U.S. Highlights

- U.S. economic growth contracted in the first three months of 2022. Real GDP fell 1.4% due largely to a sizeable increase in the trade deficit.

- The U.S. goods trade deficit widened unexpectedly by almost 18% to hit a new record in March, reflecting both higher import volumes and prices.

- Personal income and consumer spending rose on a monthly basis in March. While a key inflation measure, the core PCE deflator, eased marginally to 5.2% year/year from 5.3% in February.

Canadian Highlights

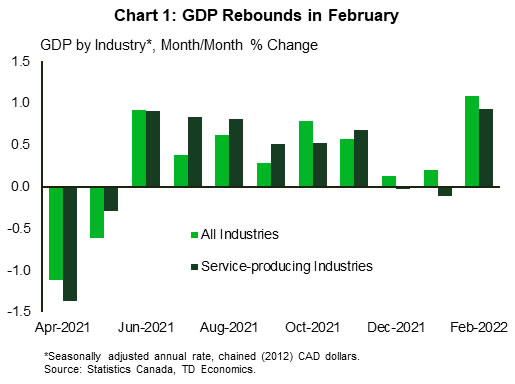

- This morning’s GDP report showed that output surged 1.1% month/month in February, beating Statistics Canada’s flash estimate of 0.8%. The preliminary estimate for March also points to a strong gain of 0.5%.

- Governor Maklem noted that “the economy has entered excess demand” territory and is starting to bump up against its capacity constraints. This is adding pressure on prices and wages, and emboldening the Bank to act swiftly.

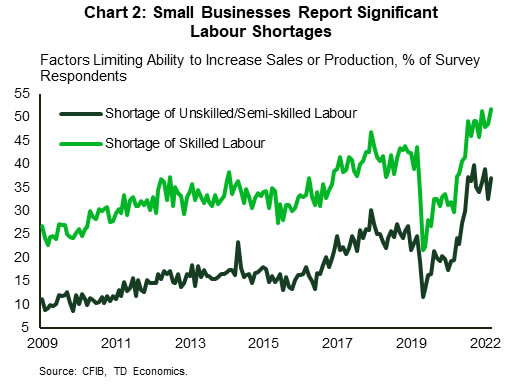

- April’s CFIB’s Small Business Barometer reaffirmed that businesses remained upbeat about the near-term outlook, but were feeling the constraints presented by the tight labour market.

U.S. – GDP Drop Obscures Strong Underlying Demand

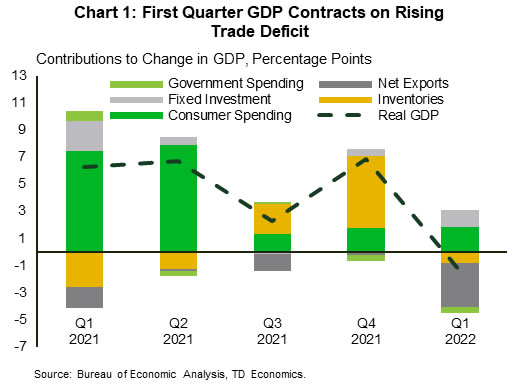

First quarter GDP was the disappointing marquee release this week, but there were plenty of silver linings. The consensus was for weak, but still positive, growth. Instead, the U.S. economy retreated by 1.4% annualized, after booming 6.9% in the fourth quarter of 2021 (see here). The unexpected retrenchment was largely due to a widening trade deficit, with slowing inventory accumulation and fading stimulus spending chipping in (Chart 1). The headline decline masked underlying strength in consumer spending and business investment, which posted solid gains of 2.7% and 9.2% respectively in the quarter.

Business investment has good momentum heading into Q2, with durable goods orders up 0.8% month-on-month (m/m) in March, after a 1.7% decline in February. The increase was driven by autos, computers and other electronics. The measure has risen in five of the last six months. The report also showed that a closely watched proxy for business investment – new orders for nondefense capital goods excluding aircraft – rose by 1% m/m, pointing to resilience in the business sector.

