Energy prices have turned into the most important issue in economics. Their trajectory will shape the future behavior of consumers, central banks, and investors alike. Oil prices have finally started to lose power, joining the ranks of other struggling commodities. If the rout deepens, both inflation and recession nerves could calm down a little, opening the door for relief rallies in FX and equity markets.

All about oil

There has been a seismic shift in global markets lately. Concerns around inflation running wild have finally been dialed back, overshadowed by risks about economic growth as interest rates move higher at lightning speed and government spending is rolled back.

A barrage of leading indicators has put traders on recession watch. Business surveys are warning about a stunning drop in demand, several major companies are either laying off workers or have frozen hiring, famous retailers like Walmart are unable to unload inventory, the housing market has started to cool, and consumer confidence is tanking.

Energy costs are in the eye of this storm. The dramatic spike in prices this year has dampened economic growth by squeezing the real incomes of consumers, and amplified inflationary pressures at the same time, forcing the Federal Reserve to push even harder with rate increases.

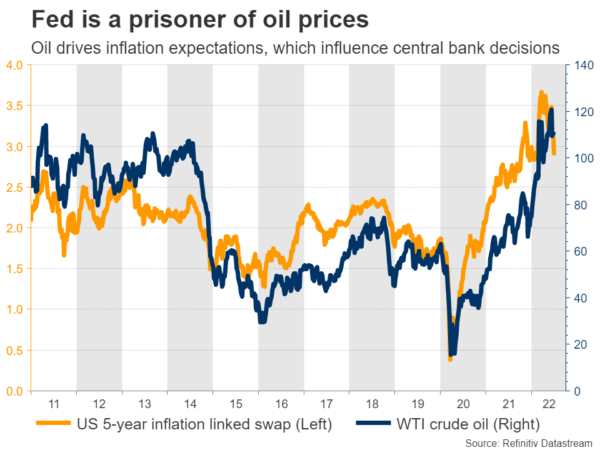

It all comes back to inflation expectations. Oil prices are one of the main drivers of where market participants expect inflation to be in the coming years, which in turn is a crucial variable in central bank decisions. The Fed doesn’t need to be so aggressive with rate hikes to extinguish inflation if oil prices cool down.

Why is oil so expensive?

The epic rally in oil started with pandemic disruptions. Shutting down the global economy led to some massive imbalances, with supply unable to catch up to soaring demand when everything reopened. But it was the invasion of Ukraine that really wreaked havoc with energy markets.

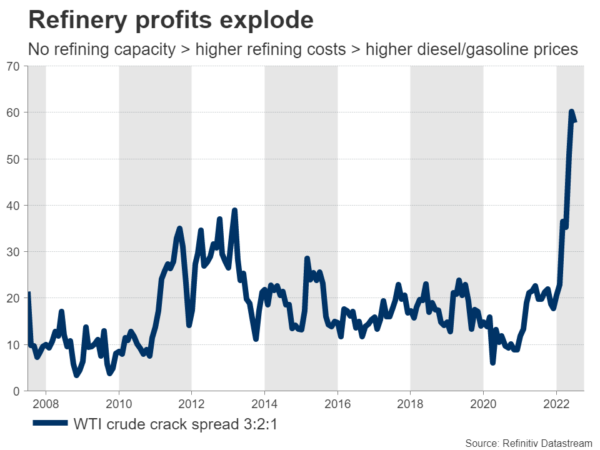

Equally critical are refinery margins – the cost of processing crude oil into refined products like gasoline. This cost has risen to astronomical levels, accounting for a third of the price of gas at the pump because the industry is stretched to its limits.

Setting up a refinery takes years, it is very expensive, and might require decades to recoup the investment. That’s why America hasn’t built one since 1977. Oil executives don’t see it as an attractive use of capital in an industry going out of style. In fact, some refineries that were near retirement were closed early during the pandemic, when there was no demand.

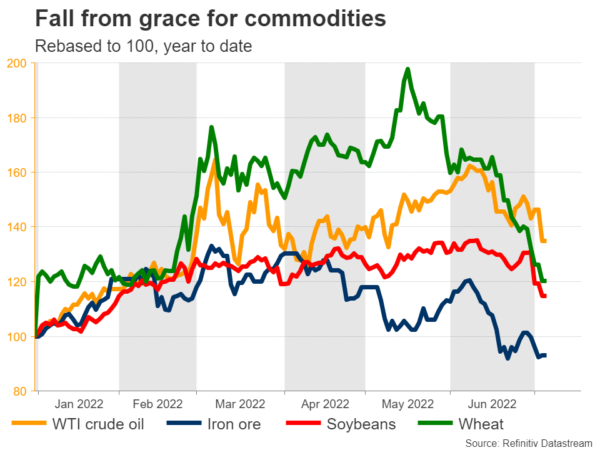

Concerns about recession have hit every commodity lately and have even halted the rally in so-called gasoline crack spreads – a proxy for refinery margins.

FX and stocks

It is never a good sign when commodities sell off because of demand fears, but at least, a drastic reduction in raw material costs will dispel some concerns around inflation. In turn, that could have serious implications for both currency and equity markets.

