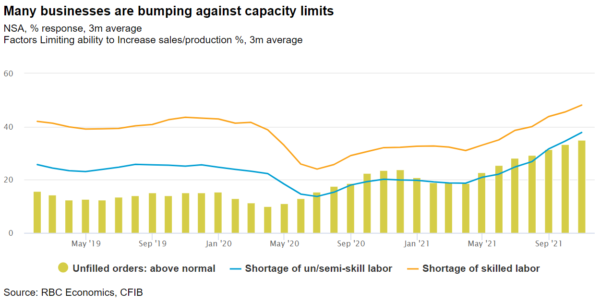

We expect next week’s Canadian survey on businesses confidence (CSBC) to show growing optimism about the outlook for the coming year. The survey was collected at a time (Oct. 1– Nov. 5) when national COVID-19 cases were falling and businesses were reopening. Against this backdrop, we’ll be watching to see what percentage of businesses—particularly in hard-hit sectors—tapped government supports. Indeed, over 64% of restaurant and hotels accessed CEBA loans last quarter with more than half of these firms using the wage subsidy program (CEWS). The report should indicate the degree to which the hard-hit travel and hospitality sectors were able to recover. For many other businesses, order books are again full, and concerns have shifted away from demand uncertainty to their ability to produce given rising input costs, supply chain disruptions, and labour shortages.

Those production capacity issues were clearly evident in the sharp 3% pullback in September manufacturing sales, led by a 36% drop in motor vehicles. We expect the preliminary October manufacturing sales flash estimate next week to look a little better—manufacturing hours worked rose 2% that month. But supply chain challenges remain acute. In last quarter’s CSBC, almost 40% of businesses cited rising input costs as an obstacle for growth. The longer those price pressures persist, the more they will flow into end-consumer prices. With evidence of price pressures broadening, and a growing likelihood of wage pressures building as firms compete for workers, the case is growing for the Bank of Canada to further pull back on policy stimulus. We look for the bank to raise the policy rate in Q2 next year.

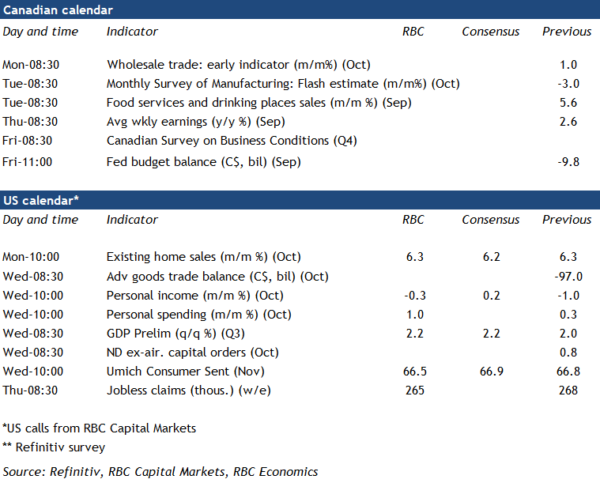

Week ahead data watch:

- The Canadian SEPH employment count will likely post another gain in September given an earlier-reported 157,000 increase in the Labour Force Survey. But the bigger issue will be how vacancies translate into wage pressures for firms. There were close to 900,000 unfilled jobs in August.

- We expect Canadian manufacturing sales ticked higher in October after plunging 3% the prior month. Supply chain disruptions remain, but manufacturing hours worked rose 2.0% in October.

- We expect US personal spending to increase by 1% in October after spending at retail stores rose in the month.