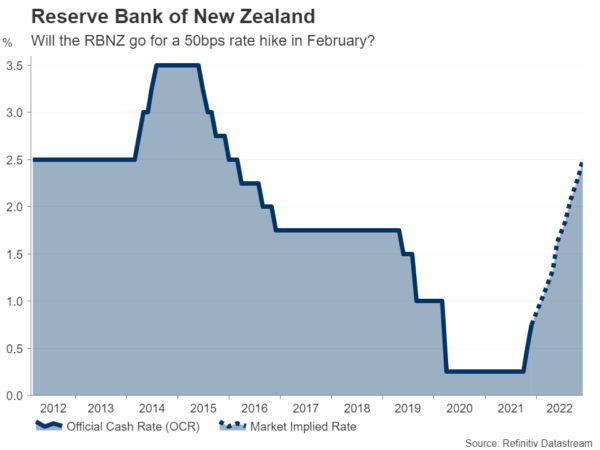

The Reserve Bank of New Zealand is poised to raise interest rates for a third time next week. But will it pull the 50 basis points trigger this time, setting a precedent for other central banks? In a week where PCE inflation numbers will be in focus in the United States, the RBNZ’s actions could have rippling effects for Fed policy speculation. Elsewhere, the flash PMI readings for February will be the centre of attention as consumers face a growing spending squeeze from spiralling inflation just as Omicron restrictions are being lifted in many places.

Will the RBNZ get the 50bps ball rolling?

New Zealand’s central bank got an early start on rate hikes, raising the official cash rate consecutively at the October and November meetings. It’s widely anticipated to become three in-a-row when policymakers meet on Wednesday. However, what’s not a done deal is whether they will opt for 25 or 50 bps. Inflationary pressures are brewing in New Zealand amid red-hot hot property and labour markets on top of the global supply-chain related price spikes.

Money markets see only about a 30% probability of a 50-bps increase so should the RBNZ confound expectations and deliver a double hike, the New Zealand dollar would likely enjoy a mini rally, extending its current rebound against the US dollar.

On Thursday, quarterly figures on retail sales might attract some attention too.

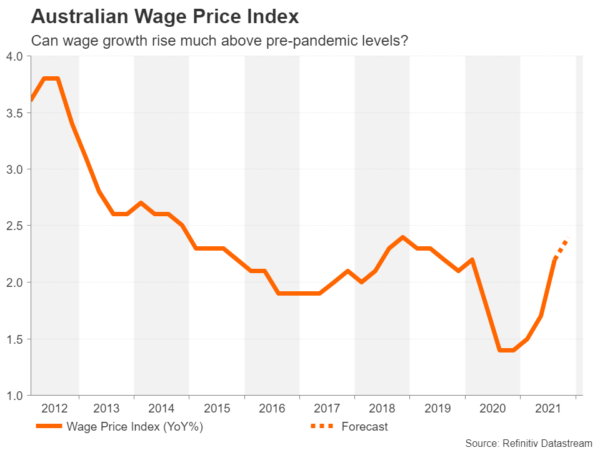

Wage data eyed in Australia

Over in neighbouring Australia, the Reserve Bank of Australia is becoming increasingly open to the idea of a rate rise in 2022. One of the criteria that the RBA is looking for to bring forward its rate hike timeline is higher wages. Thus, the wage price index for Q4 that’s out on Wednesday could be a crucial piece in the jigsaw for policymakers when it comes to assessing the immediate risks from higher inflation.

Ahead of the wage growth numbers, the flash manufacturing and services PMIs for February are due on Monday. The run of data will continue on Thursday with the capital expenditure estimate for the fourth quarter.

The Australian dollar has bounced back impressively from the 18-month lows it plumbed less than a month ago. If the wage figures underscore the subdued picture, the aussie will have a hard time maintaining its positive posture.

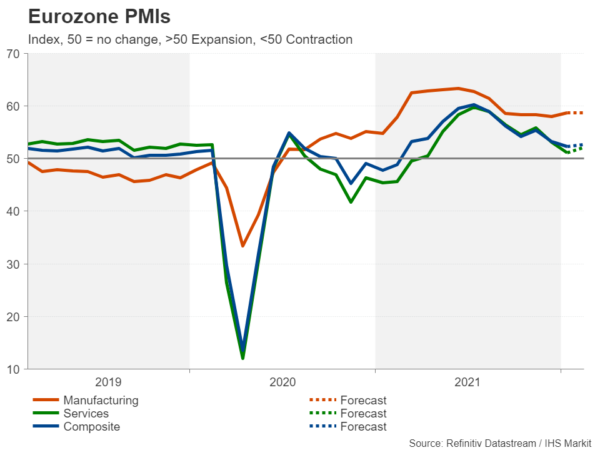

Eurozone PMIs likely improved in February

Another central bank that recently had to perform a U-turn on the possibility of a raising rates in 2022 is the European Central Bank. The final reading of euro area CPI due Wednesday is expected to confirm that inflation in the bloc hit 5.1% in January.

