Key takeaways

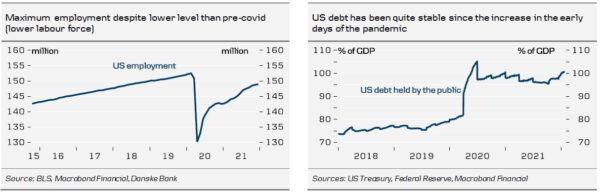

- Fed Chair Jerome Powell sounded hawkish during the press conference emphasising that labour demand and inflation are very high (“both mandates” are p ulling in the direction of tighter monetary policy). Powell spent a lot of time discussing the risks that inflation will remain elevated.

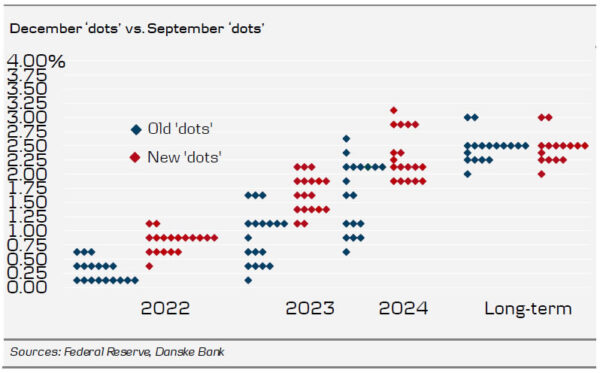

- The Fed now says that “it will soon be appropriate to raise the target range“, i.e. to make the first rate hike in March. It was one of the interim meetings without updated ‘dots’.

- Powell indicated that every meeting is “live” and refused to rule out 50bp rate hikes.

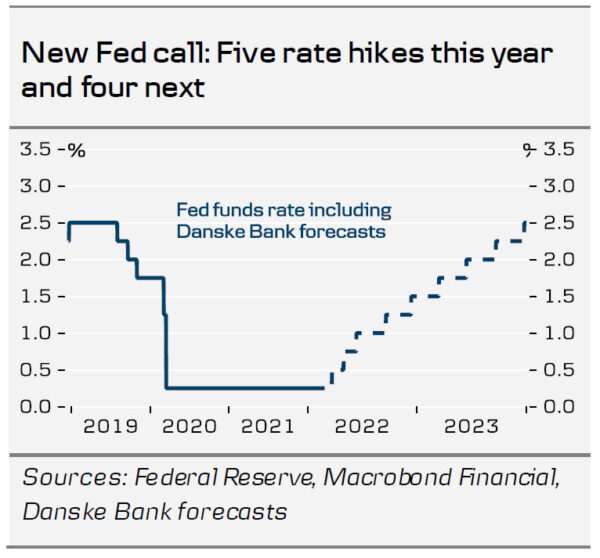

- We now expect five rate hikes this year (in March, May, June, September and December) from four previously.

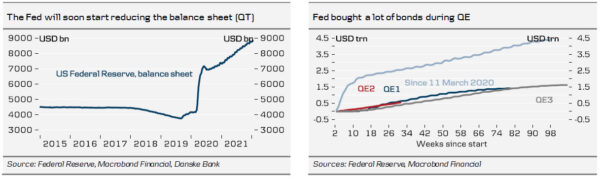

- The Fed did not provide any details on QT timing or pace, but Powell said the Fed will discuss it at the upcoming two meetings, hinting that QT is likely to start in June, which is now our base case (from September previously).

- FX: Hawkish Fed supports USD. We still target EUR/USD at 1.08 in 12M.

Fed: High inflation is a real concern

The Fed has turned more and more hawkish over the past 6-9 months and this meeting was no different. The FOMC statement was as expected with the Fed strongly indicating the first rate hike will arrive at the March meeting. Market reaction was quite muted until Fed Chair Jerome Powell started his press conference at 20:30 CET. Powell sounded more hawkish than expected emphasising the risks that inflation stays elevated, not ruling out 50bp rate hikes and indicating that every meeting is “live” (among other things). It was one of the interim meetings, so there were no up dated ‘dots’.

