The Bank of England (BoE) is largely expected to follow the Fed’s footsteps on Thursday, announcing its third rate hike in a row (12:00 GMT). While the rate decision itself could have a negligible impact on the pound, the central bank’s outlook on future policy steps could trigger the next round of volatility.

BoE to hike rates as inflation expectations soar

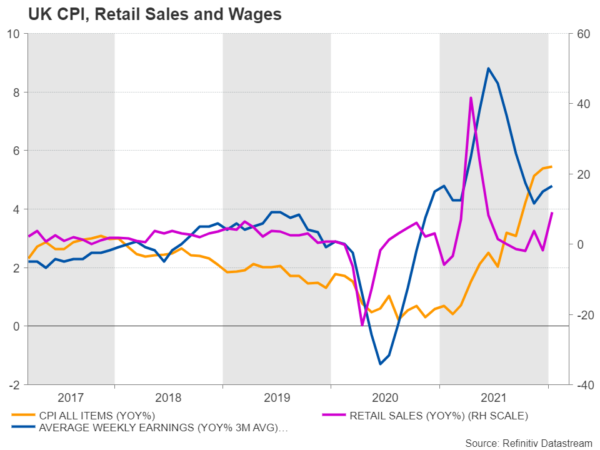

The rate hike cycle is already well underway in the UK, with the Bank of England having raised interest rates twice by 25bps so far this year, while a third increase to a pre-pandemic level of 0.75% on Thursday is a done deal according to futures markets. The issue here is that another rate increase could do little to cool inflation towards the central bank’s 2.0% target, even though adjusting borrowing costs is a more effective tool for central banks to balance price swings. But the world is not living in normal times. Following the pandemic’s supply distortions, the unexpected war in the Ukraine and the severe sanctions against Russia could create additional international inflation spillovers not only in the energy sector but also in the food industry and in manufacturing.

Of course, the UK is itself a significant producer of crude and petroleum products and has a diverse range of suppliers beyond Russia, including Norway, the Netherlands, Saudi Arabia and the US, and therefore could manage any energy shortage more efficiently than its European peers. Yet, the same cannot be said for its financial industry, which has a larger exposure to Russian oligarchs, who face new sanctions by the day.

Some investors believe that inflation could peak at 8.0% y/y next month, which is even higher from the latest 30-year high of 5.5% as of February. Hence, the central bank will need to do more to meet its price mandate. Futures markets are pricing approximately 166 basis points of monetary tightening in total for this year, which is equivalent to at least six 25 bps rate increases and there are only six meetings left in the remainder of the year. That suggests there is still room for an aggressive 50 bps rate action, which policymakers avoided during February’s meeting as only four out of nine voted for the larger rate hike.

What to look in the new policy statement

Perhaps the uncertain geopolitical crisis and the risks surrounding the UK’s financial system could once again kill the case for a 50bps rate rise this week, though whether the central bank will ever meet the aggressive rate pricing this year could be challenging to predict. Without Sunak’s additional fiscal support, and with payroll taxes jumping next month for high and middle earners, consumers could face a big squeeze in their living standards, making a recession possibly imminent.

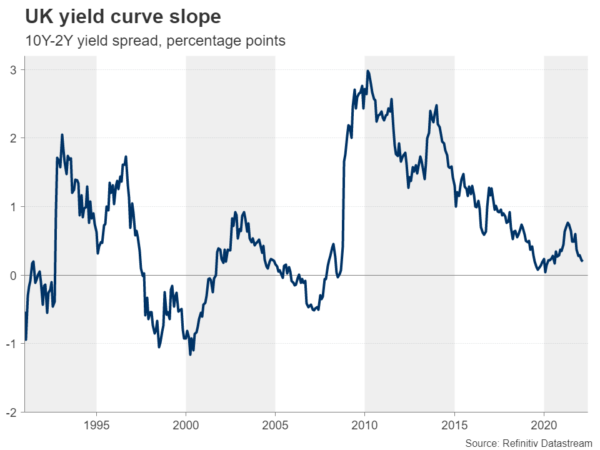

Of course, the central bank could sacrifice some economic growth to fight inflation in the next few months, though the deeper the economic recession becomes, the more feasible it will be for policymakers to push back against the aggressive rate pricing. The negative slope in the 10-year and 2-year government bond yield spread signals that the tightening cycle could be soon nearing an end. Perhaps that will be more clear during the coming months when fresh inflation and GDP data come out, and hopefully the dust in Ukraine settles down. Nevertheless, traders will be eagerly waiting to see if the 50bps camp of policymakers has narrowed this week, and whether policymakers have put greater emphasis on a potential negative financial shock than on inflation. Traders will also be looking for any indications about how willing the central bank is to accompany its rate hike cycle with a gradual balance sheet reduction (quantitative tightening) when rates reach 1.0%.

Pound hopes for a hawkish policy meeting

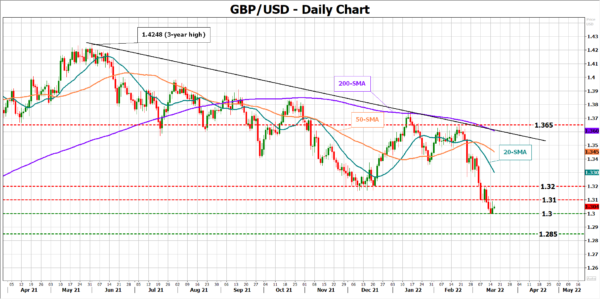

Turning to FX markets, the pound has tumbled by almost 3.0% against the US dollar, erasing December’s rally to mark a 16-month low around the 1.3000 level. A weaker currency could make the inflation situation worse. Therefore, the central bank could preserve some hawkishness to add some floor under the currency. That could occur if it acknowledges the economic jitters from Ukraine but prioritizes its inflation mandate, saying that it will stick to its steady rate hike cycle for now. If that turns out to be the case, pound/dollar will need to climb back above the 1.3100 level to gain more buying traction. The 1.3200 mark could be the next target, though for a medium-term outlook improvement, a sharper rally above 1.3650 is required.

Alternatively, if the BoE raises caution about a deteriorating economic backdrop, signaling a potential slowdown in the tightening path, pound/dollar could slide below 1.3000 to test the 1.2850 support from October 2020. A hawkish FOMC policy decision could also trigger a bearish correction in the pair earlier on Wednesday.