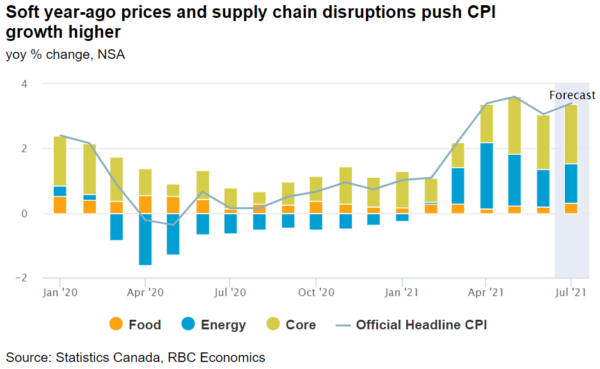

Expect another increase in the Canadian consumer price index in July, as supply chain disruptions and base effects continue to rattle price measures. The semi-conductor shortage—which has impacted all things auto-related, from production to manufacturing sales to car rental prices—has yet to show persistent signs of easing. It should keep prices higher for some products in the near-term. Meantime, we continue to compare higher energy prices this year with dramatically lower ones from 2020—distorting energy price growth measures. Overall we expect headline inflation to increase to 3.4% in July, from 3.1% in June. Core prices, excluding food and energy items, are likely to rise by 2.6%, the highest in almost two decades. Also, some volatility should be expected as Statistics Canada resumes collecting and reporting prices for products and services that were essentially unavailable during the pandemic (for example, travel and tours).

Supply chain disruptions, and the price hikes that go along with them, will eventually ease. Lumber prices have already pulled back sharply from record spring highs and auto production rebounded marginally in June. But consumer demand that has strengthened over the summer will probably be there to put a floor under inflation trends. Statistics Canada already provided a preliminary estimate that sales of merchandise bounced back 4.4% in June after falling in April and May. Our own tracking of card transactions points to some upside risk to that early estimate, and suggests another 2% increase in July. As expected, consumption for the hardest-hit service sectors has also looked much better, with our own tracking of card transactions on restaurants and hotels already back above pre-pandemic levels in July.

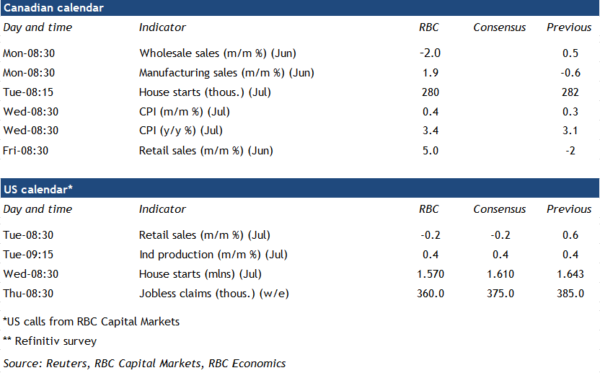

Week ahead data watch:

- Statistics Canada’s preliminary estimate of June manufacturing sales was up 1.9% from May—led by a rebound in the transportation sector, and consistent with an almost 15% increase in motor vehicle exports in the month.

- The early indicator of wholesale sales was down 2% in June from May, due to weakness in the building material, machinery, equipment and supplies subsectors.

- Housing starts likely remained elevated at 280,000 (annualized) in July, similar to June, and backed by solid permit issuance in recent months.