Summary

United States: Supply-Side Challenges Continue to Bedevil the Recovery

- After coming in below consensus for two months in a row, nonfarm employment surprised to the upside in June, with employers adding 850,000 jobs. The unemployment rate rose to 5.9%.

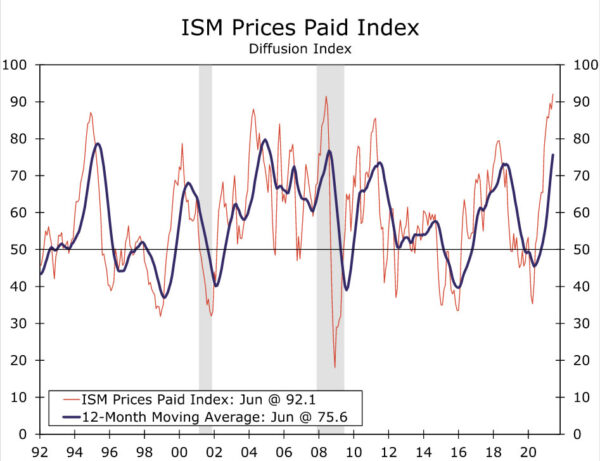

- The ISM manufacturing index fell to 60.6 in June. Manufacturers continue to report a litany of supply-chain challenges: lengthening delivery times, persistent component shortages, staffing difficulties and rising prices. The prices paid series rose 4.1 points to 92.1, its highest reading since 1979.

- Consumer confidence and buying plans both rebounded in June, but shortages of automobiles, new and existing homes, household appliances and a whole host of other items continue to weigh on the recovery. Pending home sales surged 8% in May, pointing to an end to the recent slide in existing home sales.

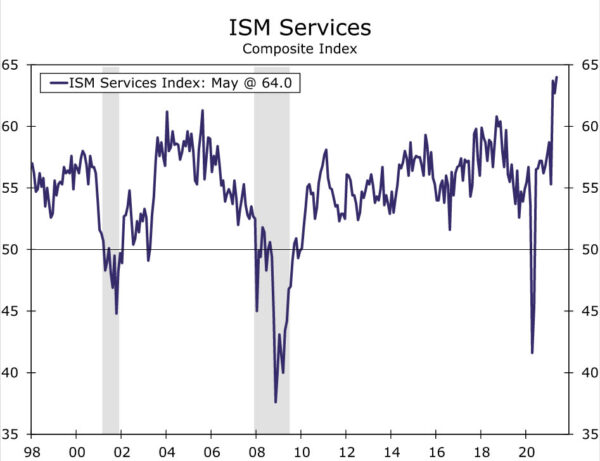

- Next week: ISM Services Index (Tuesday), JOLTS Job Openings (Wednesday), FOMC Minutes (Wednesday)

International: Eurozone Economy Looks Forward to Brighter Days Ahead

- Firming confidence surveys and rising retail sales point to better days ahead for the Eurozone economy. Canada’s GDP declined in April but may be close to bottoming out, while in Japan, the economic recovery looks to be struggling to gain any momentum.

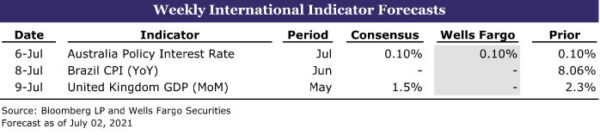

- Next week: Australia monetary policy announcement (Tuesday), Brazil CPI (Thursday), U.K. GDP (Friday)

Credit Market Insights: C&I Lending Declines: Not Worth Losing Sleep Over

- After experiencing double-digit growth in three out of four quarters in 2020, the year-over-year declines seen in commercial & industrial (C&I) lending in April and May may look disappointing, but there is no reason to worry yet.

Topic of the Week: Fourth of July Means Elevated Spirits…and Prices

- This Independence Day marks the first large gathering for many families and friends after more than a year of social distancing. Continuing with the theme of 2021, it will not come cheap.

U.S. Review

Supply-Side Issues Continue to Restrain Growth

Nonfarm employment finally broke out to the upside, with employers adding 850,000 jobs in June. Revisions to the prior two months’ data were fairly small, resulting in 15,000 more jobs. Job gains were fairly broad based during June, but the reopening of public schools at a time that they would normally be closing for the summer led to an outsized gain in state (74,500) and local education jobs (155,200). Without these gains, which were exaggerated by seasonal adjustment, nonfarm payrolls would have added 620,300 jobs and marked the third disappointment in a row.

