American stocks declined while the U.S. dollar retreated after the strong American consumer inflation data. The numbers showed that the country’s inflation surged to a multi-decade high of 9.1% in June. That increase was bigger than the median estimates of 8.8%. However, core inflation rose at a smaller pace than what analysts were expecting. These numbers imply that the Federal Reserve will likely embrace a more hawkish tone in the coming months. Analysts are now pricing in a 100 basis points hike when the bank meets later this month. Today, the U.S. dollar will react to the latest producer price index (PPI) data.

American equities also retreated as several large American companies started publishing their quarterly results. Delta delivered a bigger profit than expected but warned that inflation will likely lead to thinner margins later this year. This view was shared by PepsiCo, the second-biggest beverage company in the world. Many large companies are expected to publish their results today. This includes companies like Taiwan Semiconductor, JP Morgan, Morgan Stanley, and Cintas. These are important companies because they lead their respective industries and are key barometers of the economy.

The Canadian dollar rose sharply against the US dollar after the latest interest rate decision by the Bank of Canada. The BoC caught most investors by surprise when it decided to hike interest rates by 100 basis points. It pushed the official rate to 2.25% and warned that more hikes will likely happen later this year if inflation remains stubbornly high. The economic calendar is relativle light today. The only important events will be the the U.S. PPI figures and initial jobless claims.

USDCAD

The USDCAD pair declined to an intraday low of 1.2945, the lowest level since July 11. On the four-hour chart, the pair has moved slightly below the 25-day moving average while the Stochastic Oscillator and the Relative Strength Index (RSI) have pointed downwards. The pair has also formed a triple-top pattern. Therefore, the pair will likely have a bearish breakout as sellers target the support at 1.2850.

EURUSD

The EURUSD pair dropped to the parity level after the strong US consumer inflation data. It then bounced back to the current 1.008, which was the highest point since Tuesday. It remains below the 25-day and 50-day moving averages while the Relative Strength Index (RSI) and the Stochastic Oscillator are pointing upwards. Therefore, the pair will likely continue oscillating in this range and then have a bearish breakout.

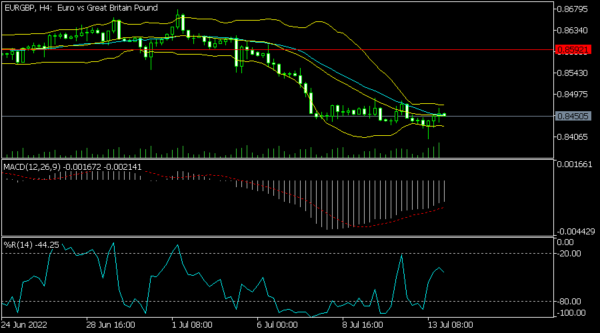

EURGBP

The EURGBP pair moved sideways as investors focused on the political happenings in the UK. It is trading at 0.8453, which is slightly above this week’s low of 0.8400. On the four-hour chart, Bollinger Bands have narrowed while the MACD remains below the neutral point. The Williams % Range has moved above the oversold level. Therefore, the pair will likely have a bearish breakout as sellers target the next support at 0.8400.