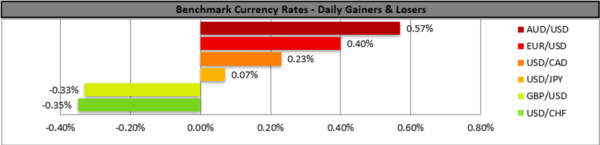

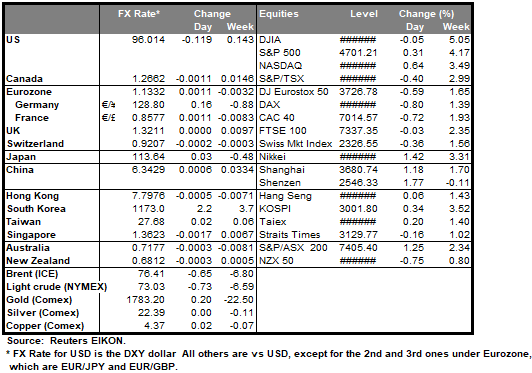

The USD tended to weaken against a number of its counterparts yesterday as markets tended to show some optimism about the Omicron variant of the pandemic and its effects on the global economy yet uncertainty is still present. It’s characteristic how US stockmarkets sent out mixed signals amidst low volatility which underscored the situation of the markets yesterday. On the other hand safe havens such as JPY tended to remain in the retreat as they suffered even greater safe haven outflows, while commodity currency AUD capitalized some gains, while TRY marked new losses as Turkish President Erdogan supported low rates again. Overall we may see this switching between optimism and pessimism about the new variant to continue to affect the market’s fundamentally in the coming days leading safe havens and riskier currencies in different directions. Today we note the release of the weekly initial jobless claims figure, especially after the release of the disappointing NFP figure for November last Friday in order to get a sense on whether the US employment market continues to tighten.

USD/JPY rose yesterday had some bullish tendencies as it tested the 113.70 (R1) resistance line. We note that the pair is marking higher highs and higher lows as an upward trendline is forming yet would require a clear breaking of the 113.70 (R1) resistance line and USD/JPY starting to aim for the 114.45 (R2) level, before switching our sideways bias for a bullish outlook for the pair. Please note that the RSI indicator remains just above the reading of 50 which could imply a rather indecisive market currently. Should the bulls actually take full charge of the pair’s direction we may see USD JPY breaking the 113.70 (R1) line and aim if not reach the 114.45 (R2) level. Should the bears take over we may see the pair aim if not reach the 112.75 (S1) line.

EUR gets some support also from Schnabel

The common currency tended to gain against the USD but also against the broader weaker GBP and JPY in a clear sign of EUR strength. No major financial data provided support for the EUR, however ECB board member Schnabel made some hawkish remarks. The ECB board member warned that the extensive QE program provided by the bank is inflating asset prices highlighting thus the negative effects of the bank’s bond buying program. It should be noted that the statements gained traction also given the bank’s meeting next week but also criticism being expressed by German Bundesbank President Weidmann about ECB’s QE program in the past. Today we expect EUR traders to remain busy with Germany’s trade data, albeit EUR’s direction could be also affected by fundamentals.

EUR/USD jumped yesterday breaking the 1.1300 (S1) resistance line now turned to support. We may see the pair advancing higher today given the bullish sentiment of the market as displayed by the RSI indicator below our 4-hour chart, which is above the reading of 50. On the other hand the correction lower of the pair’s price action during today’s Asian session, tended to create some doubts for the bulls. Should the pair actually find fresh buying orders along its path we may see it breaking the 1.1370 (R1) resistance line which proved its worth on the 18th and the 30th of November and aim for the 1.1435 (R2) resistance level. If the correction lower is extended and the selling interest of the market guides the pair, EUR/USD could break the 1.1300 (S1) line and aim for the 1.1225 (S2) support level.

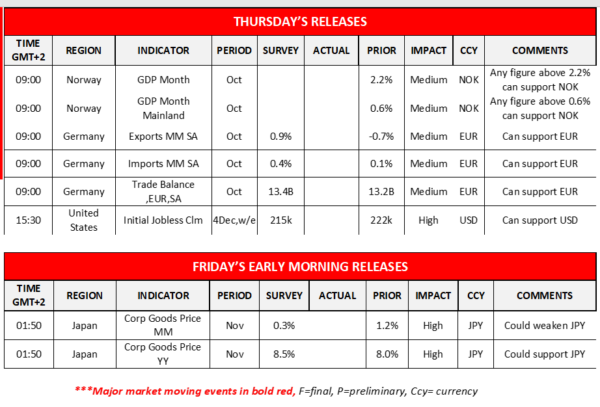

Today’s events and expectations

Today we note the release of Norway’s GDP rates for Q3 as well as Germany’s trade data for October both in the early European session. In the American session we note the release of the US weekly initial jobless claims figure and in tomorrow’s Asian session we get from Japan the corporate goods prices for November.

Support: 112.75 (S1), 112.10 (S2), 111.30 (S3)

Resistance: 113.70 (R1), 114.45 (R2), 115.45 (R3)

Support: 1.1300 (S1), 1.1225 (S2), 1.1165 (S3)

Resistance: 1.1370 (R1), 1.1435 (R2), 1.1510 (R3)