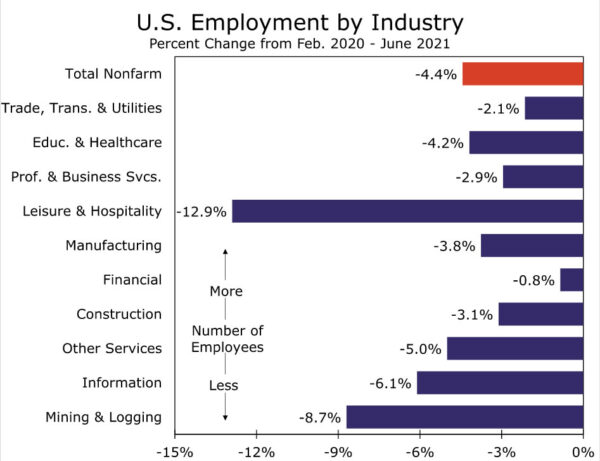

Much of the growth in jobs has come from the industries hit hardest during the lockdowns at the start of the pandemic. The leisure & hospitality sector added back 343,000 jobs, while hiring in retail trade (67,100), administrative services (40,000), social services (32,400) and other services (56,000) all rose vigorously. These five sectors lost 14.5 million jobs at the onset of the pandemic, accounting for roughly 65% of the overall job loss. The five sectors have since recovered 75% of those losses. From a broader perspective, the overall economy lost 22.4 million jobs from February to April 2020 and has since recovered 70% of those job losses.

Manufacturers added 15,000 jobs in June, with all the gain coming in durable goods. Steel and fabricated metals both rose sharply, while furniture & related products saw industry payrolls add 8,500 jobs. Employment in the motor vehicle industry fell sharply, with payrolls declining by 12,300 jobs. The shortfall likely reflects the fallout from the semiconductor shortage, which has limited motor vehicle assemblies. The chip shortage is reportedly easing somewhat, which may lead to outsized gains in July and August, when assembly plants usually shut down for model year changeovers. Construction payrolls declined by 7,000 jobs with big losses in nonresidential specialty contractors (-14,800) and heavy & civil engineering (-10,900) more than accounting for the overall drop. By contrast, hiring among residential and specialty trade contractors (12,700) and residential builders (2,500) remains strong.

The unemployment rate rose 0.1 percentage point in June to 5.9%. The household employment measure fell by 18,000 in June, while the labor force rose by 151,000. Both the labor force participation rate (61.6%) and the employment-population ratio (58%) were unchanged in June. The lackluster results from the household survey suggest the decision by many states to end their participation in the expanded federal unemployment benefits program has, so far, had little impact in bringing workers back to the labor market. However, the June report, which reflects employment conditions in early to mid-June, likely came too early to pick up the re-entry of these job seekers.

Manufacturers are still dealing with momentous supply-side challenges. The ISM manufacturing index fell slightly in June, but remains consistent with strong economic growth. The ISM manufacturers index is a diffusion index that tells us more about the breadth of the strength in the factory sector rather than the magnitude. The latest data show manufacturers are struggling to keep up with demand. The production index rose 2.3 points in June to 60.8, while the more leading new orders index fell 1.0 point to a still exceptionally high 66.0. That reading suggests two-thirds of manufacturers saw orders increase in June. The proportion of manufacturers with rising order backlogs fell 6.1 points to 64.5. Again, the monthly drop is far less important than the still historically high proportion of manufacturers that report rising order backlogs. Manufacturers report shortages of a growing list of components and also noted persistent challenges finding and retaining the workers they need. The prices-paid index rose 4.1 points to 92.1, which marks the highest proportion of manufacturers reporting paying higher prices since July 1979. The breadth of price increases and intransigence of supply-chain bottlenecks suggest the recent spike in inflation will likely prove to be sharper and more persistent than the Fed has expected.

Weekly first-time unemployment claims fell sharply during the latest week. Most of the states that have opted to pull out of the expanded federal unemployment benefits program early have seen sharp declines in initial claims in recent weeks, suggesting we should see more workers return to the workforce in coming months, paving the way for stronger job growth and some easing in wage increases.

Pending home sales came in surprisingly strong in May, rising 8%. Consensus forecast had called for 1% decrease. The rise in pending sales, which reflect signed purchase contracts, suggests the recent slide in existing home sales is coming to an end. This past week also showed home prices continue to rise rapidly across most of the country, with the S&P CoreLogic Case-Shiller National Home Price Index rising 1.6% in April and 14.6% over the past year, which is the largest year-over-year gain ever recorded. The 20-City index rose an even larger 14.9% year-over-year. Phoenix, which has seen strong population and employment growth this past year, again posted the largest year-over-year gain, with prices soaring 22.3%. Five metro areas—Charlotte, Cleveland, Dallas, Denver and Seattle—also posted their largest year-over-year gains this past month.

