The Canadian dollar depreciated on Monday hit by rising risk aversion as geopolitical events around the world dominated headlines. The German elections over the weekend showed that not even the largest member of the European Union is immune to the rise of eurozone opposition within its borders. The situation in North Korea continues to be elevated as Donald Trump’s tweets were called a declaration of war by the asian nation Foreign Minister.

Japanese Prime Minister Shinzo Abe has called a snap election of the lower house. Rising support as the result of the situation in North Korea has emboldened Abe to call for elections in October. The move is intended to weaken opponents, but like in the United Kingdom the move is a gamble that can backfire with a new national party offering the biggest threat. His major objective seems to be achieving a majority with the aim of reforming the constitution.

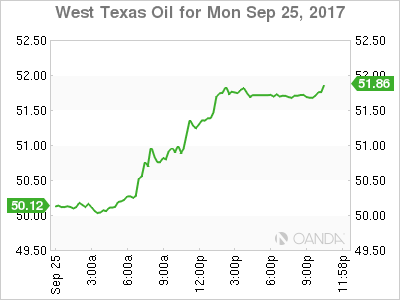

Oil is higher at the beginning of the week after the independence referendum vote in Northern Iraq could lead to disruptions in the oil rich area. The vote was not agreed to with the central Iraqi government and has drawn criticisms and threats of pipeline closures from other nations.

Trade representatives for Canada, Mexico and the United States are in Ottawa for the third round of talks of NAFTA renegotiation. Canadian negotiators have spoken out about the lack of details from the US team and despite good progress so far it is hard to predict when or how the talks will end.

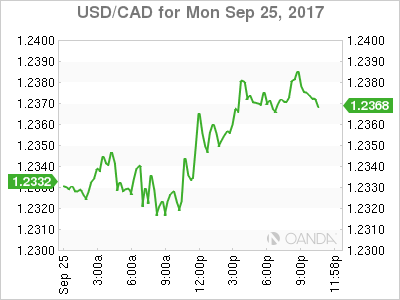

The USD/CAD rose 0.205 percent on Monday. The currency pair is trading at 1.2364 as geopolitical risks are driving the market. Safe havens have been the biggest movers in the market. The potential disruption of Iraqi supply has put oil prices higher, but offered no support to the loonie.

This week will have few economic data points for CAD traders. Bank of Canada (BoC) governor Stephen Poloz will make his first appearance since the surprise September rate hike took the benchmark rate to 1.00 percent. The central bank was quiet ahead of announcing the monetary policy decision in stark contrast with the July meeting when it gave the market a clear heads up on its intentions. The market was expecting the 25 basis points rate hike to come in October, but the BoC thought it best to do it sooner rather than later with no warning. Poloz’s speech will be filled with the bank’s assessment of the economy that prompted the BoC to make that decision.

Later in the week the monthly GDP figures will be announced which could validate Mr Poloz’s eagerness to hike. A slowdown in growth could also raise question marks about his decision given that as expected the European Central Bank (ECB) and the U.S. Federal Reserve did not touch their benchmark rates. The Fed did finally announce the details of its balance sheet reduction program. December will be once again host the most important meetings of the year for most central banks. The Fed could hike a third time, but it all depends on the economic performance in the third quarter.

Energy in the US rose by 3.029 in the last 24 hours. The price of West Texas Intermediate is trading at $51.73 due to comments about a rebalancing of the market after the production cut agreement between the Organization of the Petroleum Exporting Countries (OPEC) and other major producers. The situation in Iraq, where an independence referendum took place on Monday. Iraqi Kurds are voting against the wishes of the central government and other nations. Turkey is on alert and has threatened to cut the pipeline taking Northen Iraqi oil to market.

Market events to watch this week:

Tuesday, September 26

10:00am USD CB Consumer Confidence

Wednesday, September 27

8:30am USD Core Durable Goods Orders m/m

10:30am USD Crude Oil Inventories

4:00pm NZD Official Cash Rate

4:00pm NZD RBNZ Rate Statement

Thursday, September 28

8:30am USD Final GDP q/q

8:30am USD Unemployment Claims

Friday, September 29

4:30am GBP Current Account

8:30am CAD GDP m/m