Summary

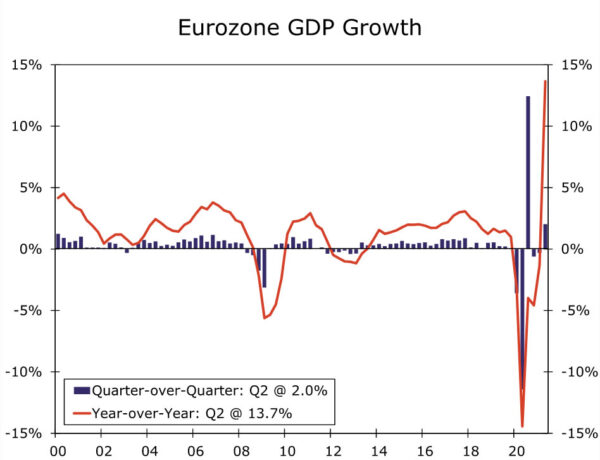

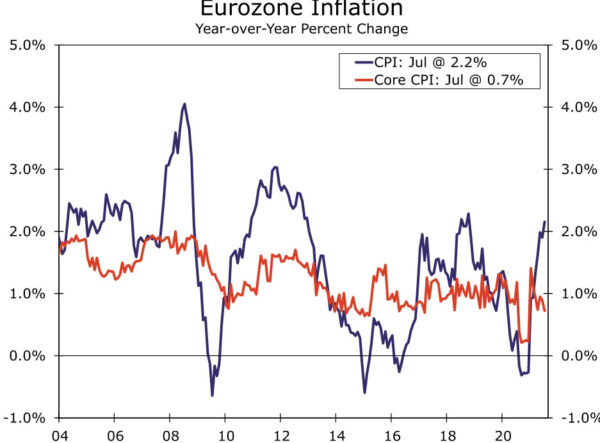

- Eurozone Q2 GDP grew a stronger-than-expected 2.0% quarter-over-quarter, with particularly strong gains reported for Italy and Spain. July inflation remained contained overall, as the headline CPI quickened only slightly to 2.2% year-over-year.

- Confidence surveys and PMI data suggest that economic momentum continued into at least the early part of the third quarter, although the recent renewed rise in COVID cases means some caution remains regarding growth prospects.

- Given this favorable growth and inflation mix we expect the European Central Bank to maintain its accommodative monetary policy and, indeed, ease policy further in December by announcing a further increase in its bond purchase program.

Eurozone GDP Jumps in Q2, July Inflation Remains Contained Overall

The latest batch Eurozone data showed the region’s economic recovery back on course, with a favorable mix of activity and inflation data. Eurozone Q2 GDP rose 2.0% quarter-over-quarter and jumped 13.7% year-over-year (Figure 1), the latter boosted by base effects. Not only was the outcome stronger than expected, but the sequential quarterly increase represented a return to growth after two straight quarters of contraction. Economic growth was also fairly broad-based across the region. With respect to the region’s larger economies, German GDP rose 1.5% quarter-over-quarter, French GDP was up 0.9%, Italian GDP rose 2.7% and Spanish GDP increased 2.8%. In terms of the countries that released details on the breakdown of growth, France saw Q2 household consumption rise 0.9% quarter-over-quarter, while Spain’s Q2 household consumption surged 6.6%.

In addition to the confirmation of strong growth in Q2, survey data suggest that activity remained firm at least during the early part of the third quarter. Eurozone July economic confidence rose more than expected to 119.0, a record high since the series began in 1985. Among the details, both services confidence and industrial confidence rose, to 19.3 and 14.6 respectively. While the strong confidence surveys (along with last week’s PMIs) are encouraging for the Q3 growth outlook, some caution still remains regarding growth prospects given the recent renewed spread of COVID cases across the region. Accordingly, confidence surveys will continue to be watched closely in the months ahead for any hints of whether the latest wave of COVID cases is weighing on activity.

So far, stronger growth in the Eurozone has not been accompanied by significantly faster inflation, in contrast to the sharp uptick of inflation seen in the United States. The Eurozone July CPI firmed moderately to 2.2% year-over-year, while the core CPI slowed to 0.7% (Figure 2). Services inflation quickened slightly to 0.9% year-over-year, while inflation for non-energy industrial goods decelerated to 0.7%.

What are the potential implications of this growth and inflation mix for European Central Bank (ECB) monetary policy? The ECB will certainly welcome the improvement in growth, while the moderate inflation trends means there is no need for the central bank to move to less accommodative monetary policy any time soon. That is reinforced by recent changes by the ECB to its policy strategy that included a shift to a symmetric 2% inflation target, and the dovish policy guidance from the ECB following its July monetary policy meeting. Indeed, given the latest COVID developments have added some element of near-term uncertainty, we now expect the ECB to refrain from tapering its bond purchases in September, and instead signal that Q4 buying for the Pandemic Emergency Purchase Program (PEPP) will continue to be conducted at a significantly higher pace than during the early months of this year.

In addition, if recent COVID developments do eventually have some influence on confidence and activity, and more importantly should underlying inflation trends fail to move meaningfully higher, we expect the ECB to announce a further increase in bond purchases. Our base case for the European Central Bank’s December monetary policy announcement is for the central bank to announce a further €500 billion increase in PEPP purchases, taking the size of that program to €2.350 trillion, with purchases under the PEPP program to continue until at least September 2022.