Despite the geopolitical mess across the Ukrainian borders and growing fears about its global economic impact, the Bank of Canada (BoC) is expected to hike its benchmark interest rate on Wednesday at 15:00 GMT. Local developments could well justify the much-awaited rate increase, though a hawkish communication is more likely to trigger a new bullish wave in the Canadian dollar than an aggressive boost in rates.

A March rate hike looks to be a done deal

The BoC defied rate hike expectations in January, keeping its borrowing costs stable at a record low of 0.25% in the face of the omicron uncertainty. Its communication, however, was quite directional, with the governor Tiff Macklem expressing the view that a rate increase is inevitable in the coming months in an economy which operates at full capacity. Having removed its rate guidance as well, there is little doubt the central bank could hold back this time.

While the world learns to live with the pandemic, the Russian-Ukrainian political tensions opened out of the blue a new, more depressing chapter in global history. The nonstop exchange of sanctions and countermeasures between Russia and Ukraine’s West allies following Moscow’s invasion in Ukraine last week is getting more intense day by day, raising alarms about the already heightened inflation and boosting fears for another bitter global economic shock as Russia is a key source of grains, energy, and metals.

An aggressive rate hike may not happen

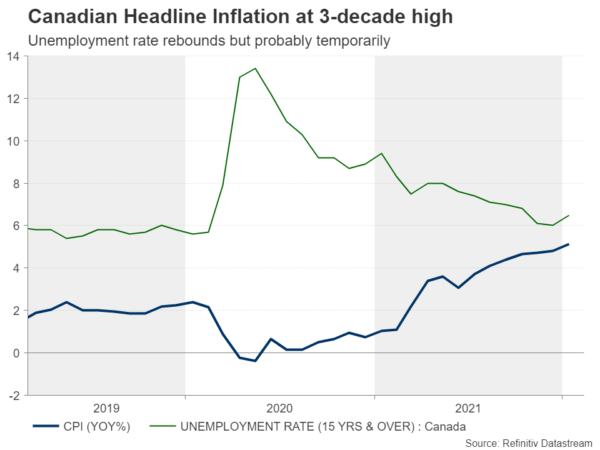

Hence, global economic uncertainties will come once again to debate the central bank’s tightening plans this week given Canada’s dependence on international trade. Policymakers, however, may not push back this time. Actually, domestic factors could overshadow external risks as inflation sits at a three-decade high of 5.1% y/y as of January, more than twice the central bank’s 2.0% midpoint target, and could sail further up as the geopolitical noise across the Ukrainian borders could add to the supply chain issues. Home prices followed higher too in the same month, and rising energy prices could even be beneficial for Canadian oil exporters as long as the energy sector is not drastically involved in the Ukrainian crisis.

Of course, the rebound in the unemployment rate, which edged up to 6.5% in January – the highest since November –, and the loss of 200k job positions have upset investors, though that hiccup in the labor market is probably an outcome of the latest omicron restrictions, which have already been scaled down.

Of course, the rebound in the unemployment rate, which edged up to 6.5% in January – the highest since November –, and the loss of 200k job positions have upset investors, though that hiccup in the labor market is probably an outcome of the latest omicron restrictions, which have already been scaled down.

The above is justifying investors’ forecast for a 25 bps rate hike, which futures markets fully price in. There is a minority of investors who are betting for a more aggressive 50bps rate increase, though given the uncertain geopolitical developments, the BoC will probably decide to play it safe for now and start its rate hike cycle with a normal rate increase to 0.50% from 0.25%.

Loonie outlook

Turning to FX markets, the loonie has survived the Ukrainian crisis with softer injuries relative to European currencies, and higher oil prices continued to defend it against the US dollar’s strength.

Investors are certain about the rate announcement, therefore the policy decision itself may not boost the loonie unless the central bank reiterates it will forcefully adjust “monetary policy if needed to address whatever situation arises” as BoC debuty governor Tim Lane stated two weeks ago. If such comments endorse the six rate hike scenario priced in markets for this year, the loonie could drift higher.

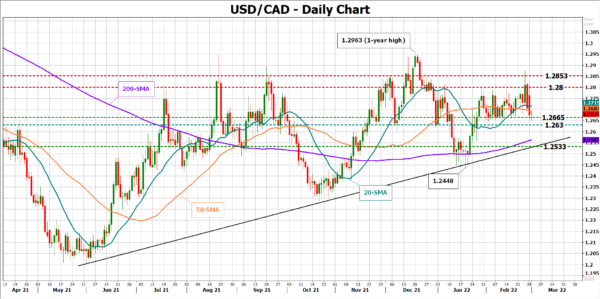

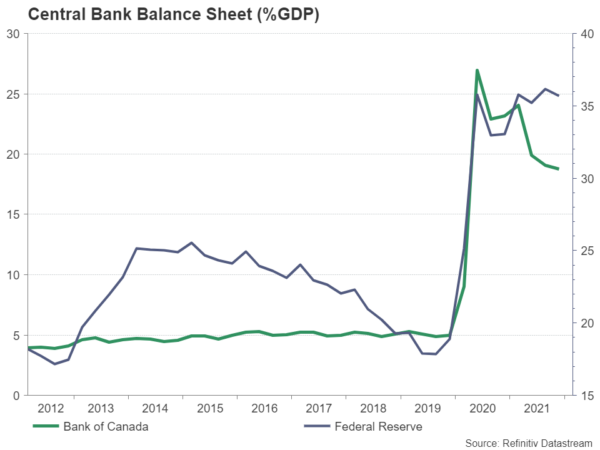

Notably, policymakers also revealed during January’s gathering that they are considering to start selling government bonds (quantitative tightening) once the first rate hike is delivered . Therefore, any positive guidance on that could further power the loonie given that the BoC has never attempted to shrink its balance sheet before. If that turns out to be the case, it would be interesting to see whether the key support region of 1.2665 – 1.2630 in dollar/loonie can collapse, clearing the way towards the 200-day simple moving average (SMA) at 1.2560 and the ascending trendline at 1.2550.

Alternatively, if the BoC rate hike is accompanied by a more conservative communication style, which questions the aggressive rate hike pricing and postpones quantitative tightening ahead of the Fed meeting, the pair may head for another test near the tough resistance of 1.2800. A steeper increase above 1.2853 could then open the door for the one-year high of 1.2963.

Alternatively, if the BoC rate hike is accompanied by a more conservative communication style, which questions the aggressive rate hike pricing and postpones quantitative tightening ahead of the Fed meeting, the pair may head for another test near the tough resistance of 1.2800. A steeper increase above 1.2853 could then open the door for the one-year high of 1.2963.