Summary

Employers added 943K jobs in July and hiring was revised higher over the previous two months. The recent pickup in momentum turns the volume up on the debate over when the labor market will meet the FOMC’s criteria of “substantial further progress.” While there were some indications that labor constraints continued to ease, the rise in the Delta variant clouds the outlook. Fed officials will likely be pleased with July’s progress, but we ultimately think they will want to see further ground recovered and if constraints boil down to short-term frictions or longer-lasting damage before kicking off tapering.

Turning Up the Heat on Hiring

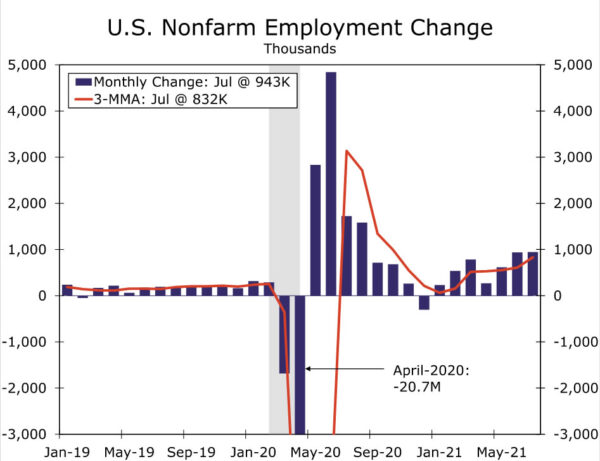

The July jobs report is likely to turn up the volume on the debate over whether the labor market has or will very soon meet the FOMC’s criteria of “substantial further progress.” Employers added 943K new jobs in July, and hiring in May and June was revised up by a combined 119K. The pace of job growth over the past three months has reached 832K, the highest since October of last year, demonstrating a considerable pickup in momentum (see chart).

Some strength was driven by seasonal factors boosting government hiring by a hefty 240K, as lower levels of employment this past year led to fewer summer layoffs than usual. The release noted, “Staffing fluctuations in education due to the pandemic have distorted the normal seasonal buildup and layoff patterns, likely contributing to the job gains in July.” But private payrolls still advanced a solid 703K last month on top of a significant upward revision to June’s figure (now +769K). Every major sector other than retail added jobs, with the leisure & hospitality sector (+380K) accounting for more than half of the private sector job gains last month.

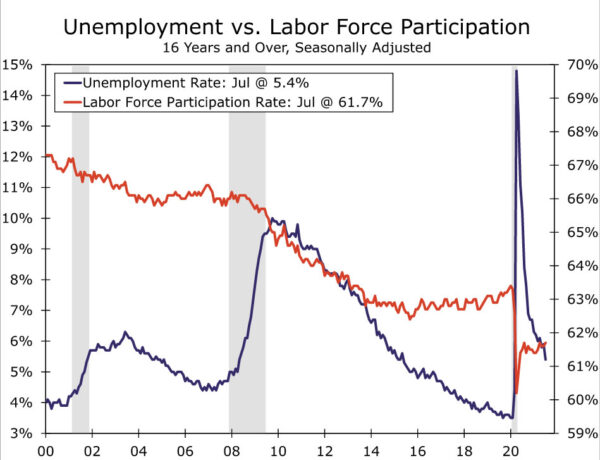

The solid gain in leisure & hospitality employment demonstrates that constraints on labor supply continue to slowly ease as workers return to the hard-hit sector. The labor force increased by 261K in July leading the participation rate to inch marginally higher to 61.7% (see chart). But participation still remains within its post-pandemic range, emphasizing that the availability of workers remains a challenge. Fear of catching COVID as the Delta variant has spread across the United States likely remains an impediment to the return to work, as does childcare responsibilities and perhaps enhanced unemployment benefits. Retirements among older workers are another challenge. With the labor force rising only moderately, the sharp drop in the unemployment rate to 5.4% from 5.9% in June was tied mostly to the +1 million increase in jobs as measured by the household survey being filled by the ranks of the previously unemployed.

