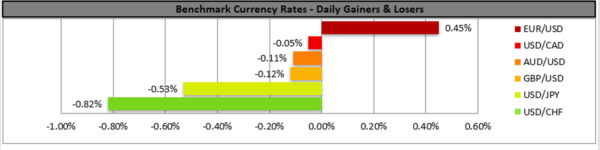

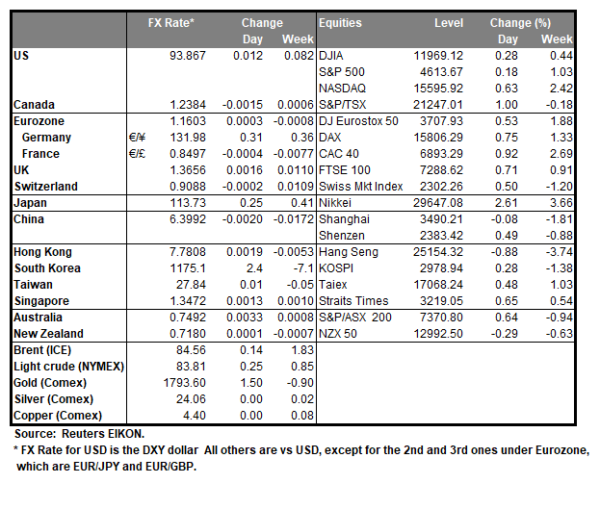

The USD tended to be on the retreat yesterday against a number of its counterparts despite the drop of the ISM manufacturing PMI figure for October being not as wide as the market had expected. Market focus is on the Fed’s interest rate decision on Wednesday and given the lack of high impact financial releases from the US today we expect fundamentals to lead the greenback. Gold’s price was on the rise yesterday benefiting from the weaker Dollar and reaffirming the negative correlation of the two trading instruments, as was mentioned at yesterday’s report. US stockmarkets sent unconvincing mixed messages yesterday with US stock indexes showing low volatility, yet today we may see the earnings releases of Pfizer (#PFE), Race (#RACE) and LYFT increasing the interest in the US stockmarkets.

The USD index dropped yesterday breaking the 94.10 (R1) support line now turned to resistance. We tend to maintain a bias for a sideways motion currently, between the 93.70 (S1) support line and the 94.10 (R1) resistance line, however expectations for the Fed’s interest rate decision could alter the index’s direction. Please note that the RSI indicator below our 4-hour chart is at the reading of 50 implying a rather indecisive market. Should the bears take over, we may see the USD Index breaking 93.70 (S1) support line and aim for the 93.20 (S2) level. Should the bulls take over we may see the index breaking the 94.10 (R1) resistance line and aim for the 94.60 (R2) level.

Oil prices steady ahead of inventory releases

WTI prices tended to remain rather steady albeit it should be mentioned that OPEC did not produce as much oil as was expected in the last month. Characteristically, it was reported that OPEC’s production levels fell short of the planned output agreed with allies as reported by Reuters. It should be noted that key producers like Saudi Arabia did increase production while short falls were reported in countries such as Nigeria. The issue tends to reinforce the market’s expectations for a tight supply of oil and if combined with higher demand level expectations could ultimately push black gold’s price higher. During today’s late American session, we note the release of the weekly US API crude oil inventories figure and should another considerable rise of US oil inventories be reported we may see oil bulls remaining on the low key.

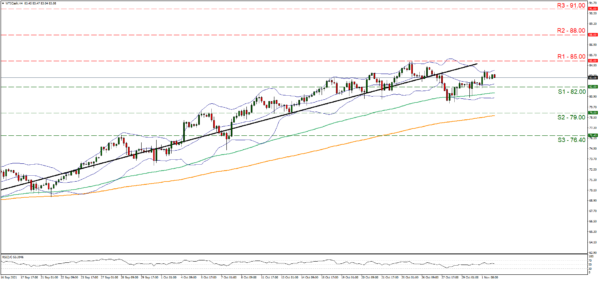

WTI remained within the midst of the corridor formed by the 85.00 (R1) resistance line and the 82.00 (S1) support level. We tend to maintain a bias for a sideways motion as long as the commodity’s price continue to respect these levels yet please note WTI’s prices have marked slightly higher highs and higher lows since Friday the 28th of October. Please note that the RSI indicator below our 4-hour chart is just above the reading of 50, yet rather stable for now, reflecting the current calm of WTI’s prices. Should buyers be in charge of the commodity’s prices, we may see it breaking the 85.00 (R1) resistance line and aim for the 88.00 (R2) resistance level. Should a selling interest be displayed by the market for the commodity, we may see it breaking the 82.00 (S1) support line and aim for the 79.00 (S2) support level.

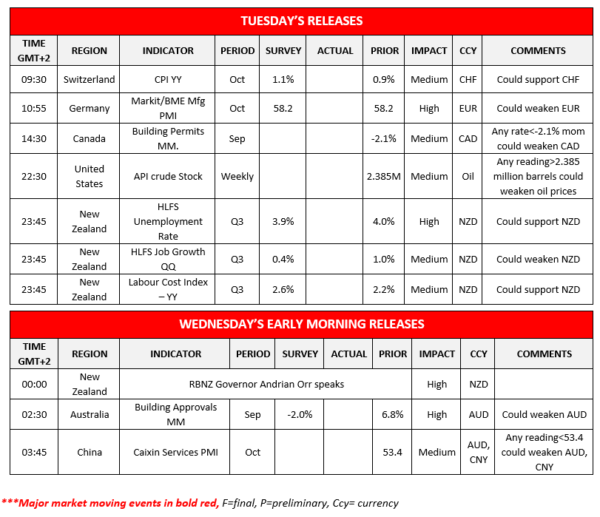

Today’s events and expectations

During today’s European session, we note the release of Switzerland’s CPI rates for October and a bit later the final manufacturing PMI figures for France, Germany and the Eurozone. We note the start of the American session, with the release of Canada’s building approvals for September and just before the Asian session starts we get the US API weekly crude oil inventories figure. During Wednesday’s Asian session we expect attention to be placed on the Kiwi as we get New Zealand’s employment data for Q3 while a bit later RBNZ Governor Andrian Orr is scheduled to speak. We would also note the release of Australia’s building approvals for September and China’s Caixin Services PMI for October.

USD Index H4 Chart

Support: 93.70 (S1), 93.20 (S2), 92.75 (S3)

Support: 93.70 (S1), 93.20 (S2), 92.75 (S3)

Resistance: 94.10 (R1), 94.60 (R2), 95.10 (R3)

Support: 82.00 (S1), 79.00 (S2), 76.40 (S3)

Resistance: 85.00 (R1), 88.00 (R2), 91.00 (R3)