- Dollar on the defensive ahead of US employment report

- Stocks and commodity currencies continue to party

- Japanese leader steps down, Nikkei smells more spending

Markets position for NFP disappointment

The moment of truth is finally here. Investors across the world are on the edge of their seats waiting for the latest US employment report, which will hopefully settle the debate of when the Fed will begin to close the liquidity taps.

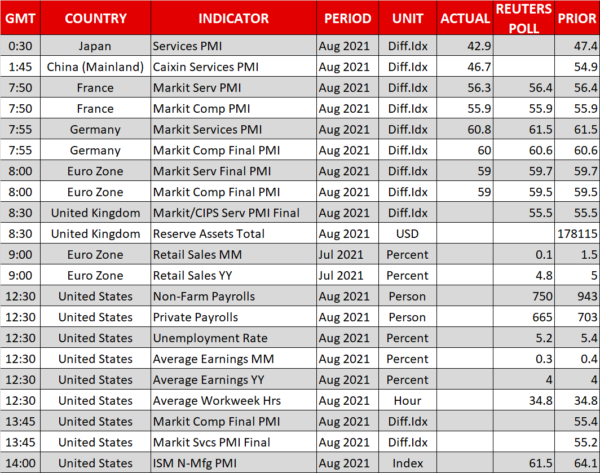

Nonfarm payrolls are expected to clock in at 750k in August, pushing the unemployment rate down another two ticks to reach 5.2%. If the actual numbers meet the forecasts, that would leave the US economy some 5 million jobs shy of a complete labor market recovery.

Subtract from that around 2.5 million people that retired early because of the pandemic and are unlikely to return to the labor force, and it is entirely possible that America returns to full employment by the turn of the year. It would only take a few more months at this pace. With the economy overflowing in open jobs and federal unemployment benefits ending, that’s quite realistic.

That said, it looks like the markets anticipate a disappointment today. The ADP jobs report printed only 374k jobs in August, the composite Markit PMI showed jobs growth hitting a one-year low, and the employment sub-index of the ISM manufacturing survey fell into contractionary waters.

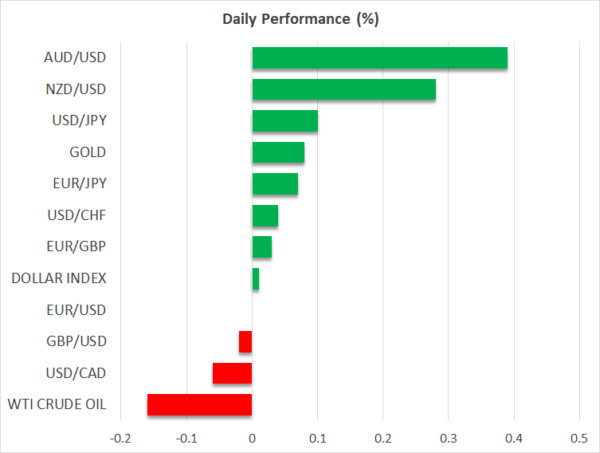

Indeed, judging by the latest price action in the dollar, bonds, and stocks, investors seem positioned for a much lower payrolls figure by now. As such, even a number that simply meets forecasts could spark a comeback in the dollar as a Fed taper move in September comes back into play.

Stocks keep going, antipodeans shine

Wall Street closed a shade higher on Thursday, with a little help from expectations for a soft US jobs report that delays the Fed’s normalization plans. Interestingly enough, markets shrugged off some remarks from Senator Joe Manchin that the Democrats should “pause” their efforts on the $3.5 trillion reconciliation bill, citing soaring debt levels and accelerating inflation.

With the Senate split 50-50, the Democrats can’t afford to lose a single vote if this bill is to pass. Of course, Manchin could be playing political chess and his opposition might ultimately water down the tax increases in this bill, so markets were happy to ignore this for now.

Meanwhile, the risk-on mood was also reflected in commodity currencies like the aussie and kiwi, both of which are headed for weekly gains of around 1.8% against the US dollar. This is the second week of sensational gains for the two currencies as they recover from their recent virus troubles.

Nikkei jumps as Japanese PM resigns

In the political sphere, Japan’s prime minister – Yoshihide Suga – announced he will not run for reelection as party leader. Suga was elevated to the role last year but has seen his approval ratings collapse lately as Japan grappled with a nasty virus outbreak and a slow vaccination rollout.

Japanese stocks were ecstatic. The Nikkei 225 rose by 2% as investors sensed momentum behind a new round of government spending after one of the frontrunners to replace Suga pledged more fiscal measures to battle the virus. The inter-party election is scheduled for September 29. Whoever wins is almost certain to become the next prime minister given the LDP’s parliamentary majority.

Over in China, incoming PMI surveys continue to confirm that the economy is losing speed, raising the question of how forcefully the nation’s authorities will respond as they try to revive growth but simultaneously remain wary of an overleveraged economy.

Finally, with all the attention on the US jobs report today, markets might be sleeping on the ISM services PMI that will be released ninety minutes later. It could also prove crucial for the Fed’s decisions.