The Bank of England is set to hike rates again on Thursday when it announces its latest policy decision at 11:00 GMT. But with many other central banks going into higher gear, will the BoE stick with 25-basis-point increments or will it join the 50-bps bandwagon? Given all the warnings of recession for the UK economy lately, a dovish tilt seems more likely than a hawkish one. Hence, there’s not much prospect of the selling pressure on sterling easing anytime soon, although what the Fed announces a day earlier will matter just as much.

Trying to read the economy

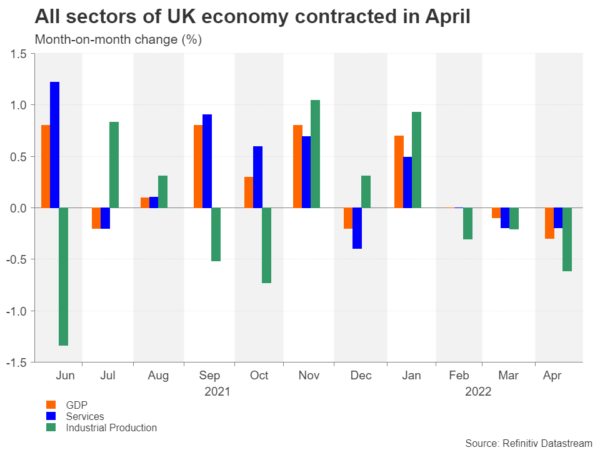

The Bank of England doesn’t mince its words. At its last meeting, it flagged the real danger of the British economy falling into recession by year-end as other central banks justified their rate hikes by arguing that their economies were too hot. But just how great are the risks of economic expansion in Britain going into reverse? GDP unexpectedly shrank by 0.3% m/m in April, though weaker government spending was to blame for most of the drop and there are still several bright spots.

Retail sales were surprisingly strong in April, house prices continue to rise, albeit more slowly, and the jobless rate fell to a 48-year low of 3.7% in the first quarter. The next dose of labour market stats is due on Tuesday (06:00 GMT) and is predicted to show the unemployment rate falling further to 3.6% in the three months to April.

Is the consumer squeeze only just starting?

However, most of the hard data is rather outdated now and what happens from May onwards will be of more interest. The combined effects of higher energy bills and national insurance contributions only kicked in in April, so the considerable squeeze on household spending likely began in May. The survey data has already started to deteriorate. Growth in manufacturing and services both slowed down sharply in May according to the S&P Global PMIs.

Nonetheless, it is possible that the negative sentiment in business and consumer surveys is being inflamed by all the doom-mongering in the UK press. There is also the strong labour market to consider which should provide some kind of a cushion to the economy. Moreover, the extra-long Bank Holiday weekend for the Queen’s Platinum Jubilee celebrations probably boosted spending in June – a trend that could continue through the summer as consumers flock to restaurants and other hospitality and leisure venues after two years of pandemic restrictions.

Outlook is bleak

But even if growth momentum is sustained over the summer, the outlook for the Autumn and beyond looks grim unless there is a significant easing in energy prices, which is where the bulk of the pain for the economy is originating from. The UK’s energy regulator has already signalled another mammoth hike in electricity and gas bills in October, and once households have drawn down on the savings they accumulated during the lockdowns, the cost of living squeeze could get a lot worse. And if Brexit hasn’t already exacerbated some of the supply constraints for British businesses, there is the threat of an escalation of tensions with the EU hanging over them if the government pursues its plans to override parts of the Northern Ireland protocol.