U.S. Outlook

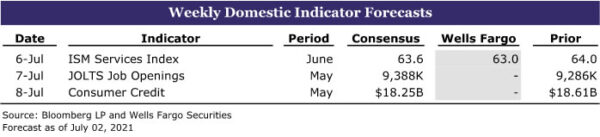

ISM Services Index • Tuesday

The service sector is soaring as further vaccination progress is made and more of the U.S. economy reopens. The ISM services index jumped to 64 during May, which is the high-water mark since records first started in the late 1990s. Like many other areas of the economy, supply has not kept pace with skyrocketing demand for services, which has resulted in upward price pressures. The prices paid component of the index rose to the second-highest reading on record. The hiring index declined 3.5 points in May, which is a reminder that service providers are also having trouble filling open positions. Looking ahead, service sector activity is likely to remain strong. During May, virtually every service industry reported overall growth, increasing business activity, and an increase in new orders. That said, abounding supply constraints are likely to take some air out of the index in coming months. Bearing that in mind, we look for the ISM services index to slip to 63.0 in June.

JOLTS Job Openings • Wednesday

We do not forecast the Job Openings and Labor Turnover Survey (JOLTS) on a monthly basis. The JOLTS, however, is likely to receive increased attention from market participants next week as labor shortages have emerged as a major impediment standing in the way of even stronger economic growth. During April, job openings rose to 9.3 million, which marked a record high. The survey confirmed that staffing open positions has become a challenge for many businesses across a wide array of industries. More workers appear to be voluntarily leaving their jobs, which suggests the labor market may be tighter than other measures indicate. The quits rate increased to a series high of 2.7%. Considering other surveys, such as the NFIB small business survey and ISM manufacturing and services indexes, continue to report that companies that are trying to hire, yet can not find the workers to do so, it would not be surprising to see the JOLTS come in at the market consensus of 9.34 million job openings in May.

FOMC Meeting Minutes • Wednesday

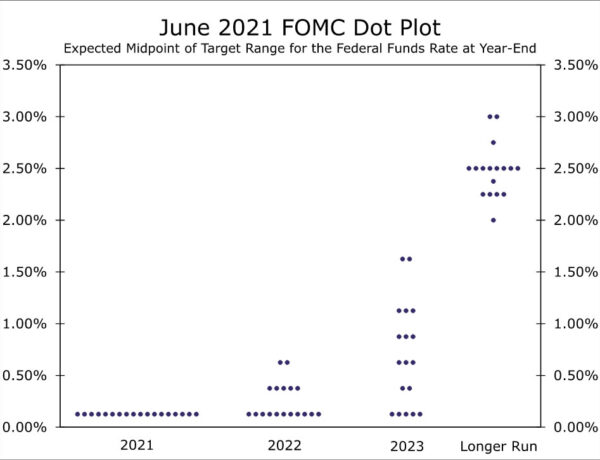

The FOMC made no substantive policy changes during the June 16-17 meeting. The committee maintained its target range for the fed funds rate between 0.00% and 0.25%, and kept its monthly pace of asset purchases unchanged. Despite leaving monetary policy essentially untouched, officials indicated that initial discussions took place on how and when to potentially start tapering bond purchases. Market participants will likely be looking through the minutes of the meeting for clues on when this process might get started. The FOMC also raised its inflation forecast for 2021, and the minutes may provide additional insights on just how “transitory” members view recent inflationary trends. Similarly, seven of the 18 committee members indicated through the “dot plot” that they expect rates to be higher at the end of next year, and 13 members look for higher rates at the end of 2023. The minutes could reveal the extent to which FOMC officials are debating moving toward tightening.

