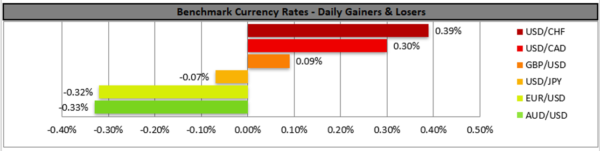

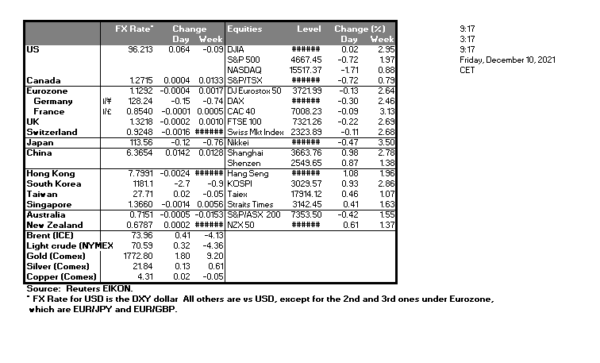

The USD gained yesterday against some of its counterparts, as the market turns its attention to the release of the US inflation rates for November. The headline rate is expected to accelerate on a year-on-year level reaching new multi-year highs and could provide some support for the USD ahead of the Fed’s meeting next week, yet on a month-on-month level it is expected to lose some steam which could tame the bulls somewhat. It should be noted that also the release of the preliminary University of Michigan consumer sentiment for December could also get some attention. On a more fundamental level we note that yesterday the US Senate passed the first of two bills required to raise the debt ceiling of the US Government and seems to avoid the possibility of a default which could lift some uncertainty from the markets. US stockmarkets tended to send out some mixed signals ahead of the release and failed to capitalise on the lower-than-expected initial jobless claims figure released yesterday. As market attention starts turning towards inflationary pressures within the US economy gold’s price seems to have stabilised yet also seems to remain soft as it remains in the reds for a fourth consecutive week.

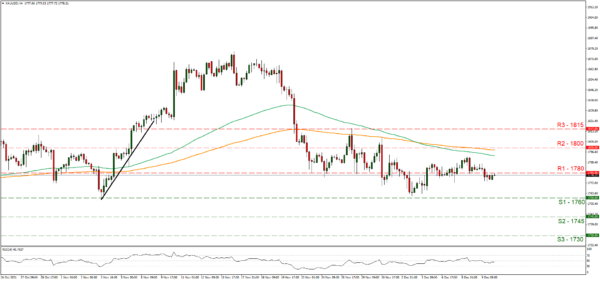

Gold’s price seemed to remain rather stable yet bearish tendencies seem to exist as it broke the 1780 (R1) support line now turned to resistance. For our current sideways bias to change in favour of a clear-cut bearish outlook though we would require the precious metal’s price to reach if not break the 1760 (S1) support line. On the other and should bulls take over, we may see the bullion’s price breaking the 1780 (R1) resistance line and aim for the 1800 (R2) round number.

Pound stabilises but the bears seem to be still present

The pound edged higher against the USD yesterday as it also gained against the EUR and stabilised against JPY. On the pound’s fundamentals the new stricter measures undertaken by the UK government to curb the spreading of the pandemic seem to weigh, while the UK braces for the possibility of a million Omicron variant infections to come. The new measures include a working from home order and a requirement for proof of vaccination for indoor venues such as nightclubs, while the pandemic seems to cloud the economic outlook of the UK and casts doubt on the possibility of BoE hiking rates in its meeting next week. Also, we must note the mini crisis which has erupted in the UK government with the possibility of the UK government lying to the public is still an issue, despite the resignation of a Downing Street 10 aide. Overall, it seems that Johnson’s government seems to be losing on popularity against the opposition Labor party. Today we expect pound traders to focus on the release of a slew of data from the UK in the European session, yet we highlight the GDP rates for October which are expected to slow down and the manufacturing output growth rate which is expected to remain at anaemic levels and if so could weigh on the pound.

GBP/USD seems to have stabilised somewhat between the 1.3280 (R1) and the 1.3160 (S1) levels. We tend to maintain a bearish outlook for the pair as long as its price action remains below the downward trendline incepted since the 29th of October. Should the selling interest for cable be renewed we may see it breaking the 1.3160 (S1) line and aim for the 1.2990 (S2) level. If buyers take over GBP/USD’s direction, it could break the prementioned downward trendline, the 1.3280 (S1) support line and aim for the 1.3430 (R2) level.

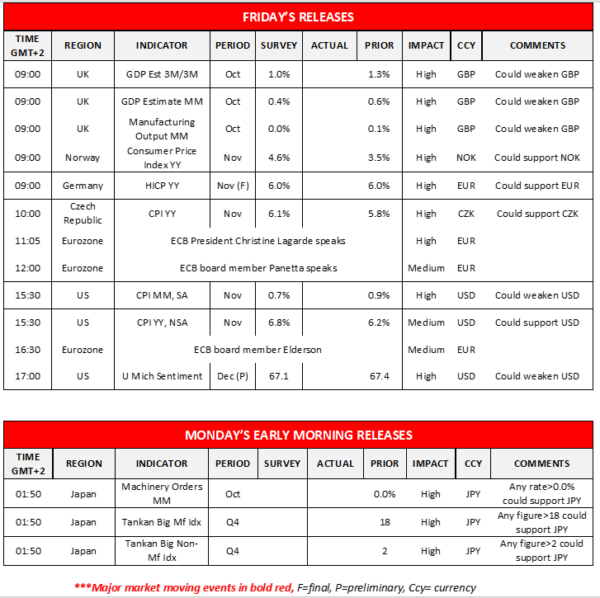

Today’s events and expectations

Today we note high number of statements from ECB policymakers which could create some volatility for EUR pairs and on second note the release of Eurozone’s and the Czech Republic’s inflation measures for November. On Monday’s Asian session we get from Japan the machinery orders for October and the Tankan indexes for Q4 which is usually closely watched.

Support: 1760 (S1), 1745 (S2), 1730 (S3)

Resistance: 1780 (R1), 1800 (R2), 1815 (R3)

Support: 1.3160 (S1), 1.2990 (S2), 1.2855 (S3)

Resistance: 1.3280 (R1), 1.3430 (R2), 1.3600 (R3)