Key Highlights

- The British Pound remains well supported for more gains above 1.3500 against the US Dollar.

- There are two bullish trend lines forming with support at 1.3460 and 1.3240 on the 4-hours chart of GBP/USD.

- The Dallas Fed manufacturing Index in Sep 2017 rose from 17.8 to 21.3.

- The US New Home Sales figure will be released for August 2017, which is forecasted to increase 3.3% (MoM).

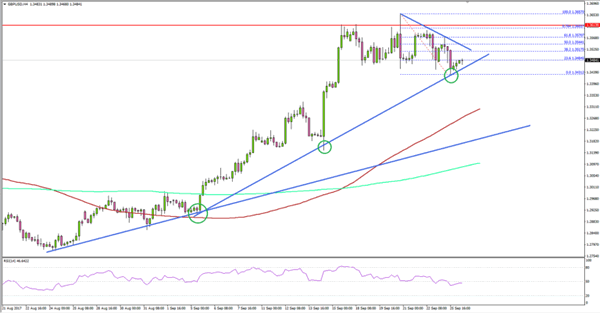

GBPUSD Technical Analysis

The British Pound started a nasty uptrend from the 1.3000 swing low against the US Dollar. The GBP/USD pair is now well above 1.3400 and eyeing further gains.

The pair moved above the 1.3500 level recently and traded as high as 1.3657 before starting a correction. It corrected towards 1.3440 where buyers emerged. On the downside, there are two bullish trend lines forming with support at 1.3460 and 1.3240 on the 4-hours chart.

Moreover, the pair is well above the 100 simple moving average (H4) and 1.3400. On the upside, there is a connecting bearish trend line with resistance at 1.3520.

Should there be a break of 1.3520, GBP/USD could retest the 1.3600 handle in the near term. An intermediate resistance is the 50% Fib retracement level of the last decline from the 1.3657 high to 1.3431 low at 1.3544.

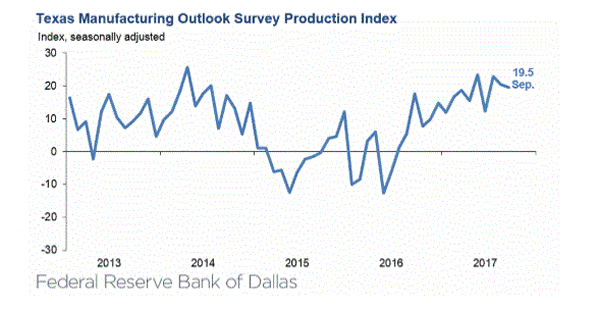

Dallas Fed Manufacturing Index

Recently in the US, the Dallas Fed manufacturing for Sep 2017 (Prelim) was released by the Federal Reserve Bank of Dallas. The forecast was slated for a decline from the last reading of 17.0 to 11.5.

The actual result was better, as there was a rise in the business index from 17.0 to 21.3. On the other hand, the production index, measuring state manufacturing conditions decreased from 20.3 to 19.5.

The report added that:

Labor market measures suggested faster employment growth and longer workweeks this month. The employment index came in at 16.3, its highest level since April 2014. Twenty-eight percent of firms noted net hiring, compared with 11 percent noting net layoffs. The hours worked index rose four points to 18.4.

The overall result was positive, which caused minor downsides in GBP/USD. However, the pair is still above its uptrend support and eying gains above 1.3500.

Other Economic Releases to Watch Today

US New Home Sales for August 2017 – Forecast +3.3% (MoM) versus -9.4% previous.

S&P/Case-Shiller Home Price Indices for July 2017 (YoY) – Forecast +5.8%, versus +5.7% previous.

Fed’s Yellen’s Speech.