- Optimism returns to equity markets as US stocks scale fresh all-time highs

- Rate hike expectations go into overdrive, dollar comes out the winner

- Dovish Lagarde deals another blow to battered euro

Growth fears ease after solid data, buoy stocks

After struggling a bit in the last couple of days, global stock markets look set to end the week firmly higher, led by another record close on Wall Street on Thursday. A robust set of economic indicators out of the United States as well as mostly positive earnings helped the S&P 500 and Nasdaq Composite wrap up a choppy session by closing at new all-time highs, though only just.

The tech-heavy Nasdaq was lifted by stellar earnings by Nvidia but a plunge in Cisco shares pulled the Dow Jones lower on the back of its revenue miss. Component shortages were a significant drag on Cisco’s earnings, while many retailers also warned of a profit hit from the lingering supply disruptions in the upcoming quarters even as they reported some strong numbers for the last quarter.

Concerns about how surging inflation and supply-chain issues would harm corporate earnings are slowly coming to the fore. But whilst there have been some disappointments in Q3 earnings, investors have overall been encouraged by corporate America’s resilience to the global supply constraints and the jump in factory and energy prices.

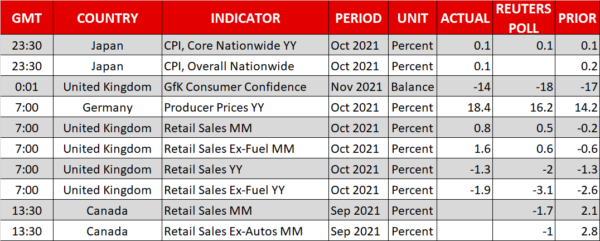

Yesterday’s big drop in continuing jobless claims to a new post-pandemic low and the stronger-than-expected rise in the Philly Fed manufacturing index were the latest reassurances that the US economy can weather the incoming headwinds.

European rally resumes too, Asia mixed

European earnings have also defied gloomy predictions and the Stoxx 600 index is today climbing back towards the record high set on Wednesday. S&P 500 and Nasdaq futures were pointing to more record gains for today.

In Asia, aside from Wall Street’s strong performance, the unveiling of a $490 billion stimulus package by the Japanese government on Friday also boost sentiment. However, there are still some dark clouds hanging over the region, namely, China’s economic slowdown and regulatory crackdowns, which were highlighted by Alibaba’s poor earnings results that pulled the Hang Seng index down by just over 1%.

Fed may be swaying towards earlier liftoff, dollar up

The improved optimism for the global growth outlook appears to be offsetting the intensifying speculation that the Fed and other central banks will hike interest rates much sooner than expected. Atlanta Fed President Raphael Bostic signalled on Thursday that he would support liftoff to begin in the summer of 2022, soon after tapering ends. His Chicago counterpart, Charles Evans, wasn’t as hawkish but was “open-minded” to raising rates in 2022 versus in 2023.

More policy remarks are expected later in the day when Fed Vice Chair Clarida and Governor Waller speak. An expected vote in the House of Representatives on President Biden’s $1.75 trillion social spending bill will also be watched.

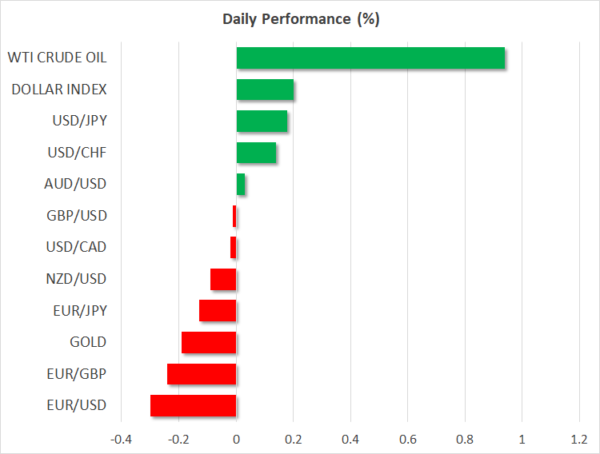

There wasn’t much of a reaction in either the bond or the equity markets to the latest rate hike conversations, but the US dollar nevertheless marched higher. The dollar index was last up almost 0.5%, rising towards Wednesday’s 16-month highs and on track for its fourth weekly gains, while piling renewed downward pressure on its rivals.

Euro & Co get hammered, steadier oil helps loonie

The euro slumped the most, plummeting back below $1.13 after ECB President Christine Lagarde once again warned against premature tightening in comments earlier today. As most other central banks increasingly lay open to the idea of hiking rates early to cap price growth, Lagarde is doubling down on the ECB’s stance of not overreacting to temporary factors that are driving up inflation.

But the euro wasn’t alone in tumbling lower as the pound and commodity-linked dollars also skidded, while the yen and Swiss franc edged higher.

Austria’s announcement that it is entering a full lockdown might have dented the mood as European trading got underway. It comes hours after Germany announced new restrictions for unvaccinated people as virus cases surge in many parts of Europe.

The pound, aussie and kiwi all slipped by around 0.5%. Better-than-expected retail sales figures out of the UK did little to shore up sterling.

The Canadian dollar fared slightly better, though, falling by 0.4% as it found support from steadier oil prices, as investors questioned whether the White House’s plan for a coordinated release of strategic oil reserves by the US, China and others would have a meaningful impact in the oil market.