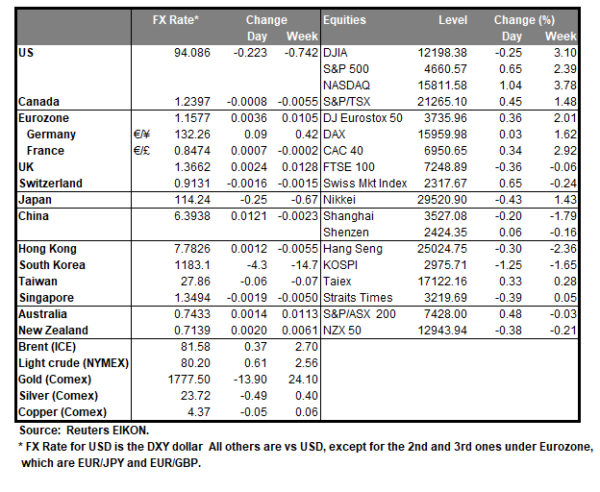

The USD remained soft against a number of its counterparts yesterday, edging lower against the EUR and GBP after the Fed’s announcement of the commencing of the tapering plans for its QE program. It should be noted that US stockmarkets on the other hand gained from the release, with equities indexes reaching new record highs while gold’s price was able to recover some of its earlier losses during the day. As was expected the bank in its accompanying statement announced a monthly US$15 billion reduction to its US$120 billion monthly asset purchases, beginning in November, which should conclude the tapering and erase the purchases by near mid-2022. It should be noted though that the bank and especially Fed Chairman Powell pushed back on the possibility of earlier rate hikes and its characteristic that the Chairman said that the bank could be patient on the matter. Also, in his opening statement the Fed Chairman said that the 4.8% unemployment rate understates the softness on joblessness due to low workforce participation, underscoring the bank’s worries regarding the US employment market. Market’s attention is expected to shift also towards employment data, especially given that tomorrow we get the US employment report for October, yet before that we would also highlight today’s release of the weekly initial jobless claims figure.

USD/CHF reaffirmed its bearish outlook yesterday slipping just below the 0.9130 (R1) support line now turned to resistance. We tend to maintain our bearish outlook for the pair as long as it remains below the downward trendline incepted since the end of September. Should the bears actually maintain control we may see the pair advancing towards the 0.9035 (S1) support line. Should the bulls take over, we may see the pair breaking the 0.9130 (R1) line and aim for the 0.9215 (R2) resistance level.

BoE: To hike or not to hike?

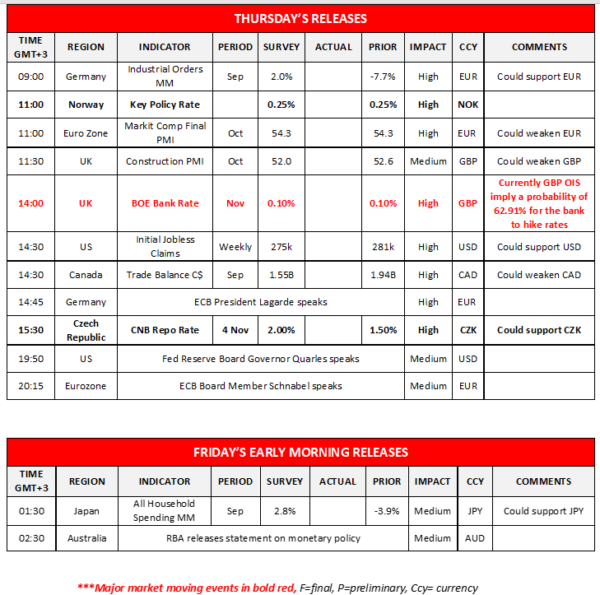

Today pound traders are to be on the edge of their seats as the BoE is to release its interest rate decision. The bank’s dilemma is intense on whether to hike rates or not. Fundamentally the bank is pressured by strong inflationary tendencies in the UK economy to actually proceed with a rate hike in order to set them under control. It’s characteristic that BoE Governor Bailey had talked in the recent past about the need to act to contain inflation expectations. Should the bank be too late to hike rates it may risk the ingraining of inflationary pressures in the recovery of the UK economy for a wider period. On the other hand, a possible rate hike may prove to be premature and could undermine the recovery of the UK economy. Its characteristic of the split within the bank on whether to hike rates or not that currently GBP OIS imply only a 62.91% probability for the bank to actually hike rates currently at 0.10% to 0.35%. On a fiscal level UK finance minister Sunak’s spending plans could be spurring for a rate hike as they could intensify inflationary pressures. If the bank hikes rates, we could see the pound gaining as the start of a tightening of monetary policy would be marked while should the bank fail to do so the pound could retreat by disappointed pound traders.

GBP/USD rose after bouncing on the 1.3600 (S1) line. We expect the pairs’ direction to be influenced by the release of BoE’s interest rate decision today. Should the bank disappoint pound traders and a selling interest be expressed for the pound we may see cable breaking below the 1.3600 (S1) support line and aim for the 1.3430 (S2) level. On the other hand, should pound buyers have the initiative over everybody else, we may see cable breaking the 1.3750 (R1) resistance line and aim for the 1.3875 (R2) level.

Today’s events and expectations

Today we also note the interest rate decisions of Norway’s Norgesbank which is expected to remain on hold as well as the Czech Republic’s CNB which is expected to hike rates. We would also highlight Canada’s trade data for September, while ECB Lagarde and Schnabel as well as Fed’s Quarles are speaking.

Support: 0.9035 (S1), 0.8930 (S2), 0.8830 (S3)

Resistance: 0.9130 (R1), 0.9215 (R2), 0.9300 (R3)

Support: 1.3600 (S1), 1.3430 (S2), 1.3290 (S3)

Resistance: 1.3750 (R1), 1.3875 (R2), 1.4000 (R3)