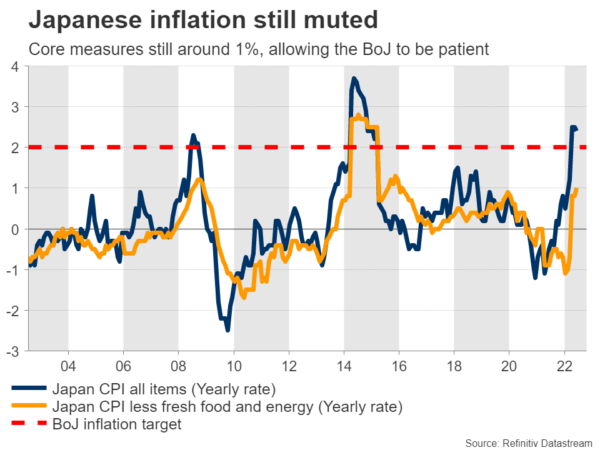

The Bank of Japan kept its foot heavy on the gas this week, in contrast to every other major central bank. With core inflation still muted, Governor Kuroda played down the prospect of any tightening, even going as far as saying that raising rates a little wouldn’t stop the yen’s weakness.

It would certainly help though. The two culprits behind the yen’s collapse have been widening interest rate differentials because of the BoJ’s refusal to adjust policy and the loss of Japan’s trade surplus because of soaring energy prices. Hence, those factors need to change before the yen finds a bottom. Alternatively, if foreign central banks stop raising rates, that could also do the trick.

Despite all the rhetoric, the BoJ seems to be headed for a pivot, perhaps in September. Kuroda was trying a shock-and-awe therapy to lift inflation expectations in Japan and kickstart the economy, but devaluing the yen any further won’t help. An extremely weak currency is counterproductive if you import more than you export.

The inflation data for Tokyo that are due out on Friday will be a key piece of this puzzle, alongside the latest jobs report and retail sales.

Finally, Australia’s inflation numbers for Q2 will also be released on Wednesday.