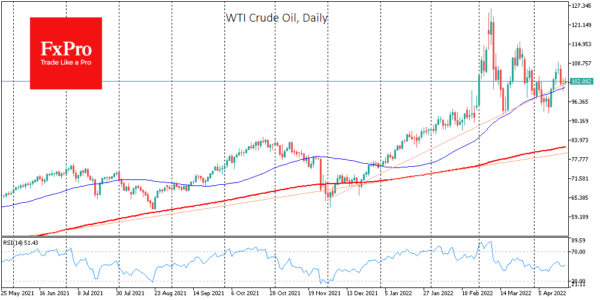

Oil gained 1.5% on Thursday morning to $103.75 per barrel for WTI and $108.2 for Brent, continuing to cling to the uptrend since December. Over the past six weeks, oil price movements are no longer unidirectional, but the market remains in ‘crisis mode’. In April, oil is supported on the declines towards the 50-day moving average, as we saw yesterday.

The uptrend is not only supported by the abrupt withdrawal of oil from Russia and the accompanying decline in production there. There are also shipment problems in Libya and prolonged pipeline repairs in Kazakhstan.

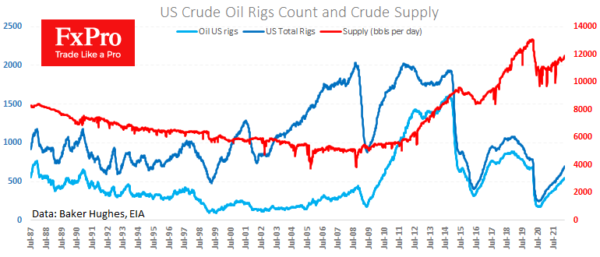

Oil producers in the US seem to be stepping up. Last week saw production increase to 11.9M barrels per day – a new high since May 2020 – from 11.8M.

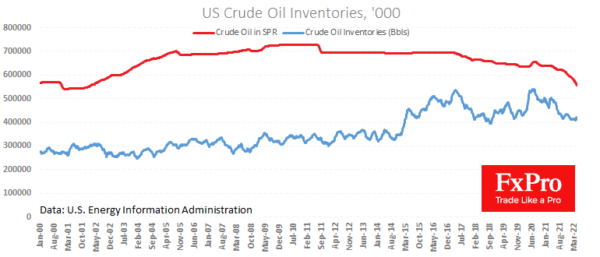

Meanwhile, US oil stocks and production data remain volatile. Commercial inventories collapsed by 8M barrels after jumping by 9.4M last week. Such fluctuations could prove to be a manifestation of the supply shifting to Europe.

Strategic stocks showed a net decline of 4.7M after 3.9m the previous week. The volume of oil in strategic storage fell to the lows in the last 20 years. However, it is not yet enough to turn around commercial inventories.

Oil supply constraints continue to put together a relatively bullish picture for oil, preventing a price reversal to the downside. A real bearish victory requires either a sharp increase in production in the US or OPEC countries or a dramatic fall in demand. We see no clear signals for either direction.

Another potential area of pressure on the oil price – a strengthening dollar – is also failing for the second day in a row, temporarily working on the bulls’ side.