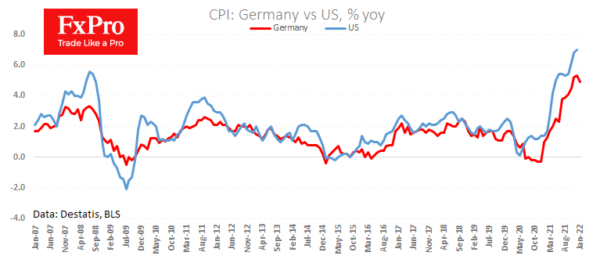

Today we have seen the first slowdown in annual inflation in seven months, but the data is better than expected.

In January, consumer prices rose 0.4%, up 4.9% on the same month a year earlier. Analysts, on average, were expecting prices to fall by 0.2% and slow inflation to 4.3% YoY.

The harmonized price index (adjusted for tax changes) shows an even more significant gap between expectations and reality. The index rose by 0.9% (a fall of 0.4% was expected).

The figures clearly show that inflation has penetrated deeper into the economy and is increasingly taking on the features of permanent price increases.

Sustained inflation raises the expectation that the ECB will also tighten its rhetoric and proceed with policy tightening more quickly than previously promised.

The markets have priced in one rate hike of 0.25% by December. But with the Fed as an example, we can see how quickly things can change. These changes should be positive for the euro.