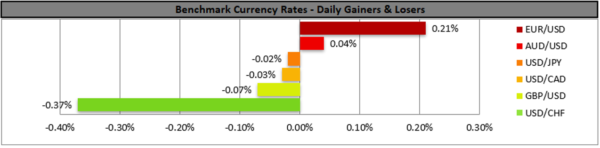

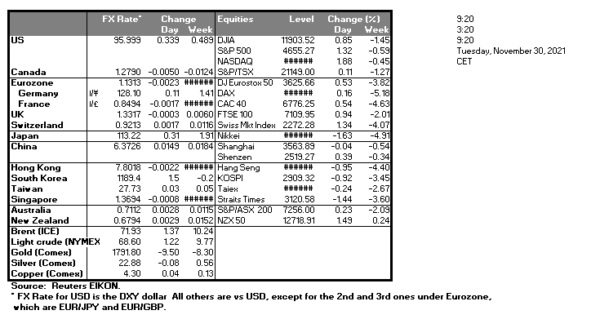

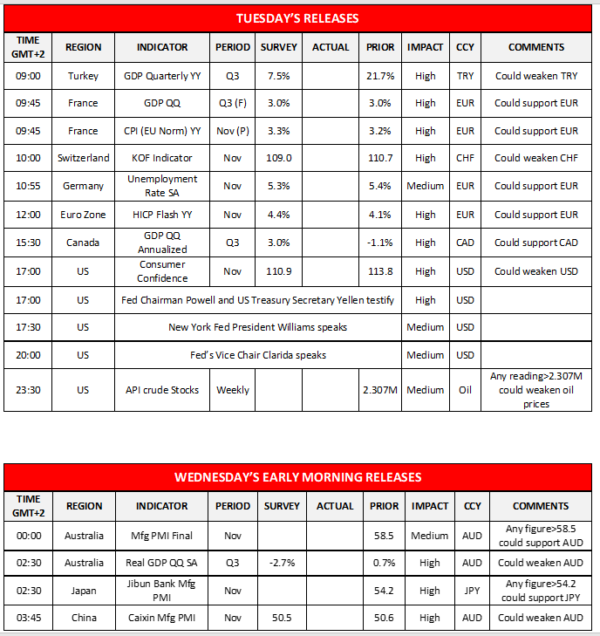

The markets seem to look through the new Omicron variant stabilising somewhat in a rebalancing act amidst lower volatility in the FX market, while the USD still remained rather soft yesterday and during today’s Asian session against its counterparts. Comments made by scientists that the symptoms of the Omicron variant seem to be mild tended to sooth market worries for the possible impact of the new variant of the pandemic on the recovery of the global economy. Today we note the release of the US consumer confidence indicator for November while on the monetary front we highlight the testimony of Fed Chairman Powell before the Senate and the speeches of New York Fed President Williams and Fed Vice Chair Clarida. Should the testimony and the speeches actually lean towards the hawkish side we may see the USD getting some support while also please note that US Treasury Secretary Yellen is also to testify before the Senate.

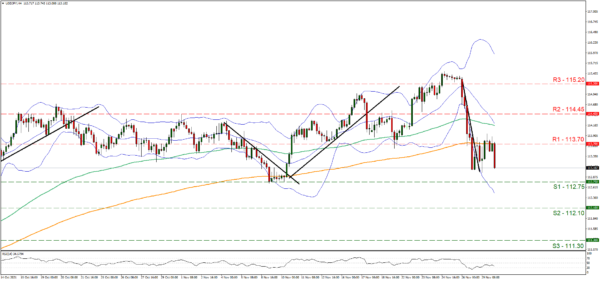

USD/JPY’s bearish tendencies seemed to come to a halt yesterday just below the 113.70 (R1) resistance line, yet during today’s Asian session the bearish tendencies seem to be renewed. As the pair has broken the steep downward trendline characterising its movement since Friday, we switch our bearish outlook initially in favour of a bias for a sideways movement. We have to note though that the RSI indicator below our 4-hour chart is nearing the reading of 30 which could imply that the bearish sentiment is still present. Should the bears regain control over the pair’s direction, we may see USD/JPY breaking the 112.75 (S1) support line and aim for the 112.10 (S2) support level. Should the bulls say enough is enough and take over the initiative over the direction of the pair, we may see it breaking the 113.70 (R1) line and aim for the 114.45 (R2) level.

EUR traders eye inflationary pressures

The common currency corrected a bit lower yesterday against the USD and was slightly lower against safe havens JPY and CHF while was on the rise against the weaker GBP. It should be noted that Germany’s preliminary HICP rate for November showed an acceleration beyond expectations as it reached 6.0% yoy a level not seen in decades in a country which is very sensitive about the level of prices. The release could increase the pressure on the ECB to tighten its monetary policy in a faster pace, yet ECB board member Schnabel stated that inflation has reached its peak in November which could imply that it is expected to retreat afterwards. So, on a fundamental level we still see the pandemic weighing on the EUR as it has a firm grip over the area despite ECB President Lagarde’s optimistic comments yesterday, while on the monetary front ECB’s ultra-loose monetary policy seems to be allowed to continue at least for now. EUR traders are to have a busy day ahead today with France’s final GDP rate for Q3 and preliminary CPI (EU normalized rate) for November due out, yet the crown may be the release of the Eurozone’s preliminary HICP rate for November and should the rate accelerate as forecasted or even more, we may see the EUR getting some support.

EUR/USD seems to have some bullish tendencies in today’s late Asian session, as it broke the 1.1300 (S1) resistance line, now turned to support. Given that the RSI indicator below our 4-hour chart is nearing the reading of 70 and the pair’s upward movement since yesterday’s American session, we maintain a bullish bias for now yet some degree of uncertainty is still present. Should the pair actually find fresh buying orders along its path we may see it aiming if not breaking the 1.1370 (R1) resistance line. On the other hand, should a selling interest be displayed for the pair we may see it breaking the 1.1300 (S1) support line and aim for the 1.1225 (S2) support level.

Other highlights today and during tomorrow’s Asian session

Besides the financial releases allready mentioned we would also like to note Turkey’s GDP rate for Q3, Switzerland’s KOF indicator for November, Canada’s GDP for Q3 and during tomorrow’s Asian session we get Australia’s GDP rates for Q3 and China’s Caixin manufacturing PMI for November.

USD/JPY H4 Chart

Support: 112.75 (S1), 112.10 (S2), 111.30 (S3)

Support: 112.75 (S1), 112.10 (S2), 111.30 (S3)

Resistance: 113.70 (R1), 114.45 (R2), 115.20 (R3)

Support: 1.1300 (S1), 1.1225 (S2), 1.1165 (S3)

Resistance: 1.1370 (R1), 1.1435 (R2), 1.1615 (R3)