The ECB has so far been relaxed about the jump in the CPI prints, blaming it almost entirely on the surge in energy prices, being mindful of the fragile recovery in Eurozone economies. However, with Omicron-induced virus curbs being gradually ditched in more and more member states, the flash PMIs due on Monday are expected to point to an uptick in economic activity in February.

There is a danger, though, that the PMIs may be weighed by weakening household spending as soaring inflation squeezes disposable incomes, while business confidence is dented by the escalating frictions between Russia, Ukraine and the West. But these are low economic risks for the moment that could become a lot more prominent in the future.

If the PMI surveys fail to provide much clarity, investors will also be treated to the German Ifo Business Climate gauge on Tuesday and the Eurozone economic sentiment indicator on Friday.

The flash PMIs will be front and centre for sterling as well, as there’s no other major release out of the United Kingdom next week.

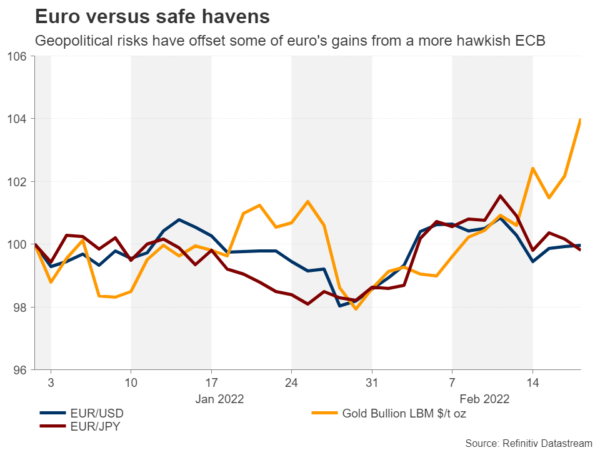

Euro shaken by Ukraine standoff

However, as geopolitical tensions come to a boil, the data might play second fiddle for the euro next week.

Diplomatic efforts by European leaders to diffuse the hostilities between Russia and Ukraine have so far failed and the threat of a war remains alarmingly high. The heightened tensions have been a boon for gold, as well as for safe haven currencies like the yen and Swiss franc, and to a lesser extent, the US dollar.

On the other hand, the euro’s rebound has faltered and further tumbles are possible if the tense standoff turns to a military confrontation. There can be no doubt that the United States would impose tough sanctions on Russia should President Putin go down the military route. A conflict and subsequent sanctions would not only come at a huge economic cost for Russia, but it could be damaging for the Eurozone economy too as the energy crisis would likely only worsen in such a scenario.

Although this would also mean the ECB would have to move quicker in normalizing policy, it would be doing so in a less favourable environment so the euro would probably not get the boost it would otherwise have gotten.

Can PCE inflation bolster the dollar?

In the US, however, there will be no shortage of data, though markets will be shut on Monday for Presidents’ Day. But the week will get into full gear on Tuesday with the flash PMIs and consumer confidence index for February. On Thursday, the second estimate of fourth quarter GDP is forecast to be revised a nudge higher to 7.0%.

New home sales are also out on Thursday, to be followed by pending home sales on Friday, as well as durable goods orders for January.

But the main highlight on Friday and for the week will be the PCE report, which should shed some light on how well consumption held up in January and whether the price pressures in the Fed’s preferred inflation metric remained as elevated as they did in the consumer price index.

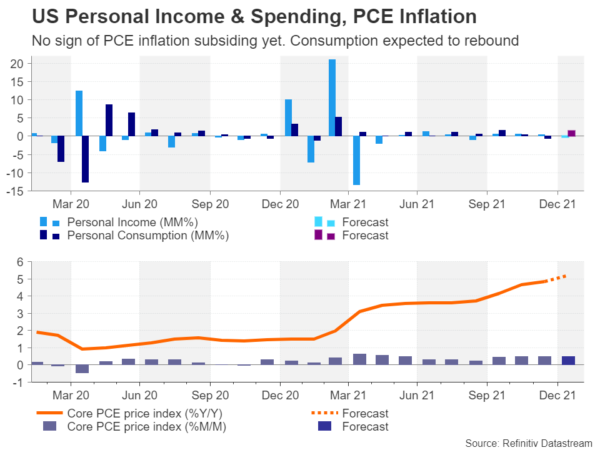

Following January’s much stronger-than-expected bounce back in retail sales, it’s not difficult to guess an equally upbeat consumption number. Personal consumption is forecast to have risen by 1.5% month-on-month in January, more than reversing the prior month’s slide. Personal income, however, is expected to have declined by 0.3% m/m.

More importantly from this report, the core PCE price index is projected to have edged up by another 0.5% m/m in January, showing no sign of easing in the monthly pace of increase and reinforcing the worrying trend seen in the CPI figures.

Any positive surprises in the upcoming raft of data could bolster the dollar, which has gained only modestly from the growing bets that the Fed will hike rates by 50 bps in March. Geopolitical worries haven’t provided a significant boost either, but an unexpectedly strong PCE inflation print might.