Bitcoin continues its tedious walk around $30K in a narrow range of $28.6-30.6K. Ethereum lost 0.4%, while other leading altcoins in the top 10 fell between 1% (XRP) and 2% (Solana). The exception was Binance Coin (+2.9%).

The total capitalisation of the crypto market, according to CoinGecko, fell 0.8% overnight to $1.33 trillion. The Bitcoin Dominance Index fell 0.5% to 42.1%. The cryptocurrency Fear and Greed Index was up 2 points to 12 by Tuesday and remains in “extreme fear”.

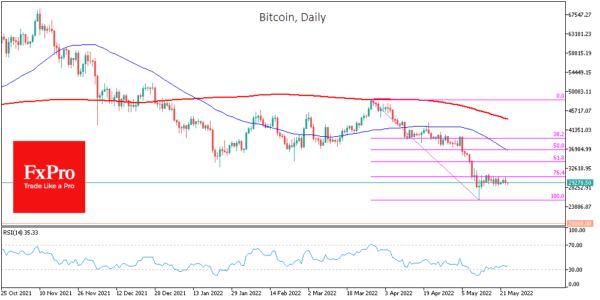

The dynamics of the first cryptocurrency in recent days seem to have become determined by the balance of power between bulls and bears, but not the stock market dynamics. The latter showed gains on Monday, while bitcoin reversed from the upper end of its range for the past two weeks.

CoinShares data for last week showed a record weekly outflow of institutional investors from crypto funds since the start of the year. Funds are operating cautiously, and their actions may be holding back growth while buying on the dips comes from retail and crypto whales. Thus, the market is distilled from sporadic participants who want to “ride the wave” but are not crypto enthusiasts by nature.

Without the hype inherent in the golden days’ for crypto, the flow of money into the industry is drying up, a cruel test of strength. Over the past two weeks, investors have withdrawn more than $10bn (13%) from Tether’s USDT stable coin. According to Gary Gensler, head of the SEC, many crypto-sphere projects are about to fall.

But that is not stopping lobbyists from promoting cryptocurrencies as a long-term investment vehicle. A bill has been introduced in the US House of Representatives that could lift restrictions on crypto investments by pension funds.