Supply Constraints Continue to Bid Up Wages

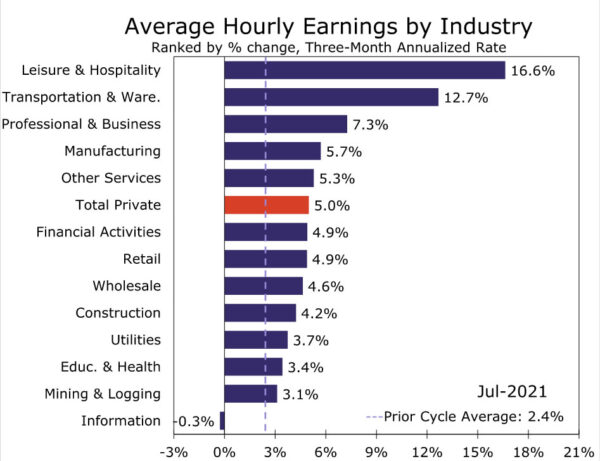

In further evidence that inflation is broadening beyond physical inputs and transportation costs, average hourly earnings (AHE) rose another 0.4% in July, bringing the three-month annualized pace to 5.0% (see chart). Wage gains continue to be most acute in the sectors where job losses remain the steepest, such as leisure & hospitality where wages are up 7.6% just since the start of the year. Constraints on the supply of labor continue to bid up wages as employers are finding it increasingly difficult to find the help they need.

Continued supply challenges will keep pressure on wage growth. Wages and salaries should offset some of the hit to personal income from dwindling fiscal support over the next couple of months, and this increased financial incentive from higher wages could potentially pull more workers back into the labor force. The bargaining power looks increasingly in the hands of workers, and with demand for labor strong, workers are able to consider their options rather than taking the first job that comes their way.

Still Need Better Visibility on Labor Supply

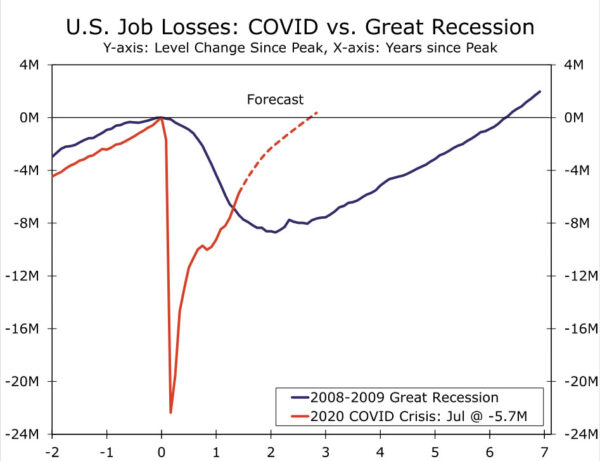

The better-than-expected July report is certainly a step in the direction of “substantial further progress” that the Fed is looking for. Through July about 75% of the jobs lost during lockdowns last year have been added back, but there remain 5.7M fewer jobs compared to February 2020 (see chart). At the same time, labor force participation has barely budged since the economy’s broad reopening this spring.

We continue to look for the factors currently constraining the labor supply to ease this fall, which should keep hiring strong. However, the rise of the Delta variant is likely to lead to a more muted rebound in labor force participation over the next few months than we had previously expected. Not only have health concerns reemerged, but even as in-person schooling resumes, the chance of outbreaks that intermittently send children home will make it difficult for some parents to commit to new jobs just yet.

Therefore, September may still be too soon to bring the clarity on the jobs market many are looking for. While additional progress is a good bet over the next month, we do not expect it will be enough for the bulk of the FOMC to get on board with tapering as early as its September 22 meeting even following today’s report. A clearer picture of whether the current weakness in the labor supply largely boils down to short-term frictions or longer-lasting damage will probably not emerge until the October jobs report is released on November 5, two days after the November FOMC meeting concludes. While this report certainly puts the Fed closer to the threshold of “substantial further progress,” key Fed officials are likely to see that some ground still needs to be recovered.