On the housing front, data from the S&P CoreLogic Case-Shiller Index showed that home price growth remained robust in February. Prices posted a 19.8% y/y gain, up from 19.1% in January. This was the highest growth rate since August and reflects extremely low levels of inventory relative to demand. As mortgage rates continue to climb, however, purchasing power will dim, resulting in lowered demand which should restore greater equilibrium to the market.

There are already some indications of this as sales of newly built single-family homes fell in March for the third consecutive month. New home sales were down 8.6% m/m. There was also a decline in contracts signed to purchase homes. Pending home sales headed lower for the fifth consecutive month. The metric fell 1.2% m/m in March, pushing signed contracts to the lowest level since May 2020. As prices and interest rates head higher, and a solid supply of homes under construction are completed, the current imbalance between housing supply and demand should start to close.

There was little sign of improvement in the trade deficit through the quarter, as the monthly deficit hit a new record in March. A surge in imports dwarfed export gains (Chart 2). The goods trade gap rose by 17.8% m/m to $125.3 billion. While strong demand from businesses and consumers lead to a surge in imports, rising prices also contributed to the sizeable increase in the deficit. Front-loading of imports due to geopolitical and supply-chain uncertainty saw sizeable increases in the import of consumer goods (13.6%) and motor vehicles (12%).

Finally, both nominal personal income and spending rose in March by 0.5% and 1.1% m/m respectively. Accounting for prices, real spending rose 0.2% on the month. The Fed’s preferred inflation gauge, the core personal consumption expenditure deflator, rose 5.2% y/y, a slight deceleration from February. Add it all up, and with inflation still elevated, and strong momentum in consumer spending and business investment, the Fed is expected to look past the headline decline in GDP, and press full steam ahead with policy normalization, with a 50 basis point hike next week.

Canada – Some Do Not Like It Hot…

This was a relatively quiet week in terms of economic data, with industry-level GDP for February the main highlight. Bank of Canada speeches were also on the docket, providing some additional colour on the Bank’s view of the economy, inflation and monetary policy.

In his speeches earlier this week the Bank of Canada Governor Tiff Maklem sought to make three key points: that “the Canadian economy is strong”, that “inflation is too high”, and that higher interest rates are very much needed in order to stomp out the inflationary fire. Indeed, this morning’s monthly GDP report echoed his words on the strength of the recovery, with economy expanding 1.1% month/month in February. This result was well-ahead of expectations, lifting the level of GDP 1.5% above its pre-pandemic level. Easing public health restrictions supported the rebound in February, particularly in the services sector. Accommodation and food services industry led the way with real GDP surging by 15.1% on the month (Chart 1).

With GDP above its pre-pandemic level, and the unemployment rate falling below its pre-crisis mark, Governor Maklem noted that “the economy has entered excess demand” territory and is starting to bump up against its productive capacity constraints. The labour market is a poster child of this. Businesses are having a tough time filling vacant positions, even at higher wages. This week’s CFIB’s Small Business Barometer survey reaffirmed that businesses are acutely feeling those challenges. Half of survey respondents reported shortages of skilled labour were limiting their ability to ramp up production, and 37% cited a shortage of semi-skilled/unskilled labour as an impediment (Chart 2).

On inflation, the governor said that it “remains the Bank’s primary focus”, noting that “high inflation affects everyone”. Indeed, rapidly rising prices are being felt by all Canadians, but as we note in this week’s report, inflationary pressure also varies by province. Inflation has been particularly hot in most of the Atlantic Provinces, lifted by food and energy product prices (which carry a large weighting in the region). Inflation has been much slower in most of Western Canada, on the back of relatively muted recoveries in Alberta and Saskatchewan and a slower increase in transportation costs in B.C.

On average, however, the BoC estimates that 5% inflation costs the average Canadian $2000 more per year relative to 2% inflation. To bring it down and to keep expectations anchored, the BoC will not be shy to raise rates. Together with inflation, higher interest rates will be another hit to household finances. We estimate that annual debt servicing costs will increase by $2000 per household by the first quarter of 2023 as the overnight rate reaches 2.25%. Let’s hope this will be enough to cool domestic demand and bring inflation down, otherwise the Bank is not afraid to raise interest rates more “forcefully”.