Following the stubbornly high Victorian case count and the associated decision by the Victorian government to abandon the zero case objective we have reviewed our growth forecasts for the Australian economy.

The Growth Numbers

Our forecasting process is based around using our estimates for growth in hours worked in the states which rolls up into the national numbers. This approach gives allows us to cross check our estimates against previous Lock Downs while also taking into account the proprietary information on credit and debit card usage with our Card Tracker Index.

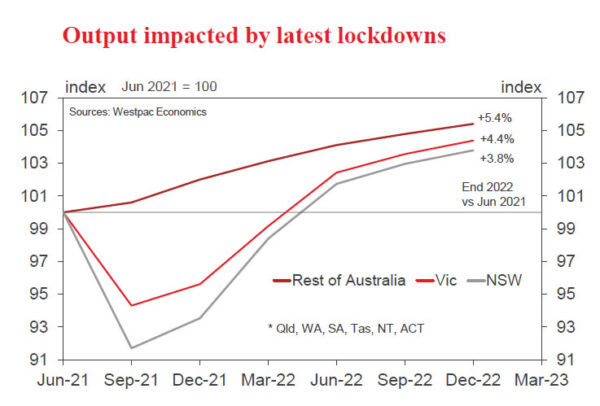

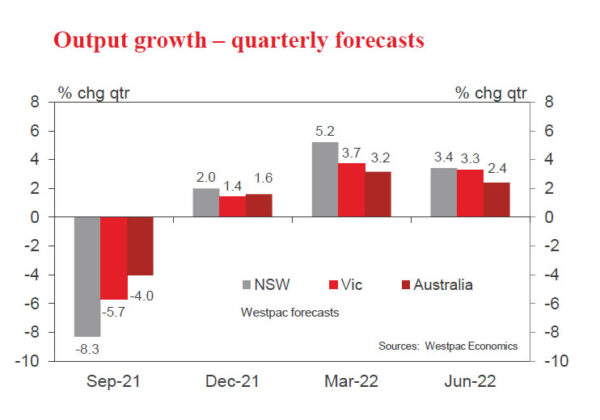

We have lowered our forecast for GDP growth in the September quarter from –2.6% to –4.0%.

We have lowered our growth forecast in the December quarter from 2.6% to 1.6%.

We have lowered our growth forecast for 2021 from 2.4% to 0%.

We have increased our forecast for growth in 2022 from 5% to 7.4%.

For the September quarter we maintain our forecast that NSW will contract by 8.3% but now expect Victoria to contract by 5.7% – recall Melbourne went into Lock Down on August 6 and is now forecast to stay there until the end of October.

The forecast recovery pace in NSW in the December quarter has been lowered to 2% while the Victorian pace of recovery is forecast at 1.9%.

Recognising this weaker near-term growth outlook will mainly impact the labour market through falls in hours worked and the participation rate we have retained our forecast unemployment rate by end October at 5.8% while the slower recovery in the December quarter sees the unemployment rate down to 5.4% in December compared to 4.9% in our earlier forecast.

With a strong recovery expected in 2022 we have retained our target unemployment rate of 4% by end 2022.

The Background

Our most recent set of forecasts was released on August 16 and was underpinned by the assumptions that the NSW Lock Down would continue until early November but the Victorian Lock Down would be eased in early September.

On August 16 NSW reported 478 cases while Victoria announced 22 new cases.

Today NSW reported 1431 new cases and Victoria reported 208.

As Victoria has struggled to contain the virus in the intervening weeks it became clear that extensions to the Lock Down would be necessary but we have waited for more concrete guidance from the Government. That guidance was delivered this week with Premier Andrews abandoning the zero cases target in favour of a vaccination target.

Our new forecasts assume that Melbourne will remain in Lock Down until the end of October, although there will be some easing in the Victorian regions.

Our assumptions around NSW and the rest of the country (no significant Lock Downs) remain unchanged from the August 16 estimates.

We have also reviewed our assumptions about the shape of the recovery in the months of November and December once the NSW and Melbourne Lock Downs are eased.

The early stages of the recovery are now expected to be much more restrained than earlier expected as state borders remain closed and the NSW and Victorian governments, despite achieving the 80% vaccination targets, are cautious about overwhelming already stretched hospital systems in the early stages of a reopening.

The openings in both NSW and Victoria are now expected to be in the context of ongoing heavy case loads.

The current pace of vaccination in Queensland and Western Australia points to the 80% vaccination rate in those states not being reached until well into December making it highly likely that these states will continue to close their borders to NSW and Victoria.

A report in the Australian Financial Review recently quoted statistics from NSW Health that in the four weeks to August 14 of the 6480 positive cases reported in NSW only 2.7% were fully vaccinated, compared to around 30% fully vaccinated in the community.

This statistic best summarises the power of full vaccination and as we move into 2022 when the nation is set to reach 80% vaccination (16 and above, with the 1.2 million children in the 12–15 age groups also rising quickly) and likely to move to 90% (surveys show that only around 10% of the population are opposed to vaccination) allowing the economy to recover quickly.

That will be underpinned by a large boost in federal government stimulus as the federal election draws near; the reopening of NSW and Victoria after a “slow start” in the December quarter of 2021; a strong household balance sheet (household savings rate likely to start the year well above 10%); the reopening of all borders including the foreign border (by mid-year); a booming housing market and a strong world economy.

