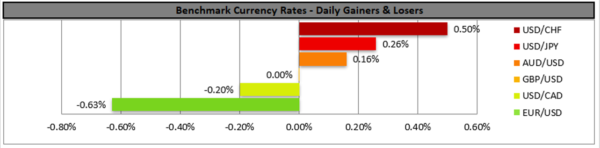

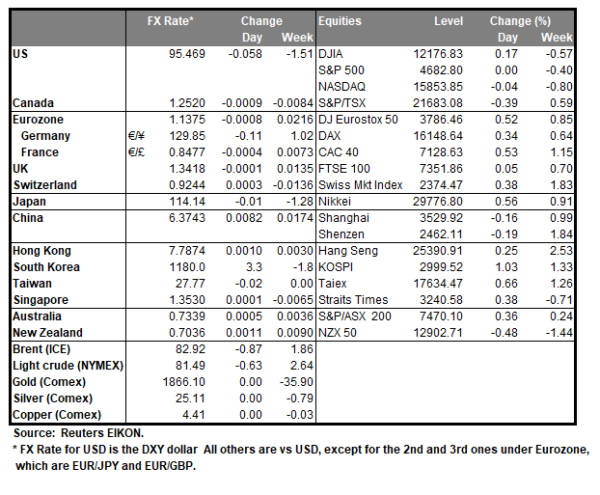

The USD tended to gain against a number of its counterparts yesterday as the market’s attention turns to the release of the US retail sales growth rate for October in today’s American session. It should be noted that shortly after the release also the US industrial production growth rate for the same month is to be released and could extend the volatility for the greenback. On a monetary level the market’s bets on whether the Fed will tighten its monetary policy at a faster pace, after the release of the US CPI rates for October last week, were carried forward and we note Atlanta Fed President Bostic’s speech later on today. On a more fundamental level, we note the friendly tone in the meeting of US president Biden and Chinese leader Xi Jinping and its characteristic that the Chinese leader called the US president an “old friend”, while also called for more cooperation and communication. The Yuan tended to gain and the partial thawing of tensions in the US-Sino relationships could create some safe haven outflows for the USD and provide support for commodity currencies such as the Aussie. US stockmarkets presented little volatility yesterday, yet we would note that Tesla’s share price continued to drop given also that Elon Musk threatened to sell another part of its shareholdings in a Twitter spat with Democratic senator Sanders.

The USD Index rose yesterday testing the 95.60 (R1) resistance line before retreating lower. We tend to maintain a bullish outlook for the index, yet we note that the RSI indicator below our 4-hour chart is at the reading of 70 and could be signalling that the index is overbought and ripe for a correction lower. Should the bulls actually maintain control over the index we may see it breaking the 95.60 (R1) resistance line and aim for the 96.15 (R2) level. Should the correction lower be extended, we may see the index breaking the upward trendline guiding it, the 95.10 (S1) support line and take aim for the 94.60 (S2) level.

Pound traders eye employment data

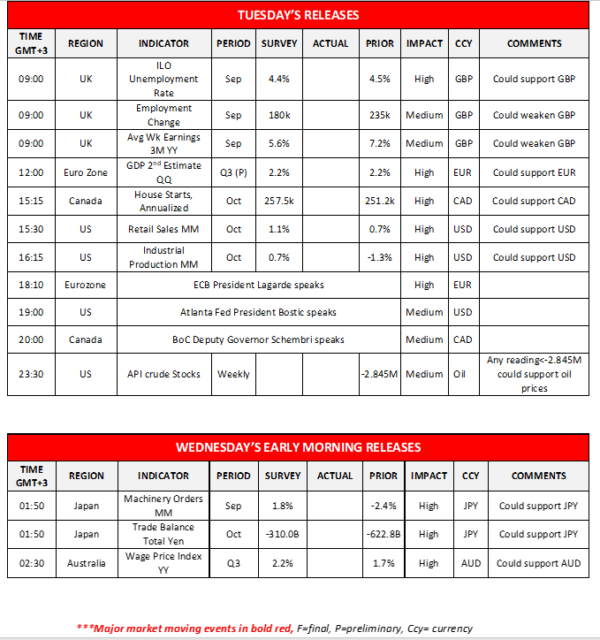

Despite some stabilisation of the pound against the USD, we still are bearish on cable, yet the pound gained substantially against the weakening EUR and also edged higher against JPY yesterday. On a fundamental level, we get highlight the sleaze allegations against the UK government and should they intensify, we may see the pound retreating somewhat as it could provide some degree of political instability. On the other hand the situation of the pandemic in the UK remains worrying. It’s characteristic of the situation that UK Prime Minister Johnson has warned that a new UK lockdown is possible, given that the National Health Service is struggling. On the monetary front BoE’s dilemma on whether to hike or not in its next meeting is still present and in the following days we note that financial data due out could provide more clarity. Today we highlight the release of UK’s employment data and should a tightening of the UK employment market be reported, we may see the sterling getting some support and vice versa.

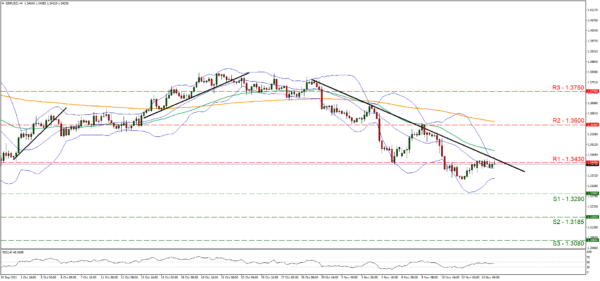

GBP/USD maintained a sideways motion yesterday near the 1.3430 (R1) resistance line. We tend to maintain a bearish outlook for the pair as long as it remains below the downward trendline incepted since the 29th of October. Should a selling interest be displayed by the market for cable we may see the pair aiming if not breaking the 1.3290 (S1) support line. Should the pair find fresh buying orders along its path, we may see it breaking the 1.3430 (R1) line, the prementioned upward trendline and aim for the 1.3600 (R2) level.

Other market highlights for today

Today we also note the release of Eurozone’s 2nd estimate of the GDP rate for Q3, Canada’s House starts for October and the API weekly US crude oil inventories figure. During the Asian session tomorrow we get from Japan the machinery orders for September and the trade data for October while from Australia we note the wage price index for Q3. On the monetary front ECB’s Lagarde, Atlanta Fed President Bostic and BoC Deputy Governor Schembri is scheduled to speak.

Support: 95.10 (S1), 94.60 (S2), 94.10 (S3)

Resistance: 95.60 (R1), 96.15 (R2), 96.65 (R3)

Support: 1.3290 (S1), 1.3185 (S2), 1.3080 (S3)

Resistance: 1.3430 (R1), 1.3600 (R2), 1.3750 (R3)