The price of crude oil rose in the overnight session as investors reflected on the latest OPEC+ meeting. In a statement, OPEC+ members said that they did not see any material impact on oil demand because of the rising number of Omicron cases around the world. As a result, the members stuck with their previous guidance of pumping more crude oil in the market. They will add their output by 400k barrels of oil per day in February. This means that the members have resumed about two-thirds of the oil supplies that they slashed when the pandemic started. Later today, oil prices will react to the latest US inventories by the Energy Information Administration (EIA).

US equities were mixed on Tuesday. The benchmark S&P 500 index rose by 5 points while the Dow Jones index added more than 300 points. On the other hand, the Nasdaq 100 index declined by about 216 points. This divergence is likely because investors are afraid of high-interest rates and a hawkish Federal Reserve. It also happened after data by the health department showed that the number of daily cases jumped to 1 million on Monday, with most infections being of the Omicron variant. This surge was expected since most Americans traveled and gathered in large groups during the holidays.

The economic calendar will have some important events today. Two days after publishing strong manufacturing PMI numbers, Markit will release the latest services PMI data. Economists expect the data will show that these PMIs held steady in December amid the variant. For example, in the United States, analysts expect the data to reveal that the services PMI was at 57.5 in December. In the Eurozone, they expect that the PMI declined slightly to 53.3. Other key important numbers will be the ADP private payrolls from the US and Canada’s building permits and housing starts.

XBRUSD

The XBRUSD pair rose to a high of 80.60 on Tuesday after the OPEC+ meeting. It made a false breakout after it moved slightly above the upper side of the horizontal channel. Also, it seems like it has formed a double-top pattern whose chin is at 76.67. Also, the pair has moved slightly above the 25-day moving averages while the Relative Strength Index (RSI) is at the neutral level of 60. Therefore, the pair will likely pull back and then resume the bullish trend above $80.

EURUSD

The EURUSD pair moved sideways after the latest US ISM manufacturing PMI data. This performance is likely because investors are waiting for upcoming jobs numbers. The pair is trading at 1.1300, which is between the horizontal channel shown in red. It is also slightly below the 23.6% Fibonacci retracement level. Also, the pair is along the 25-day moving average. Therefore, the pair will likely remain in this range today.

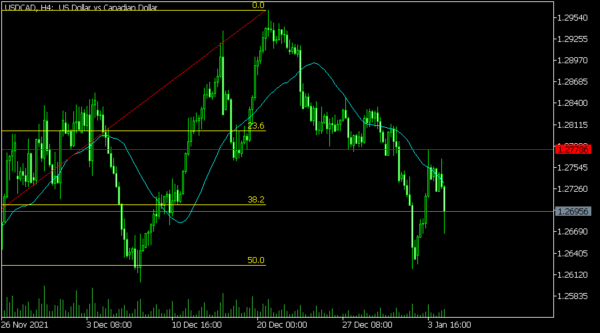

USDCAD

The USDCAD pair declined sharply after the latest Canadian retail and industrial inflation data. The pair declined to a low of 1.2667, which was substantially lower than Monday’s high of 1.2778. It moved below the 25-day moving average and slightly below the 38.2% Fibonacci retracement level. Therefore, the pair will likely remain under pressure today.