Fed members forecast one more US rate hike

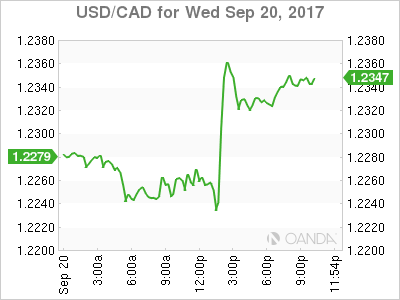

The Canadian dollar is lower against its US counterpart on Wednesday. The U.S. Federal Reserve published its updated economic projections and as expected kept the interest rate unchanged at 100-125 basis points. Also keeping with market forecasts the US central bank announced it will start the reduction of its balance sheet in October. The start date was the only piece missing as the Fed has already outlined the process it would follow.

The loonie had been trading higher against the USD ahead of the Federal Open Market Committee (FOMC) statement but retreated once the economic projections were published. The main takeaway was the number of members that still see a rate hike in 2017. 11 out of 16 officials still see the appropriate level for this year at 125 to 150 basis points. Fed Chair Janet Yellen press conference did not add a lot of additional details but went through the statement and faced questions from the financial press. The Fed is facing a balancing act of strong growth and solid employment but on the other hand declining inflation.

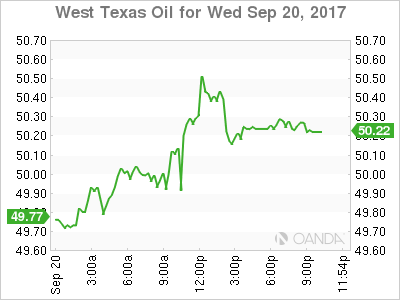

Oil rose during the day, despite the larger than anticipated weekly US crude inventories reported this morning. The higher than expected number was taken as a positive given the disruption caused by Hurricane Harvey and Irma in oil refineries and platforms.

Canadian inflation and retail sales data due on Friday will close the week for CAD traders. The currency pair will now trade guided on other economic indicators, geopolitical events and the statement of the Bank of Japan (BOJ).

The USD/CAD rose 0.612 percent on Tuesday. The currency pair is trading at 1.2347 after the U.S. Federal Reserve announced the beginning of its balance sheet reduction plans. The pair is near daily highs as the dollar rally stalled once Fed Chair Janet Yellen press conference started. The US central bank updated its economic projections and while inflation remains muted there are still 11 members who are forecasting another price hike before the end of the year.

The Fed has raised rates at the December Federal Open Market Committee (FOMC) meeting in the past two years and could do so at the final meeting of the year. The central bank has supported the dollar with 2 rate hikes in 2017 so far, and is now shedding its massive balance sheet. The portfolio of bonds that were accumulated as part of the stimulus program will shrink by $10 billion each month.

US energy prices rose 1.433 percent in the last 24 hours. The price of West Texas Intermediate is trading at $50.18 near a four month high. Sparks between the United States and Iran and signals from Organization of the Petroleum Exporting Countries (OPEC) and nom-members about extending the production cut agreement supported higher energy prices. A meeting is scheduled for this Friday with could come with confirmation of an extension beyond March 2018.

The Energy Information Administration (EIA) report of weekly US crude inventories showed a higher than expected rise at 4.6 million barrels. The glut is seen as a positive given the disruptions in American production and proof of the flexibility and speed of shale output.

Market events to watch this week:

Wednesday, September 20

6:45pm NZD GDP q/q

11:50pm JPY Monetary Policy Statement

Thursday, September 21

Tentative JPY BOJ Policy Rate

2:30am JPY BOJ Press Conference

8:30am USD Unemployment Claims

Friday, September 22

8:30am CAD CPI m/m

8:30am CAD Core Retail Sales m/m

8:30am All Day NZD Parliamentary Elections