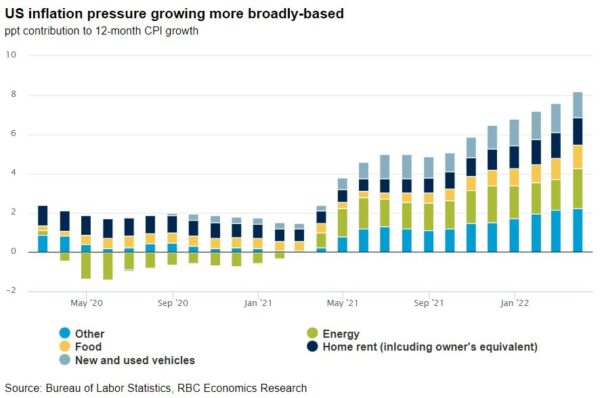

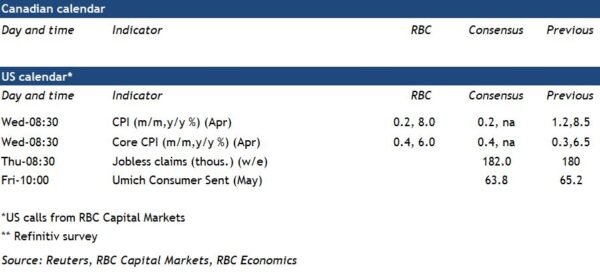

Torrid growth in the U.S. inflation rate likely slowed in April. This would mark the first decline in almost a year and come on the heels of price growth that soared to 8.5% year-over-year in March. Oil prices in April reversed part of that March surge, which was driven by Russia’s invasion of Ukraine. But prices at the pump were still much higher compared to the beginning of the year. The price for regular grade gas was $4.1 per gallon in April compared to $3.3 per gallon in January. Growth in food prices is also expected to have remained strong, as producers continue to pass on rising input, labour and transport costs to consumers. These challenges are not limited to food producers and distributors. Labour shortages (and wage pressures) in particular are widespread and expected to persist given exceptionally high demand for workers and long-run demographic headwinds that will add to the crunch.

Outside food and energy products, growth in core CPI at 0.3% in March marked the smallest increase in 6 months. The measure was slowed by a 3.8% decline in used car prices during the period. Though still elevated, those prices likely fell again in April according to early reports from the Manheim used vehicle value index. The slowdown compares to an almost 10% month over month surge in April 2021. And it should leave the used car series accounting for almost all (0.4 ppts by our count) of the expected moderation in the headline year over year CPI growth rate from March.

Still, inflation pressure remains broadly based. Further risks to global supply chains from the Russian invasion and China’s lockdowns will continue to add tailwinds to global inflation pressures. With labour markets still exceptionally tight and inflation pressures exceptionally strong, the Fed is expected to continue to act quickly to move interest rates higher. We expect another 50bp hike in June to build on the 50 bps hike (and start of QT tightening) announced earlier this week.