- Headline CPI rose to 4.7% supported by higher energy costs.

- Growth in prices ex-food & energy ticked lower to 3.2%.

- Inflation pressure will continue to broaden; central bank to ease off the accelerator with rate hikes starting in the second quarter of next year.

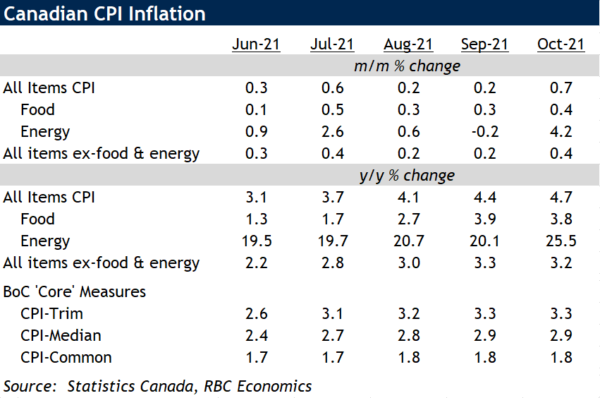

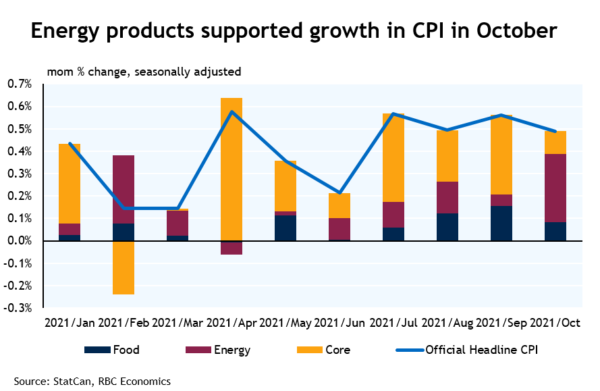

Canada’s headline inflation rate rose to 4.7% in October from 4.4% in September. All of the 0.3 ppt gain can be attributed to higher energy prices (+25.5%). Gasoline grew more expensive for consumers as global demand for oil firmed for power generation amidst a shortage of other energy sources. Prices for food ticked slightly lower but remained elevated (3.8%) as meat products grew pricier (+9.9%). High agricultural commodity and oil prices are expected to underpin food and energy prices near-term. But the breadth of growth across other products and services has also been edging higher, with 57.9% of the consumer basket seeing faster-than-target growth compared to pre-pandemic (2019) levels on average over the last 3 months.

Excluding both food and energy, prices grew a slower 3.2% from a year ago in October or 2.2% on an annualized seasonally adjusted basis from pre-shock February 2020 levels. Much of the latter can be attributed to home-owning related expenses (realtor/broker fees and higher housing ‘replacement’ costs), which look poised to remain elevated in the near-term given the recent resurgence in resale activity. Prices to purchase or lease autos was still elevated in October (+6.6%) with the global semi-conductor shortage limiting vehicle supply. Even outside of autos, supply chain disruptions and strong demand are pushing up production input costs, though much of those increases have yet to be passed on to final consumer customers.

While inflation has bounced back dramatically from pandemic-low levels, the labour market recovery also looks increasingly on firm footing. Job openings have been outpacing the amount of available unemployed workers in the market for months. That is expected to begin to bid up wages in the months ahead. Against that backdrop, we expect the Bank of Canada to begin to ease off the monetary-policy accelerator by beginning to hike rates in the second quarter of next year.