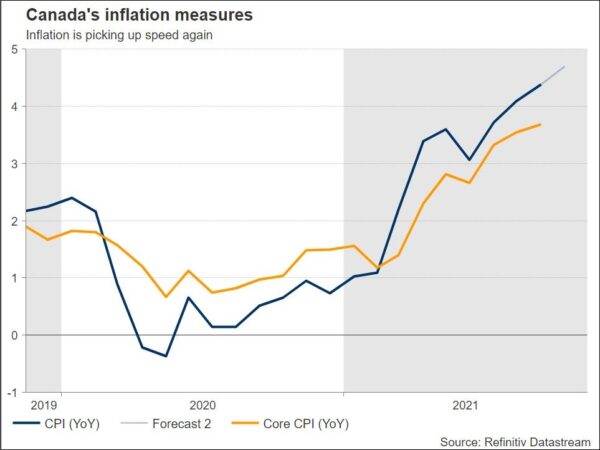

Canada will announce its inflation data for the month of October at 13:30 GMT on Wednesday. It is possible that the data will indicate that inflation has continued to accelerate, which would strengthen the case for an earlier rate hike and support the Canadian currency versus the greenback, helping it bounce back from the one-month low that was posted in the previous week.

Annual CPI is forecast to tick higher

The projection for the monthly CPI is for it to rise to 0.7% in October from 0.2% in the prior month. The annual inflation rate is predicted to tick up to 4.7% versus 4.4% before, holding well above the 2.0% midpoint target. As a result of supply chain concerns and low base year impacts, the inflation rate has risen to its highest level since February 2003.

Will BoC get closer to raising rates?

Will BoC get closer to raising rates?

As the economy recovers, Bank of Canada Governor Tiff Macklem said the central bank is “getting closer” to raising interest rates, in accordance with previous forward guidance. Also, his team has its eyes on its inflation target despite rising risks related to price pressures.

The BoC hinted last month that its first-rate hike might come as soon as April 2022, while money markets are betting on a boost in March and a total of five rate hikes during next year. Quantitative easing was ended in October and replaced with reinvestment in Canadian bonds, a process that will continue through the end of the year. Canadian economic growth has been revised downward from 5.1% this year to 4.25% in 2022 and 3.75% in 2023. Inflationary pressures, notably rising energy prices and supply bottlenecks due to the pandemic, appear to be larger and more permanent than predicted. By the end of 2022, CPI inflation is expected to fall back to the 2% target level.

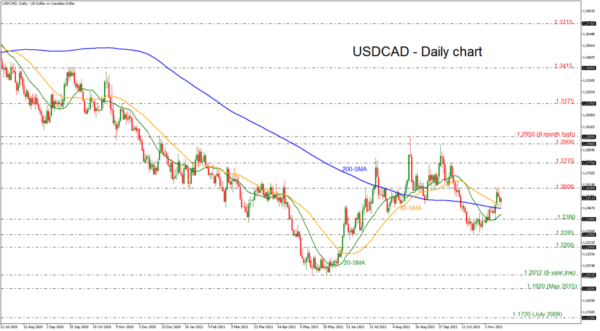

Technical View: Dollar/loonie shows some improvement

Turning to FX markets, dollar/loonie has been gaining some ground over today’s session, remaining above the simple moving averages (SMAs). If the numbers beat expectations, they could strengthen the Canadian currency, pushing the dollar/loonie pair lower towards 1.2390 and then the 1.2285 support reached on October 20.

On the flip side, disappointing CPI figures could see the pair re-challenge the resistance around the 1.2600 psychological number ahead of the 1.2770 barrier.