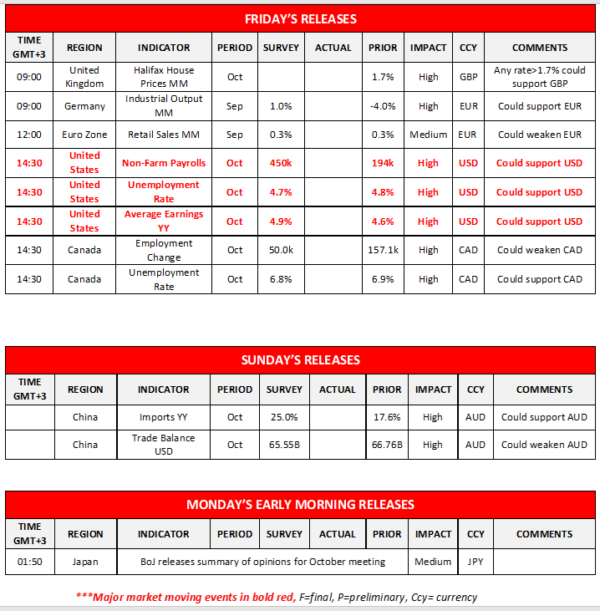

The USD gained against a number of its counterparts yesterday ahead of the release of the US Employment report for October later today. It should be noted that in an encouraging sign, the weekly initial jobless claims figure dropped more than expected implying a tightening of the US employment market also on the last week of the month. From the US employment report’s key indicators, the Non-Farm Payrolls is expected to rise substantially and reach 450k if compared to September’s disappointing 194k, while the unemployment rate is expected to tick down and the average earnings growth rate to accelerate year on year. Overall, should the actual rates and figures meet their respective forecasts or show an even wider tightening of the US Employment market we may see the USD getting some support as it could boost the confidence of the Fed. On the other hand, should the rates and figures miss their targets we may see the greenback retreating as it did at the release of the September report last month.

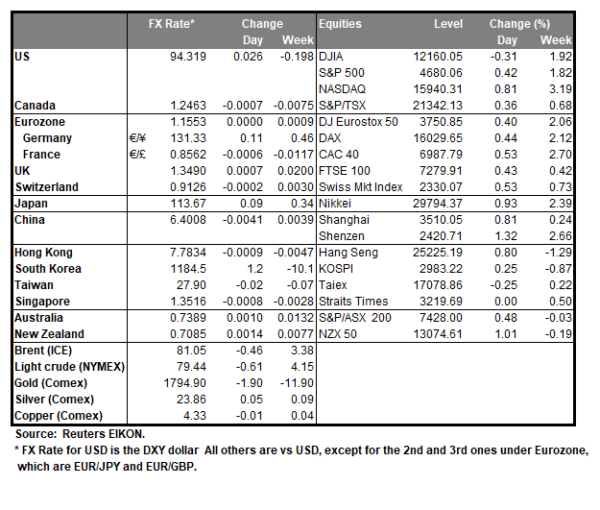

The USD index was on the rise yesterday breaking the 94.10 (S1) resistance line, now turned to support. Given that the index has started to mark higher highs and higher lows we see the bullish tendencies, yet we note that today’s employment report release could alter the index’s direction. Should USD buyers continue to dominate the scene we may see the index rising, breaking the 94.60 (R1) resistance line and take aim for the 95.10 (R2) level. Should the market decide to sell the greenback we may see the index dropping once again below the 94.10 (S1) support line and take aim for the 93.70 (S2) level.

CAD traders eye employment data and oil prices

The CAD continued to retreat against the USD yesterday and reached its lowest point since the 13th of October, as the Loonie’s value was undermined by dropping oil prices. WTI’s price action erased any gains made earlier in the day and continued to be in red territory for a third consecutive day. It should be noted that OPEC’s decision to rebuff US calls for higher production levels and continue to produce what was agreed may make oil bears think twice before advancing further. Nevertheless, we tend to maintain the view that should oil prices continue to drop we may see CAD bears remaining present. Today CAD traders could focus on the release of the Canada’s employment data for October due out at the same time as the US employment report. The unemployment rate is expected to drop which could be a positive for the CAD, yet also the employment change figure is to drop which could moderate any gains for the CAD or even encourage the bears, if the actual rates and figures meet their respective forecasts.

USD/CAD was on the rise yesterday breaking the 1.2425 (S1) resistance line, now turned to support. We tend to maintain a bullish outlook for the pair yet the employment data for the US and CAD for October which are due out today could alter the pair’s direction. Please note that the RSI indicator below our chart is just below the reading of 70, implying an advantage for the bulls. Should the bulls actually continue to push the pair higher, we may see USD/CAD breaking the 1.2500 (R1) resistance line and aim for the 1.2580 (R2) level. On the flip side should the bears take over, we may see the pair breaking the 1.2425 (S1) support line and aim for the 1.2330 (S2) level.

Today’s events and expectations

Today in the European session, we note the release of UK’s Halifax House prices for October, Germany’s industrial output for September and Eurozone’s retail sales growth rate for the same month. In the American session we note the release of the US employment report for October as well as the Canadian employment data for the same month. On Sunday we would also note the release of China’s trade data for October, while on Monday BoJ is to release the summary of opinions for October’s meeting.

Support: 94.10 (S1), 93.70 (S2), 93.20 (S3)

Resistance: 94.60 (R1), 95.10 (R2), 95.70 (R3)

USD/CAD H4 Chart Support: 1.2425 (S1), 1.2330 (S2), 1.2250 (S3)

Support: 1.2425 (S1), 1.2330 (S2), 1.2250 (S3)

Resistance: 1.2500 (R1), 1.2580 (R2), 1.2660 (R3)