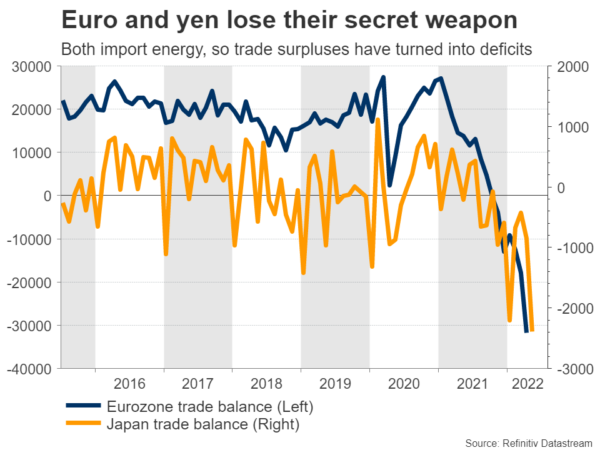

Let’s start with FX. Soaring energy prices have devastated both the euro and the yen, by depriving them of their main historical advantage – a massive trade surplus. Both the Eurozone and Japan are running large trade deficits now because they have to pay more to import energy products. This also implies slower growth in those economies.

Therefore, a sustained decline in oil prices could offer some much-needed relief to the euro and yen, and simultaneously hamstring the US dollar since the Fed wouldn’t need to raise interest rates so much.

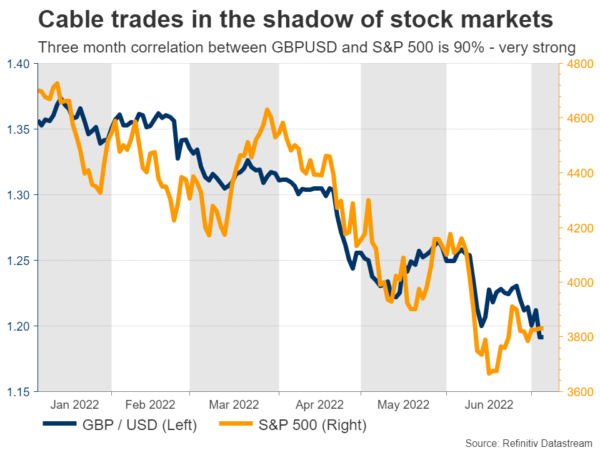

The same logic applies to the British pound and stocks. Lower oil prices lessen the pressure on the Fed to act, which is music to the ears of equity markets that are sensitive to rate expectations. And since Cable has essentially turned into a proxy for global risk sentiment, any relief in stocks would likely spill over into sterling.

What can trigger this?

Now to be clear, none of this is on the cards if the world economy enters a recession and there’s panic in markets. The yen might strengthen as investors take shelter in bonds and yields across the world drop, but that’s it. Neither the euro nor sterling nor stocks are likely to perform well in such an environment, even if oil prices collapse.

What is needed is some catalyst that pushes energy prices down for healthy reasons, with more supply coming online. The most powerful trigger would be a ceasefire in Ukraine. Unfortunately, there are no signs this might happen as the two sides are not even negotiating.

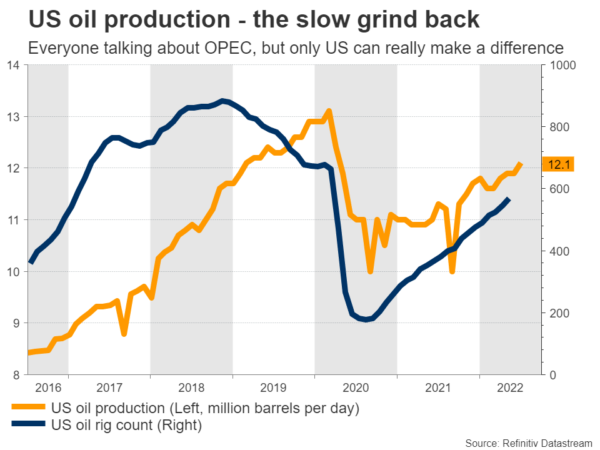

Another way would be increased production from OPEC members. Everyone is looking to Saudi Arabia, yet reports suggest the Kingdom is almost tapped out, having little spare capacity. Supply outages in Libya and Ecuador amid social unrest have exacerbated the shortage, while negotiations with Iran and Venezuela have gone nowhere.

Instead, the only player that can ride to the rescue is US shale. American companies have been reluctant to really open the taps because of poor government incentives, but there has been a slow increase in production. The White House is desperate to cool oil prices ahead of the midterm elections, so there is a chance it finds a way to accelerate this process.

Big picture

All told, how the energy crisis concludes will be pivotal for global markets, via the spillover effects for monetary policy and trade balances. While a retreat in oil prices can plant the seeds for a turnaround in other assets, the reasons why oil is falling are equally important. A drop because of demand fears is not the same as a drop due to supply returning.

The charts suggest this uptrend is losing power, although some catalyst is required to give credence to this view. Until then, it is difficult to envision anything more than relief rallies in equities and currencies.