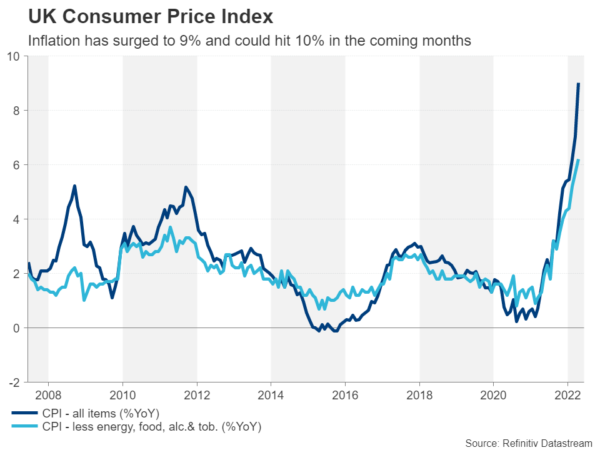

It’s also worth remembering that the UK economy is very consumer driven, so the more inflation surges (currently the highest in the G7 at 9.0% y/y), the greater the downward pressure on demand will be. Paradoxically, this is what distinguishes the Bank of England from its peers as it can make a more convincing case that high inflation will partially do the job of dampening demand and thus interest rates don’t need to rise too steeply.

The BoE can be unpredictable

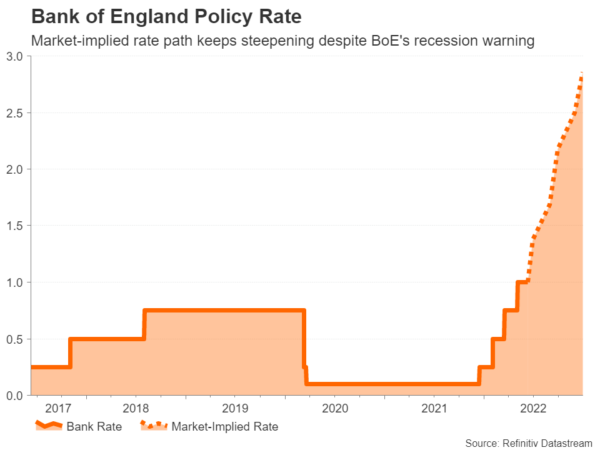

In May, most BoE policymakers agreed that “some degree of further tightening in monetary policy may still be appropriate in the coming months”. This is quite a contrast from the likes of the Fed, Bank of Canada, RBNZ and RBA who have hiked by 50 basis points and will likely do so again at their next meetings. Even the ECB is now contemplating increments of 50 bps.

However, there is a reason why the Bank of England has earned its reputation as “the unreliable boyfriend” and policymakers have a history of flip-flopping, including in the current tightening cycle. Hence, a 50-bps rate rise cannot be ruled out in June. Not only is it possible that other central banks’ aggressive actions might embolden the BoE, but this could also be the only time window that Governor Bailey would be able to push through a larger increase before growth completely stalls and it becomes inevitable to hit the pause button.

Pound is tumbling

Investors think there’s about a 50% probability of a 50-bps move and have priced in at least two double rate hikes this year. That leaves quite a lot of scope for disappointment if the BoE gets the jitters and turns even more cautious than it already has following the worrying April GDP numbers.

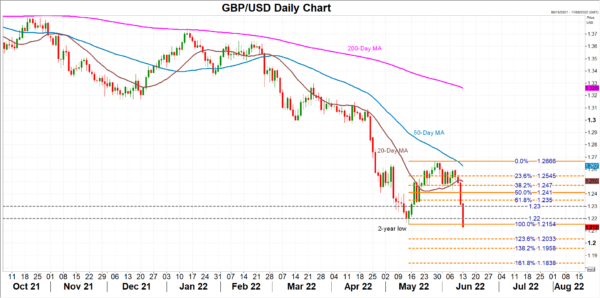

The pound has gotten off the week on the wrong foot, breaching the two-year trough of $1.2154 set in May, having flirted with the $1.26 level just a week ago. If the bears retain the upper hand, the $1.2033 mark might be targeted next as it’s the 123.6% Fibonacci extension of the May upleg. Further down, the 161.8% Fibonacci extension of $1.1838 could be another major support.

Are there any upsides?

In the event that the BoE doesn’t let down the hawkish market expectations, the pound could make its way up towards the 61.8% Fibonacci of $1.2350 before aiming for the 20-day moving average, currently at $1.25.

However, for a more meaningful rebound, investors would have to be positively surprised by the incoming UK economic indicators – something that potentially depends on whether the government decides to loosen the fiscal purse strings. Otherwise, a more hawkish BoE might be of little comfort to sterling if there’s signs the economy is entering a recession just as inflation is hitting double digits.