Employment indicators for the third quarter are due out of New Zealand on Wednesday (Tuesday, 21:45 GMT). Despite the return of tough lockdowns since August, New Zealand’s labour market is expected to have weathered the latest pandemic storm well. Hence, the data is unlikely to stand in the way of the Reserve Bank of New Zealand hiking its policy rate for the second time this year when it meets later in the month. However, will upbeat numbers be enough for the kiwi to resume its rally, which has stalled recently?

Economy resilient in the face of Delta

Following the onset of the highly infectious Delta variant, New Zealand has joined Australia in abandoning its zero Covid strategy. Nevertheless, the government is keeping strict curbs in place until at least 90% of the population aged 12 or above have been fully vaccinated. But meeting that target could take several more weeks, meaning economic activity looks set to remain dampened in Q4 as well. However, as seen in many other countries, subsequent lockdowns have not been as disruptive as the first shutdowns and New Zealand’s experience is no different.

House prices have continued to soar during the latest lockdown, retail sales appear to have stabilized after the August drop, agricultural exports – the lifeline of New Zealand’s economy – are booming thanks to higher commodity prices, and the government has loosened its purse strings once again to support the economy through the crisis. Most important of all for policymakers, inflation is surging.

Inflation is a worry

The consumer price index jumped to 4.9% year-on-year in Q3 – well above the RBNZ’s target band of 1-3%. Although wage growth has yet to accelerate to similar levels, the surprising tightness of the labour market suggests that this could only be a matter of time, especially if inflation doesn’t come down as quickly as everybody is hoping it would.

Will jobs market go unscathed by Delta?

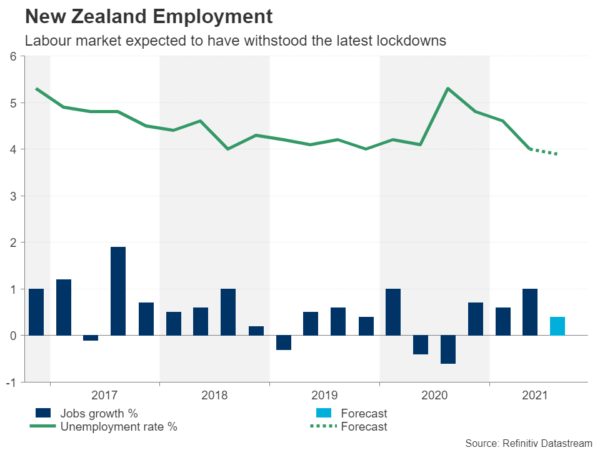

Looking at Wednesday’s data, employment is expected to have increased by 0.4% in the three months to September compared to the prior quarter when it rose by 1.0%. The government’s wage subsidy scheme, which was reactivated in August after the Delta outbreak plunged the country into a fresh shutdown, likely played a big role in minimizing the impact. Unemployment in the hardest hit sectors such as tourism and retail would most definitely have been much higher had it not been for generous government assistance.

The jobless rate is forecast to have edged down one percentage point to 3.9% in Q3, while the labour force participation rate is expected to have ticked up slightly to 70.6%. As for wages, the labour cost index is predicted to have increased from 2.2% to 2.6% year-on-year.

RBNZ rate hike: not if but by how much

If the upcoming numbers are more or less in line with expectations, there will be no reason for the RBNZ to hesitate to hike rates at its next meeting on November 24. It’s also questionable whether policymakers would be deterred from tightening monetary policy further if the jobs figures disappoint by a sizeable margin.

Unless the employment report is shockingly bad, the RBNZ will likely go ahead and lift the cash rate in November. The real question is, what are the chances that the RBNZ raises rates by an aggressive 50 basis points instead of the more regular increment of 25 bps? A much stronger-than-expected set of jobs numbers could shift the odds in favour of a larger hike, bolstering the kiwi.

Can the kiwi resume its uptrend?

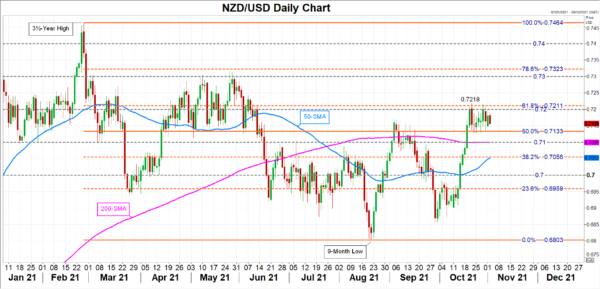

The New Zealand dollar is currently being capped by the 61.8% Fibonacci retracement of the February-August downtrend at $0.7211. A positive surprise could push the currency above this resistance barrier, opening the way for the $0.73 handle, which halted advances in May.

However, if the data is weaker than anticipated, forcing investors to scale back some of their more bullish bets, kiwi/dollar could slip below the immediate support of the 50% Fibonacci at $0.7133 and head for the 200-day moving average (MA) at the critical $0.71 level. If this support fails too, the next big test would be the 38.2% Fibonacci of $0.7056, which is about to be intersected by the 50-day MA.

With markets pricing in a rate rise at every meeting for at least the next six meetings, the kiwi is vulnerable to a downside correction. However, this week’s employment report is unlikely to be what triggers it.