Tuesday March 14: Five things the markets are talking about

With a Fed rate hike almost fully priced in by the markets for tomorrow, expect investors to be fully focused on Ms. Yellen’s press conference and the central bank’s so-called ‘dot plots’ for clues about future moves on monetary policy.

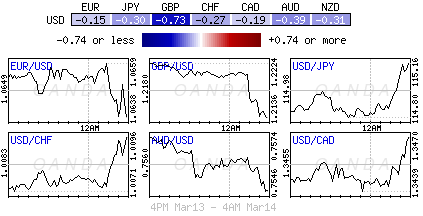

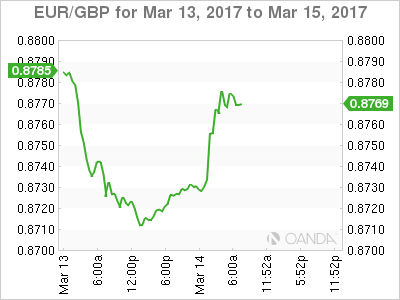

In the U.K, the upper house has removed the final hurdle to PM May’s plan to commence talks on Britain leaving the E.U – no date on when the PM would trigger talks, but signs still point to the end of the month. However, the threat of another Constitutional crisis with referenda in Scotland and possibly Northern Ireland has the pound again under pressure (£1.2120). Has the market priced-in enough political and economic risk for sterling?

Elsewhere, Dutch voters are heading to the polls tomorrow, in a highly anticipated general election seen as a bellwether for how populist opinion will fare next month in France.

1. Global Stocks mixed reactions

Global stocks sit atop record high as the market increase their expectations for the Fed to raise interest rates at a faster pace.

In Japan, stocks edged down overnight. The Nikkei share average shed -0.1% in quiet trading, while the broader Topix dropped -0.2%. In Hong Kong, the Hang Send was unchanged as investors stayed on the sidelines ahead this week’s global risk events (FOMC, BoE, BoJ, OPEC, Dutch elections).

India’s Nifty 50 surged +1.8% overnight as the market reopened after a public holiday.

Note: PM Modi’s Party won 312 seats in the 403-member assembly of Uttar Pradesh, according to the Election Commission of India, up from 47 in 2012.

Chinese shares traded in Hong Kong climbed +0.6% after surging +1.9% on Monday for the biggest gain in four-months. On the back of stronger industrial data and retail sales (see below)

In Europe, equity indices are trading mixed. Banking stocks are leading the losses in the Eurostoxx while the FTSE 100 is outperforming on the back of commodity and energy names.

U.S equities are set to open in the red (-0.2%).

Indices: Stoxx50 -0.4% at 3,404, FTSE +0.1% at 7,375, DAX -0.1% at 11,980, CAC-40 -0.3% at 4,986, IBEX-35 -0.6% at 9,932, FTSE MIB -0.4% at 19,628, SMI -0.1% at 8,672, S&P 500 Futures -0.2%

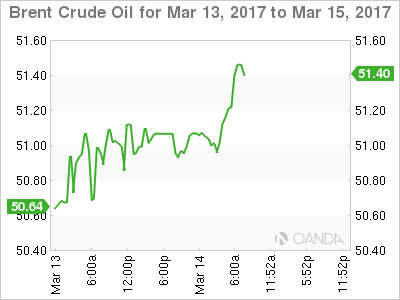

2. Oil hovers near three-month lows as markets await data

Crude oil prices trade atop of their multi-month lows ahead of the U.S open, as dealers wait for key reports that are expected shed light on a supply overhang in the market.

Brent crude futures are up +3c to +$51.32 a barrel, having settled down -2c yesterday. West Texas Intermediate crude (WTI) is down -7c at +$48.33 a barrel. The contract ended down -9c Monday.

Prices fell sharply last week as investors worried that swelling U.S. crude supplies would hinder OPEC’s efforts to restrict output and reduce a global glut.

Note: OPEC releases its monthly oil market report later today along with the API’s stockpiles, while the IEA releases its closely watched monthly report tomorrow.

Any signs of another big crude inventory build and the market "bears" will be expected to take price control for the short term.

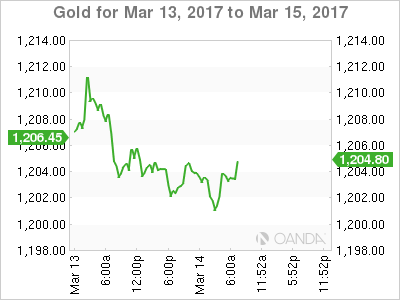

Gold prices are steady (-0.1% to +$1,202.36) as the market waits for the start of the Fed’s two-day meeting today that is expected to end with the bank raising interest rates for the second time in three-months.

Gold dealers will also be focusing on tomorrow’s Dutch elections – the fears of a Eurosceptic party coming to power is seen as small, however, a strong showing could fuel speculation of a surprise result in next month’s French Presidential election.

Note: Holdings of the world’s largest gold-backed exchange-traded fund (SPDR) rose +0.83% yesterday after four sessions of outflows.

3. Central bank decisions dominate yield curve shape

Fixed income dealers view a +25bps Fed hike this week as a virtual certainty after last Friday’s non-farm payroll (NFP) print (+235k and +4.7% unemployment rate). Dealers will be watching the policy decision for signals on what will come next – another two hikes or maybe three?

Overnight, the yield on U.S 10’s fell -1bps to +2.62% – trading above the psychological +2.60% benchmark that many dealers consider the beginning of a bear market if it holds for a week. Down-under, 10-year Aussie bonds fell -1bps to +2.92%.

Elsewhere, the Bank of Japan (BoJ) is expected to keep its rates and yield-curve policy unchanged in its policy decision on Thursday, while the Bank of England (BoE) and the Swiss National Bank (SNB) are also expected to stand pat with their own policy decisions.

4. Sterling drops to multi week low vs. EUR and Dollar

Concerns about Brexit and calls for a Scottish independence referendum has pushed the pound to a two-month low against the dollar (£1.2109) and a seven-and-a-half week low against the EUR (€0.8789) ahead of the U.S open.

Yesterday, the U.K. parliament cleared the way for PM Theresa May to start Brexit by triggering Article 50, while Scottish First Minister Nicola Sturgeon pledged to push for a second independence vote.

If U.K. data continue to surprise to the downside, fixed income dealers are likely to react by moving to remove the implied increase in interest rates currently priced into U.K rates – this will only aid the pound downfall further.

The EUR is hovering around the mid-€1.06 area. Earlier this morning, German Final CPI reading confirmed highest annual pace since August 2012 (+2.2% vs. +2.2%e).

Note: Despite the pickup in headline inflation in the Eurozone there may be no change in the ECB’s "loose" monetary policy given that it is volatile energy and food prices that are pushing the inflation rate up.

USD/JPY is holding above the psychological ¥115 level aided by yield differentials.

5. China Sales disappoint, industrial production improves

China’s retail sales missed estimates to fall below the psychological +10% for the first time since 2003, while fixed-asset investment and industrial output improved.

Retail sales growth disappointed with a multi-year low of +9.5%, despite recent comments from Beijing that the economy is making progress in transition to consumption-driven growth.

Other data showed that industrial output improved, hitting a six-month high with +6.3% increase in power generation, +5.8% rise in crude steel production, and -8% decline in crude oil output. Fixed Asset investment printed an eight-month high rate of growth, driven by +8.9% rise in property investment amid +26% increase in property sales value.

Note: China’s Stats bureau also noted that consumption is expected to remain stable this year and that the CPI will rebound after last month’s surprise decline.