- Sentiment improves after energy prices ease; US debt deal and Biden-Xi meeting help too

- Strong turnaround on Wall Street pulls global stocks higher but inflation threat not gone

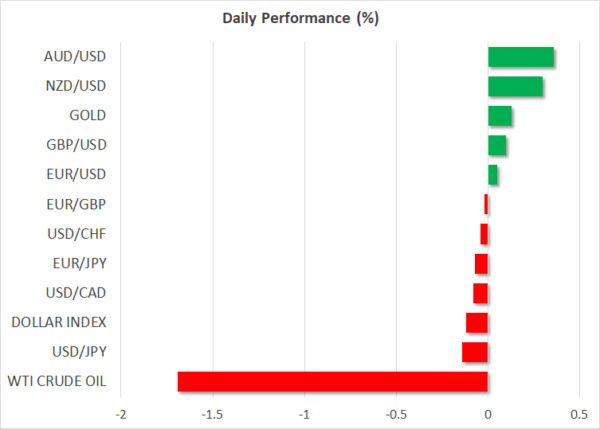

- Aussie and kiwi lead rebound in FX but energy crisis fears still weigh on euro and pound

Fears of an energy crunch subside, for now

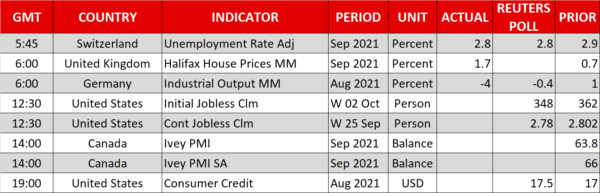

Markets were in a much more cheerful mood on Thursday as some of the gloom around a deepening global energy crisis, soaring inflation and never-ending supply disruptions was lifted. An intervention by Russia’s president, Vladimir Putin, to ease Europe’s natural gas shortage by offering to boost exports to the continent sparked a sharp pullback in UK and European gas contracts, dragging oil prices lower too.

Although Britain’s and the EU’s energy woes are far from being resolved, some of the panic appears to have dissipated for now on hopes that there is the political will to deescalate the power crisis. The surge in energy prices is just another unintended side effect of the demand and supply shocks triggered by the economic shutdowns and ensuing blitz of fiscal and monetary stimulus. However, if businesses and consumers are forced to foot the bill of fuel costs going through the roof, the economic impact could be far greater than that from the price hikes stemming from the broader supply constraints.

This might explain why the euro and pound have been underperforming lately, as investors adjust their expectations of the UK and Eurozone economies enjoying uninterrupted growth for the rest of the year and through 2022.

Equities revel in energy, US debt ceiling relief

WTI oil snapped its four-day winning streak to retreat from seven-year highs on Wednesday, extending its losses to more than 5% today, while coal prices also tumbled. Energy stocks took a hit but the rest of the equity market was in a buoyant mood.

The S&P 500 reversed sharply higher, having slumped at the open, to close up by 0.4%. Tech stocks rebounded as well, helping the Nasdaq Composite add 0.5%. Shares in Asia and Europe also turned green today, with US stock futures pointing to solid gains at the open.

Aside from the dip in energy prices, there was relief for the markets on other fronts too. The US Senate looks set to vote later today on a bill that would allow the Democrats to temporarily lift the debt ceiling until December following a deal with the Republicans. Although lawmakers would have to address the issue again in a couple months’ time and Democrats still have to reach a compromise between party moderates and progressives on the size of the spending bill, the deal does at least remove the immediate threat of the US government defaulting on its debt.

Meanwhile, reports that President Biden and Chinese leader Xi Jinping have agreed to hold a virtual meeting before the year end further calmed the heightened market anxiety of recent days.

Dollar resists selling pressure, aussie and kiwi bounce back

In the currency markets, the US dollar drifted slightly lower, having steadied from yesterday’s slide, as expectations of Fed tapering and lingering risks to the global growth outlook kept the losses in check. The euro and pound were struggling to maintain positive momentum, inching marginally higher against the greenback today. The Canadian dollar didn’t fare much better but the aussie and kiwi put up a decent fight.

The Australian dollar bounced back strongly from yesterday’s low of $0.7224 to briefly top the $0.73 level earlier today. In addition to the improved risk appetite, the relaxation of lockdown restrictions in Australia further bolstered the antipodean currency.

The New Zealand dollar, on the other hand, recovered above the $0.69 level, with yesterday’s buy the rumour sell the news reaction to the RBNZ’s decision to hike rates likely overdone.