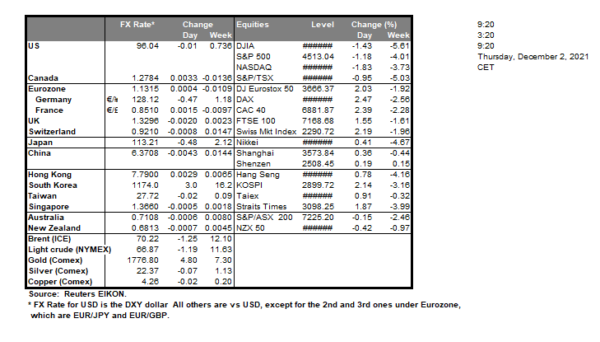

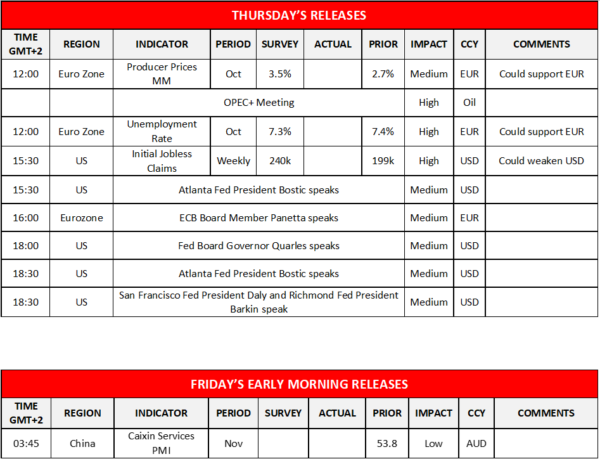

The USD tended to remain rather stable against a number of its counterparts yet the alarm is ringing as the first case of the Omicron variant was detected in the US. On the other hand Gold’s price seemed to gain yesterday yet relented any gains made and moved lower during today’s Asian session while US stockmarkets moved considerably lower due to the uncertainty posed by the pandemic. Fundamentals are still to play a key role for the market’s mood yet focus may start shifting towards the US employment market as the US employment report for November is due out tomorrow and today we highlight the release of the weekly US initial jobless claims which is also expected to rise after last week’s record low (since 1969) and if so could weaken the USD. On the monetary front we note the planned speeches of Atlanta Fed President Bostic (twice), Fed Board Governor Quarles, San Francisco Fed President Daly and Richmond Fed President Barkin. USD/JPY seems to have some bearish tendencies as it tests the 112.75 (S1) support line. For the time being though we maintain a bias for a sideways motion and for it to change in favour of a bearish outlook we would require a clear breaking of the 112.75 (S1) line. Please note that the RSI indicator below our 4-hour chart is between the reading of 50 and 30 implying a slight advantage for the bears. Should the bears actually take charge of the pair’s direction we may see it breaking the 112.75 (S1) support line and aim for the 112.10 (S2) level. Should the bulls take over, we may see the pair aiming if not breaking the 113.70 (R1) resistance line.

EUR remains stable as it remains firmly in the grip of the pandemic

The pandemic is all over EUR’s fundamentals as Europe is in the firm grip of the pandemic once again and could weigh on the common currency. It should be noted that the pandemic is blurring the outlook for the area and may support the notion of ECB’s dovish stance, yet given Fed Chair Powell’s hawkish turn, accelerating inflation rates and some member’s stance, ECB policymakers may want to have second thoughts. Today we note ECB Board Member Panetta which is scheduled to speak and should he maintain a dovish tone we may see EUR slipping. As for financial releases today we note the release of the Eurozone’s producer prices growth rate and the unemployment rate both being for October and their forecasts, seem to favor the common currency’s bulls as the accelerated inflationary pressures are expected to be reported for the area, while the unemployment rate is expected to tick down.

EUR/USD maintained a tight rangebound movement yesterday between the 1.1370 (R1) resistance line and the 1.1300 (S1) support line. We maintain expect the sideways motion to continue and for our outlook to change we would require a clear breaking of the either of the levels mentioned. Please note that the RSI indicator below our 4-hour chart is a bit higher than the reading of 50 and could be implying a slightly bullish sentiment in the market. Should the pair find extensive buying orders along its path, we may see it breaking the 1.1370 (R1) resistance line and aim for the 1.1435 (R2) resistance level. Should on the other hand, the pair fall under the selling interest for the market we may see EUR/USD breaking the 1.1300 (S1) support line and aim for the 1.1225 (S2) support level.

Other highlights today and during tomorrow’s Asian session

Besides the financial releases and central bank policymakers mentioned in the report we would like to highlight the OPEC+ meeting. The meeting is to discuss the oil production levels for the next months and given the release of strategic oil reserves by the US, China, Japan and India we may see OPEC maintaining its production levels unchanged, which could provide some support for oil prices. On the other hand, the Omicron variant may serve as a reason and/or an excuse to cut production levels further a scenario which is less possible yet should it be materialised could provide substantial support for oil prices.

Support: 112.75 (S1), 112.10 (S2), 111.30 (S3)

Resistance: 113.70 (R1), 114.45 (R2), 115.20 (R3)

Support: 1.1300 (S1), 1.1225 (S2), 1.1165 (S3)

Resistance: 1.1370 (R1), 1.1435 (R2), 1.1515 (R3)