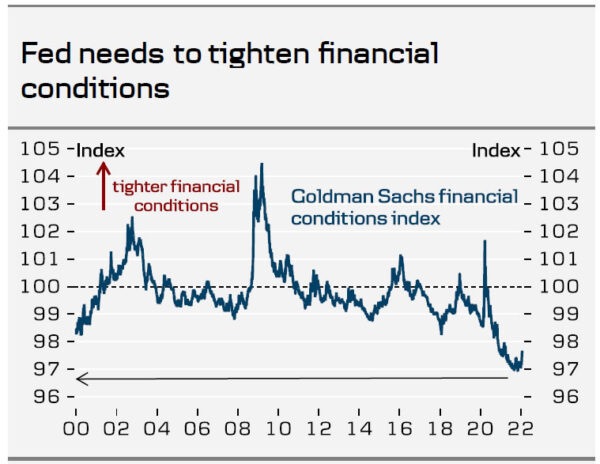

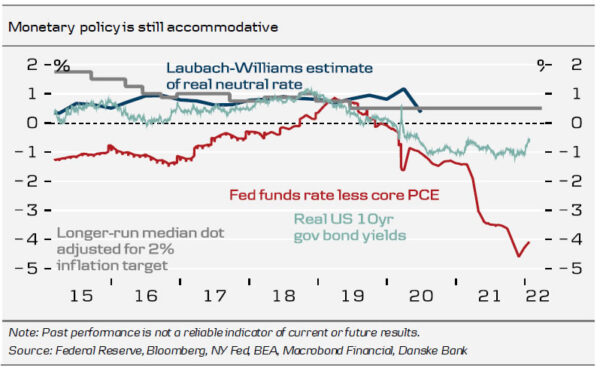

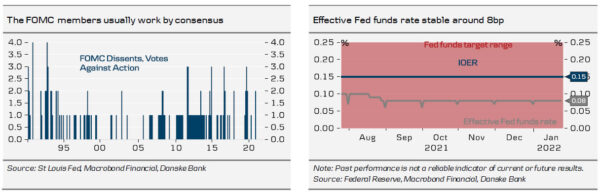

Overall, what the Fed needs to do is to tighten monetary/financial conditions to put an end to the very strong inflation narrative among consumers, businesses, investors and in the media. It sounded like the Federal Reserve may follow the “emerging market central banks” p lay book, where central bank sin Hungary , Poland and Czech Rep ublic have tightened more than expected. Admittedly, the Fed likes to manage expectations in between meetings but financial conditions are still very easy despite markets are already pricing in more than four rate hikes this year, so the Fed likely needs to do more than currently priced to tighten financial conditions.

This also means that speeches in between meetings are going to be extremely important for markets over the course of the year, like we saw with Fed Governor Chris Waller’s recent comments. Noteworthy , Powell did not rule out that the Fed may hike by 50bp instead of the “usual” 25bp .

Based on today’s meeting, we modify our Fed call, as Fed Chair Powell sounded a lot more serious about fighting high inflation now that the US economy has reached full emp loyment. Based on today ‘s information, we now expect five rate hikes this year from four previously. We expect the hikes to arrive in March, May, June, September and December. We still see risks tilted towards more rate hikes. We still expect the Fed to hike four times in 2023.

We now expect the Fed to start QT in June (from September previously), as Powell hinted the Fed would need 1-2 meetings to discuss QT principles in further details. We still expect the run-off caps to be in the range USD75-100bn.

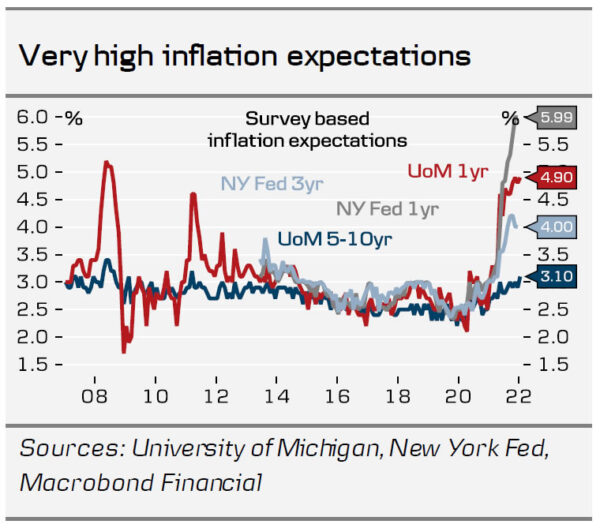

So what is the trigger for the Fed tightening more? Unsurprisingly, inflation is key. Both we and the Fed expect inflation to peak here in Q1. If that is not the case (because we once again underestimate underlying inflation pressure), the Fed is likely to hike more aggressively. The Fed is also likely to follow long-term inflation expectations from the University of Michigan closely. Right now they are running at 3.1% y/y and it did not move above 3.2% y/y before the financial crisis.

FX: Fed supports a stronger USD

For FX, it is of course not ground breaking that Fed is moving towards hiking but the formulations employed by Powell were quite vocal. If Fed is a super tanker, then it surely has turned now. These things are well in line with our EUR/USD view: 1) the investment environment is changing, 2) European data will likely disappoint and 3) EUR is too strong vs fundamentals. All three and incoming data (this week, e.g. hawkish Fed and IMF downgrading global growth outlook) keep suggesting a lower EUR/USD. We remain of the view that EUR/USD spot will be headed even lower over the coming quarters and target 1.08 in 12M.

One of the few asset classes that have stayed afloat amid the latest sell -off is commodities. It will be of particular interest for the FX narrative to see for how long commodities will remain resilient amid a very sharp change in direction of monetary policy and with an already slowing economy. Real rates are rising sharply and the USD is strengthening. Hence, commodity/cyclical-sensitive currencies are trading on the back-foot post Fed and our strategic (broad USD positive) narrative is for this to extend into H1.

Our Fed call summarised

The Fed continues to move in a more hawkish direction, as inflation in general continues to surprise to the upside and labour demand is quite high. The Fed needs to tighten financial conditions to put an end to the strong inflation narrative among consumers, businesses, investors and in the media. Financial conditions have tightened lately but remains very easy in a historical perspective, despite markets are pricing in a lot of rate hikes. This means that the Fed may have to get “ahead of the curve” to change current exp ectations.

We expect the Fed to hike five times this year (in March, May, June, September and in December) and four times in 2023. We still see risks skewed towards the Fed hiking more than what we are pencilling in.

We expect the Fed to start QT in connection with the June meeting. We still expect the run-off caps to be in the range USD75-100bn.