It is worth noting the 9.6% growth rate in the Australian economy in the year to June 2021, as printed in this week’s national accounts, reflected the benefits of the previous reopening.

In that context our 7.4% for 2022 seems achievable.

Also note that our forecast of a 1.4% fall in the unemployment rate in 2022 compares with the 3.0% fall we have seen in the last year.

While there seems little doubt that the Australian economy will contract sharply in the September quarter the recovery profile carries much uncertainty.

We have already highlighted some issues for the near term while the medium-term outlook carries even more risk.

Low levels of vaccination in the developing world raise the prospect of new vaccine resistant mutations. Questions about the duration of the efficacy of the current vaccines have been raised with the prospect of regular boosters on the horizon. Vaccine hesitancy, particularly in the “zero case” states may be higher than currently estimated – delaying the reopening of borders or risking the problems we see in the US where the rate of vaccination varies widely across states leading to crises in those states with low vaccination.

Domestic risks centre around potential scarring in the business sector as policy support for business in these Lock Downs is much less generous than JobKeeper, especially in Victoria where there has been a patchwork of support measures compared to the Job Saver package in NSW.

We expect that now that the Victorian picture is clearer there will be a more coordinated support package for business where the Federal government plays a key role.

So, while our 7.4% recovery pace in 2022 is our base case the forecast carries much more uncertainty than is usually the case where risks are typically dominated by the more familiar policy risk; structural imbalances and the global outlook.

The Reserve Bank

The Reserve Bank Board meets next week on September 7.

Markets will be focussed on the Board’s decision on its Quantitative Easing Policy.

Last month the Board confirmed its decision in July to scale back bond purchases from $5 billion per month to $4 billion from early September.

Daily cases in NSW were running at around 200 and Melbourne was still open. Today NSW has just reported 1431 cases and Victoria 208.

The Board was advised that the economy was likely to contract by “1% at least” in the September quarter and the economy was set to expand 4% in 2021.

At the time of the August meeting Westpac had forecast that the economy would contract by 2.2% in the September quarter as NSW was in Lock Down.

As discussed above, Westpac is now forecasting a contraction of 4% in the September quarter and zero growth in 2021.

We expect that the Board will now be getting advice that the contraction in the September quarter will be much greater than 1% and the growth forecast in 2021 will be slashed.

Recall the Board’s comments in the July Minutes, “Given the high degree of uncertainty about the economic outlook members agreed that there should be flexibility to increase or reduce weekly bond purchases in the future, as warranted by the state of the economy AT THE TIME.”

With that guidance in mind, it came as a surprise that the Board decided to persist with its taper policy – effectively reducing the amount of policy stimulus at a time when it was being advised that the economy was contracting.

The explanation was (SOMP, August 6) “The need for additional policy support in response to the outbreaks is in the short term…strong growth is expected to resume next year…fiscal policy is the more appropriate instrument” BUT, “the Board will nonetheless keep the rate of bond purchases under review in light of the evolving health situation and is prepared to act if worsening health outcomes affect the economic outlook.”

I think there is no doubt of “worsening health outcomes” so it would be quite extraordinary if the Board did not decide to delay the taper.

The subtle issue is around timing. If the view at the Board is that QE is only effective in the medium term then I think they are underrating the only flexible instrument (highly unlikely to increase the TFF; no need for negative rates or extending YCT) which it has at its disposal.

Recall the almost immediate market response back in September last year (when the recovery was clearly underway), after the Deputy Governor hinted at the possible introduction of QE – bond spreads and AUD responded immediately.

A delay in the taper is unlikely to generate much market response but a decision to actually lift weekly purchases from $5 billion to $6 billion would impact markets, including bond spreads and the AUD.

It would not be the size of the increase but the signal that the RBA was prepared to do more than just reverse the August decision and respond to the deteriorating outlook.

Some may describe the current situation as merely a temporary contraction that will soon be unwound. And our forecast of 7.4% growth in 2022 is consistent with that view. But it is unprecedented and while base cases point to a strong recovery there are formidable risks (as discussed above), firstly around the shape of the near-term recovery and secondly with ongoing and unique health uncertainties.

The view of others is that the Board could not save face if it flipped from confirming a taper to boosting purchases. But the health situation has deteriorated alarmingly and the uncertainties with the virus cast meaningful doubt around the outlook for 2022.

And the wording in the July Minutes and the August SOMP have cleared the way for a policy surprise.

Perhaps there are considerations of limited supply. But the cost of support packages already in place; along with further packages, including additional pressure on NSW and Victorian governments could lift supply by $30 –$40 billion while the automatic stabilisers associated with a fall in GDP growth in 2021/22 from 4.25% (Budget estimate) to 2.5% will also lift the deficit by a further $10– $5 billion.

In fact, a pivot towards more support for State governments in any lift in purchases would be prudent. (Perhaps the additional $1 billion could be allocated 50/50 between Commonwealth and States).

Conclusion

We fully expect that the taper commitment will be deferred.

But an even better response would be to lift purchases from $5 billion to $6 billion with a review at the November Board meeting when the risks around the reopening of the economies and the spread of the virus will be much clearer.

The Reserve Bank has always been prepared to contribute to policy efforts to assist in dealing with economic shocks. This brutal contraction in the economy should be no exception.