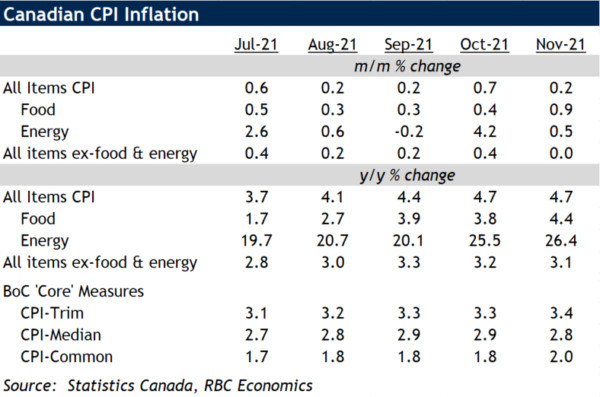

- Headline CPI held at 4.7%, matching consensus expectations

- Growth in prices ex-food & energy ticked lower to 3.1%, offsetting strength in food and energy prices

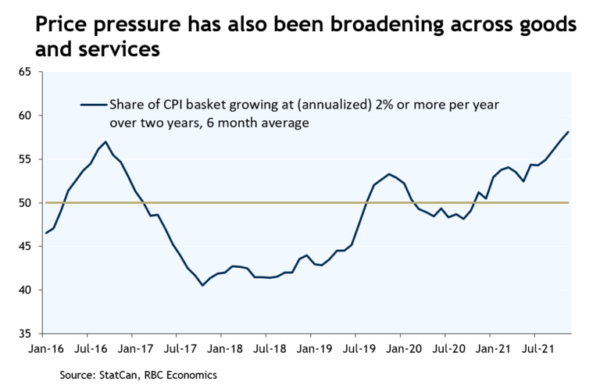

- Inflation pressure continues to broaden; stronger labour markets to prompt rate hike in Q2/22

Canada’s headline inflation rate was unchanged in November, at 4.7% year over year. Energy price growth inched higher again, backed by still elevated gasoline prices, which were 43.6% above levels in November 2020 and accounted for just under a quarter of the headline inflation rate. Growth in food prices also strengthened, to 4.4% or the highest since 2015. Meat costs remained elevated (9%) and price growth in bakery and cereal products also accelerated more significantly (4.1%). We expect that to start moderating in coming months however, given slower pace of price growth for wholesale meat, fish and dairy products from September to November. Gasoline prices are also expected to track lower in December with Omicron worries rattling energy demand.

Excluding food and energy products, CPI ticked slightly lower to 3.1% from year ago in November, or 2.7% on an annualized seasonally adjusted basis relative to the pre-shock February 2020 level. Roughly half of that 2.7% can be still attributed to rising expenses related to home-owning and car purchase or leasing. But the breadth of inflation pressure has also widened, with 58% of the consumer basket seeing faster-than-2% annualized growth in November from pre-pandemic (2019) levels on average over the last 3 months. That compares to 47% in February 2020. The broadening is expected to carry on in 2022 as rising input, transport and labour expenses continue to flow through supply chains for a wider swath of goods and services. Further disruptions to supply chains and energy markets from Omicron and the BC flood later in November are expected to add to price uncertainties in the near-term. But very firm demand growth means inflation rates will likely remain above pre-pandemic levels over the next year. And with labour markets also growing increasingly tight, we expect the bank of Canada to start hiking rates around the second quarter of 2022.