North Korea, Brexit and German elections distract from Hawkish Fed

The US dollar is higher against major pairs at the end of trading on September 22. The NZD and the EUR are the main exceptions with elections in the next 48 hours in both regions. Parliamentary elections will begin in New Zealand on Friday, September 22. The ruling party is making a comeback in the polls and has given the Kiwi a boost, but the Labour party could still come up with a shock upset. German elections appear to be a more predictable affair with Angela Merkel’s party the likely to come up on top, but with the rise of the far-right and the need for a partner for a grand coalition the number of seats of other parties will be of utmost importance.

Japanese Prime Minister Shinzo Abe is expected to call a snap election next week. Rising support as the result of the situation in North Korea has emboldened Abe to call for elections in October. The move is intended to weaken opponents, but like in the United Kingdom the move is a gamble that can backfire with a new national party offering the biggest threat. His major objective seems to be achieving a majority with the aim of reforming the constitution.

Economic data release will play a part during the week of September 24 to 29 but since no major release will be published it will be a minor role. In the United States The Consumer Board will release its Consumer confidence index on Tuesday, September 26 at 10:00 am EDT. US durable goods and Crude oil inventories will be published on Wednesday, September 27. The Final GDP estimate will be released on Thursday, September 28 at 8:30 am EDT with a forecasted 3.1 percent.

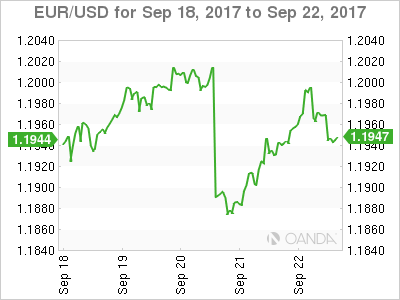

The EUR/USD gained 0.057 on in the last five days. The single pair is trading at 1.1945 after strong purchasing managers index in Europe beat expectations managing to stop the US dollar that the Fed economic projections had sparked in the middle of the week. The pair also got a boost from rumours that the United Kingdom would seek a softer Brexit alternative, although there was not a clear mention of that during Theresa May’s speech on Friday. A softer Brexit scenario and the German elections expected to bring little in the way of surprise brought the single currency slightly higher to end the week.

Germany is expected to reelect Angela Merkel’s party the Christian Democratic Union (CDU) during the Sunday, September 24 election. The main question still unanswered is who will make up the coalition needed to form a government. The Social Democratic Party (SPD) is anticipated to come in second, but is said to want to avoid a repeat of the current grand coalition. Germany has not proven immune to the rise of populism with the rise of the Alternative for Germany (AfD), the far-right party is expected to grab as much as 10 percent of the vote. The party formed in 2013 has gained support by preaching an anti-immigrant message and is could end up being the third largest party and in some scenarios could be the opposition to Merkel’s CDU led grand coalition. Exit polls will be quick to announce the results, but the coalition forming process could last weeks but knowing the allocation of the votes will be instrumental in adding stability to the market.

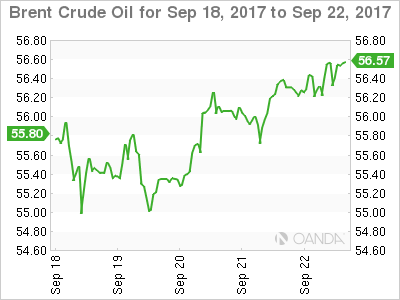

Oil rose 1.76 percent this week. The price of Brent is trading at $56.54 very near weekly highs. Oil prices ended the week with gains after the Organization of the Petroleum Exporting Countries (OPEC) and other major producers met in Vienna to discuss the current production cut agreement. While no big decision was announced OPEC members had been supportive of extending the deal beyond the March 2018 end. Russia’s Energy Minister was more pragmatic and offered no clues other than its too early to discuss a decision. With US production disrupted by tropical storms and the OPEC and other producers reducing their output oil prices have risen.

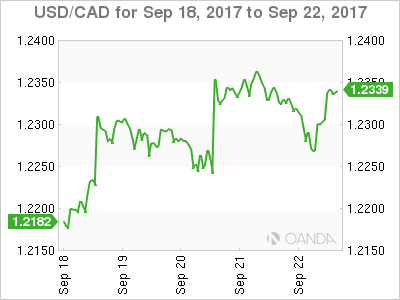

The USD/CAD gained 1.204 percent this week. The currency pair is trading at 1.2344 after Canadian data put a stop to the loonie rally. Canadian inflation underperformed in July rising by only 1.4 percent and retail sales rose by 0.4 percent but a decline in the volume of goods sold is a cause for content. The Canadian dollar appreciated versus the US dollar in early September when the Bank of Canada (BoC) hiked rates earlier than expected. The Canadian benchmark is now 1.00 percent, the same level as back in 2015 before current BoC governor made two pro-active rate cuts ahead of a forecasted fall in oil prices.

The market was originally expecting a rate hike in October, and with the September rate move and mixed data the probabilities are down to 38 percent. What is keeping the odds high is the fact that the Canadian economy surprised with a 4.5 percent annual growth in the second quarter. The US dollar got some support from the Fed on Wednesday when the central bank as anticipated announced the beginning of its balance sheet reduction plans. The hawkish economic projections published at the same time put downward pressure on the loonie as the interest rate divergence will could still favour the US dollar with a December rate hike above 70 percent probability.

Gold lost 2.01 percent in the last five days. The precious metal is trading at $1,295.11 after touching highs of $1,322.02 earlier in the week. Gold managed to score a daily gain on Friday, but could not reverse the downward trend triggered by the U.S. Federal Reserve economic projections showing another rate hike still on the table for this year. The Fed has hiked twice already with the Fed funds rate sitting at a 100 to 125 basis points range. The FedWatch tool developed by the CME shows a 71.4 percent probability of a rate hike at the end of the Fed’s December meeting.

North Korean tension has kept Gold bid as a war or worlds could trigger a real armed response. The move in the yellow metal this week shows the market is more focused on rates than geopolitics, but as always that could be subject to change if there is an escalation in hostilities.

Market events to watch this week:

Sunday, September 24

- All Day EUR German Federal Elections

Tuesday, September 26

- 10:00am USD CB Consumer Confidence

Wednesday, September 27

- 8:30am USD Core Durable Goods Orders m/m

- 10:30am USD Crude Oil Inventories

- 4:00pm NZD Official Cash Rate

- 4:00pm NZD RBNZ Rate Statement

Thursday, September 28

- 8:30am USD Final GDP q/q

- 8:30am USD Unemployment Claims

Friday, September 29

- 4:30am GBP Current Account

- 8:30am CAD GDP m/m

*All times EDT