- Crude oil finally retreats

- Aluminium at 3-year highs

- Gold testing resistance

Crude oil finally retreats

Crude oil prices have remained under pressure after falling about 2% on Tuesday. The losses come after a strong start to the year. Until this week, prices had risen for 7 consecutive weeks. Will the buyers keep buying those dips, or have prices exceeded their fundamental values and due a correction?

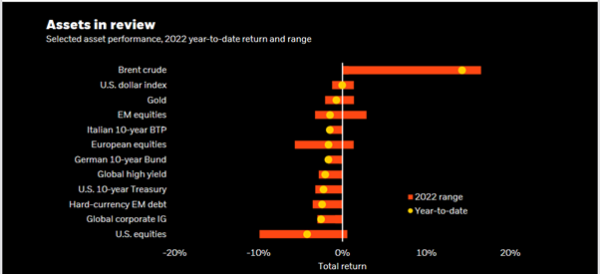

Oil prices have been by far the most notable mover so far this year, as per this handy graphic by BlackRock:

Source: BlackRoack

Investors have been buying crude oil as concerns over the economic impact of omicron variant did not materialise. On top of this, the OPEC+ stuck with its plan to increase supplies by only 400k barrels per day every month, despite calls for it to do more from oil consumer nations. But the group repeatedly failed to even hit that target, which created a supply/demand imbalance. Oil prices then found further support from geopolitical risks concerns Russia and Ukraine. Meanwhile, temporary travel restrictions were lifted across most of Europe, causing investors to expect strong demand for oil in the summer as travel and tourism is likely to ramp up. Indeed, TUI has noted strong booking momentum across all markets, with new bookings for summer 2022 now above pre-crisis levels. Travellers are happy and willing to pay higher prices, after two years of disruption because of the pandemic.

But how much of that is priced in remains to be seen. But I certainly expect the supply and demand imbalance to be temporary and expect it to move back into balance in the months ahead. Against this backdrop, I doubt oil prices will spike noticeably higher from current levels.

WTI has also sold off because of technical reasons as prices retreated from THIS trend line on the weekly time frame:

Source: ThinkMarkets and TradingView.com

It is worth watching WTI closely here as a failure to hold above the $90 psychological level could trigger a bit of profit-taking and opportunistic shorting opportunities.

Aluminium at 3-year highs

Aluminium continues to find support on the dips due to tight supply and falling inventories. The main problem is the cost of electricity which has sky-rocketed, making it very expensive for smelters to operate. This is why we have seen inventories falling sharply. What’s more, China is keen to reduce pollution to improve air quality, especially during the Beijing Olympics. One of the ways to achieve that is to reduce fossil fuel consumption. Smelters, which use huge amounts of electricity generated by coal-fired power plants, have been directly hit by this. There are also reports of covid outbreaks in aluminium-producing city of Baise, in China.

Gold testing resistance

The yellow precious metal broke to a fresh weekly high today, as yields dipped back a little. But overall, yields have been going higher alongside the metal. In the US, the 10-year yield has closed in on the 2.000% level. It looks like investors happy to pile into gold, a non-interest-bearing asset, as they seek to protect their wealth against the impact of soaring inflation. Rising prices are eroding the value of fiat currencies around the world, making gold an appealing investment for many. But gold must now clear the key $1830-$1850 resistance range, if it were to make a more serious comeback.