- Bond yields pressured amid risk of Fed following RBA in pushing back on early rate hike

- Softer start for stocks after Wall Street notches up another record close

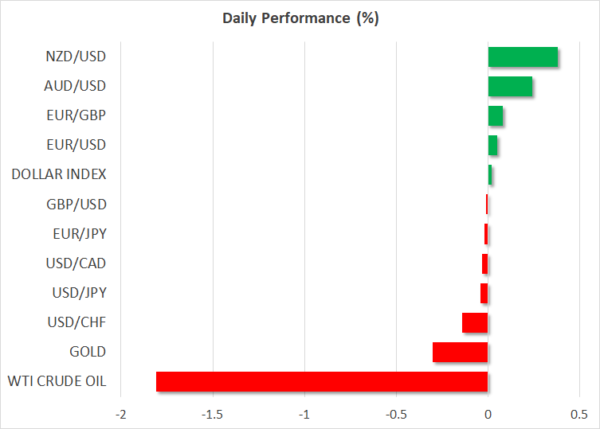

- Aussie and kiwi recoup losses but pound mired in BoE uncertainty

- Oil skids on inventories build-up, mounting pressure on OPEC

Bond markets choppy as Fed awaited for liftoff clues

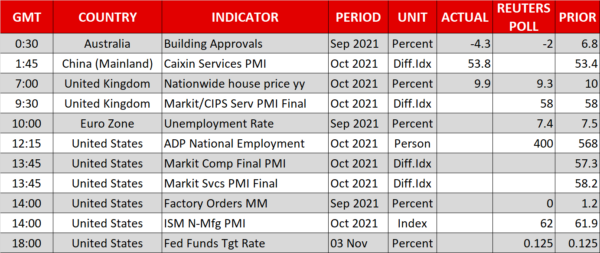

Markets are gearing for the Fed’s long-anticipated taper announcement on Wednesday when the world’s most important central bank will formally call time on its pandemic-era stimulus. However, with markets having had plenty of time to digest the expected tapering decision, the real focus in today’s meeting will be on the post-tapering policy path, specifically, how soon the Fed will begin to raise interest rates once bond purchases have been wound down.

Investors are on the lookout for two possible giveaways that could reveal the timeline for a rate increase. First is the possibility that the Fed could end its asset purchases much sooner than the middle of 2022 that Chair Powell had hinted at the last meeting. The second clue could come from remarks about the inflation outlook. Powell will probably do his best to steer clear of talking about liftoff but his views on inflation will be crucial as should he suggest that the Fed is getting more worried about the threat of persistently high inflation, short-dated Treasury yields could spike up again.

In the most dovish scenario, Powell could take his cues from his Aussie counterpart and rule out an early rate hike, although unlike for the RBA, a 2022 liftoff is firmly on the cards for the Fed. The question is whether policymakers will rush to raise rates soon after tapering has ended or wait a few months.

The RBA’s pushback yesterday has certainly instilled some doubt into the markets about pre-emptive tightening to fight off inflation, pulling government bond yields lower globally. Two-year US Treasury yields attempted to bounce higher today before giving up, indicating investor caution going into the FOMC meeting and Powell’s press conference.

Stocks still riding high, mostly, as some nerves set in

Nevertheless, the US dollar was in no mood to hand back some of its recent gains and held steady against a basket of currencies on Wednesday. But weaker yields were clearly positive for Wall Street as all the three main indices ended Tuesday in record territory.

Minus some disappointments, the Q3 earnings season has been exceptional, allaying concerns about profits taking a big hit from the supply shortages and soaring raw material prices. Some of the highlights on today’s earnings roster are Roku, Qualcomm and Electronic Arts.

However, some caution can be detected in equity markets too today, with Asian stocks slipping and a mixed start in Europe. Wall Street futures were also mixed as Nasdaq 100 e-minis were the only ones in positive territory.

Lingering worries about a slowdown in China amid a fresh jump in Covid cases, regulatory crackdowns and only measured support from policymakers are weighing on Asian markets as the region couldn’t be farther from the record highs being recorded in Europe and America.

Aussie and kiwi rebound but pound lags, oil tumbles

In the currency markets, the Australian and New Zealand dollars were recovering from yesterday’s RBA-led plunge, though the loonie remained on the backfoot. The euro and pound were up too, but only just. The pound has slumped by about 200 pips since late last week, only just holding above the $1.36 level, as investors think the Bank of England is on the verge of making a policy mistake by hiking rates prematurely at its meeting on Thursday.

In contrast, there’s less panic about the RBNZ raising interest rates as the New Zealand economy appears to be roaring despite months of lockdown. The country’s unemployment rate unexpectedly fell to a record low of 3.4% in the third quarter, bolstering expectations of a rate hike later this month and lifting the kiwi.

The yen was mixed after Tuesday’s impressive gains, while tumbling oil prices dragged the Canadian dollar lower.

OPEC and its allies are due to decide on Thursday whether to increase output by the predetermined quota of 400,000 barrels per day or cave in to US demand and boost supply by a much bigger amount. So far, there has been no indication that OPEC countries are willing to do that but mounting pressure from President Biden has made oil markets nervous. WTI futures were last down 1.9%, as rising US crude inventories had already put a dent in oil prices yesterday.