The Canadian dollar rose on Thursday after the economy surprised to the upside with a 4.5 percent GDP growth in the second quarter being expectations of a 3.7 percent increase. This makes Canada the best performing country in the G7 and has put a rate hike before the end of the year firmly on the table. The Bank of Canada (BoC) is set to deliver its rate statement on September 6, which could be too early with market analyst favouring the October monetary policy meeting which could give the central bank enough time to see what its American and European counterparts will be launching in September. Bond markets are pricing in a 37.8 percent probability of a rate hike in September, up from yesterday’s 20.9 percent. The October rate hike has a 86.8 percent chance according to fixed income prices.

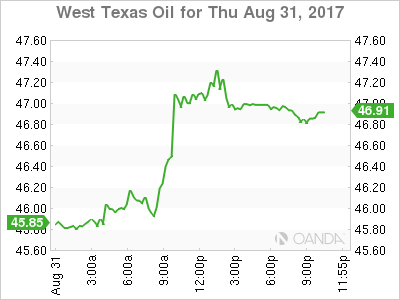

Oil prices came back from the lows caused by Hurricane Harvey. The US administration has approved use of the country’s energy reserves to offsets the shutdown in refinery capacity caused by the tropical storm.

The Trump administration has used hardball tactics ahead of the NAFTA renegotiations that are set to begin formally this weekend. Although the treaty itself leaves the door open for any member to exit the deal by giving six months notice, there are winners and losers of the deal in all three countries. American businesses would be hurt by a sudden end to the agreement, although their gain came from the job losses suffered in America that propelled Mr. Trump into the White House. American companies are hard at work lobbying for the deal to be reshaped for the modern world, but instead are getting anxious at Trump’s tweets threatening to end NAFTA. The three nations have signed non-disclosure agreements on the negotiations leaving the market to speculate on the talks as they happen.

Canadian Prime Minister Justin Trudeau was on a call today with US President Donald Trump the topic was the hope of reaching a deal before the end of the year. Later that day Trudeo addressed union workers and promised them a NAFTA deal they can be proud of while in Montreal.

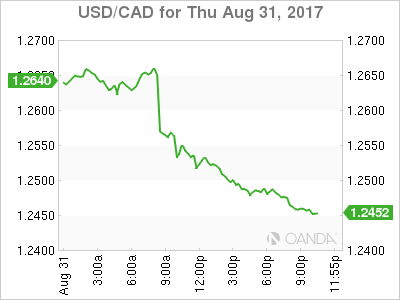

The USD/CAD lost 0.889 percent in the last 24 hours. The currency is trading at 1.2515 near daily lows after a surprise increase in the expected rate of growth of the Canadian economy. The monthly gross domestic product (GDP) release shoed a 4.5 percent rate of growth beating estimates of 3.3 percent. Strong consumer spending was one of the main drivers of the accelerated rate in the second quarter.

The highest rate of growth in six years has put back on the table a follow up rate hike by the Bank of Canada (BoC) before the end of the year. The central bank cut rates twice in 2015 down to 0.50 percent and with a quick pivot in June, announced a rate hike in July against previous expectations of a 2018 first quarter move. The BoC has made it clear that those cuts are no longer needed as the economy has recovered from the impact of low oil prices. A rate hike in the October meeting could still happen given the strong data released today and is propelling the loonie higher versus the greenback.

Energy prices jumped 2.594 percent in the last 24 hours. The price of West Texas Intermediate is trading at 47.15 after the Trump administration has tapped the Strategic Petroleum Reserve to ease the disruption caused by Hurricane Harvey. The US government will loan its reserves to a refinery set in Louisiana, unaffected by the tropical storm in an effort to offset the shutdowns in Texan refineries.

The US also holds gasoline in emergency reserves and could consider tapping into them if gasoline prices remain elevated during the next couple of weeks until refineries can come back online. Harvey affected about a quarter of Texan refineries and is expected to be two to three weeks until they can reassume operations.

Market events to watch this week:

Friday, September 1

4:30 am GBP Manufacturing PMI

8:30 am USD Average Hourly Earnings m/m

8:30 am USD Non-Farm Employment Change

10:00 am USD ISM Manufacturing PMI