International Review

Eurozone Economy Looks Forward to Brighter Days Ahead

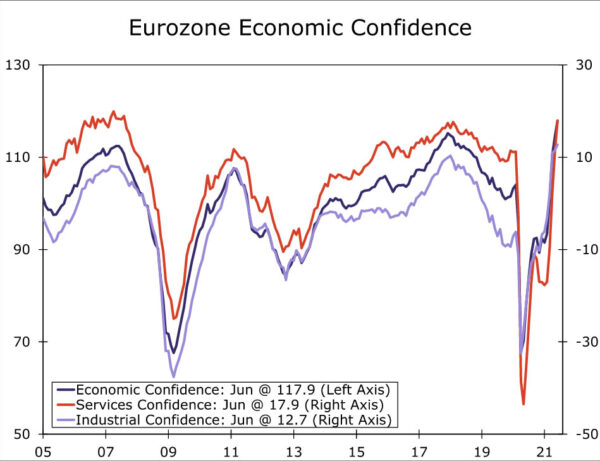

This week’s news from the Eurozone was generally favorable in terms of the region’s economic prospects. Of particular note, Eurozone economic confidence rose more than expected to 117.9 in June, the highest level in more than two decades. The evidence of economic reopening was apparent in the services confidence component, which jumped to 17.9 in June from 11.3 in May, whereas the increase to 12.7 in industrial confidence in June was more modest. Meanwhile, important activity data also offered encouraging evidence of the economic impact of reopening. German May retail sales rose 4.2% month-over-month, reversing a sizable portion of April’s sales decline, while French household consumption rose 10.4% month-over-month, more than reversing the April fall. Given these favorable economic indicators, we view the risk to our Eurozone full-year GDP growth forecast of 4.3% as tilted to the upside.

Separately, while surveys have indicated some supply shortage and bottlenecks, inflation pressure at the consumer price level remain reasonably contained for now. In June, the headline CPI eased to 1.9% year-over-year, while the core CPI also eased to 0.9% year-over-year. Inflation trends will almost certainly quicken in the coming months due to base effects, given the comparison with unusually low price readings in Q3-2020. Nonetheless, even with some pickup in prices likely in the months ahead, the extent of inflation pressures across the Eurozone appears likely to be much less than those currently being experienced in the United States, for example.

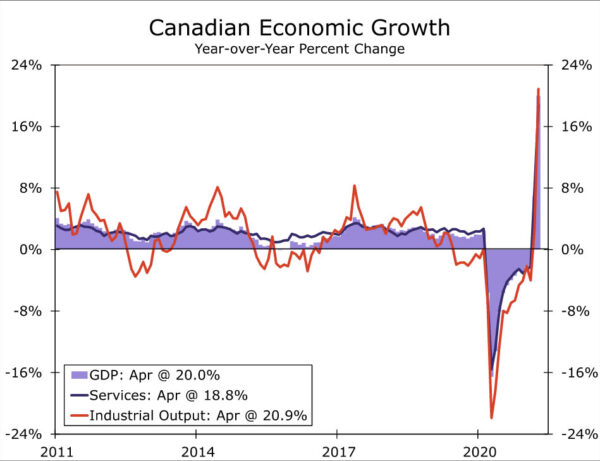

Canada’s Economy Might Be Close to Bottoming Out

The economic news from Canada was steady rather than strong. That said, there are hints from this week’s data the economy may be passing the worst effects of recent COVID-related restrictions, with hopes that GDP growth could soon resume. Canada’s GDP fell 0.3% month-over-month in April, much less than expected, while March was also revised higher to show a gain of 1.3%. In terms of the details, services activity fell 0.6% month-over-month in April, with noticeable declines in retail trade (-5.5%) and accommodation & food services (-4.6%). Manufacturing activity also fell, while mining, quarrying & oil and gas activity rose. With respect to May, Statistics Canada’s early estimate is for a further decline of 0.3% month-over-month. Still, that would mean GDP for the April-May period would be 0.6% above the Q1 average, with hopes that economic growth will soon resume. Overall, we see little in these figures that would alter the central bank’s monetary policy path. We still expect the Bank of Canada to slow its pace of bond purchases further at its July monetary policy meeting.

Economic Sun Still Struggling to Rise in the East

This week’s news from Japan suggests that country’s economic recovery remains in a challenging phase. The Bank of Japan’s Tankan survey—a closely followed barometer of the economy—showed a Q2 increase in the large manufacturers’ diffusion index to +14 from +5 in Q1, a bit less than expected. Meanwhile, the large non-manufacturers’ diffusion index edged only slightly higher to +1 in Q2, from -1 in Q1. Activity data also remained subdued as a state of emergency was in effect in Tokyo, Osaka and surrounding regions during much of the second quarter. May retail sales dipped 0.4% month-over-month, falling further after a 4.6% slump in April. Meanwhile, May industrial output fell 5.9%, more than reversing the gain seen in April. With the Tokyo Olympics scheduled to proceed with limited spectators, even that is unlikely to provide much of a boost to activity in the months ahead. As a result, we expect Japan to be a laggard among the major economies in terms of GDP growth in 2021. Finally, June PMI surveys from China continued to point to an up-and-down performance from that economy through much of this year. The June manufacturing PMI eased broadly as expected, dipping to 50.9, but the services PMI was a negative surprise, unexpectedly declining to 53.5.

International Outlook

Australian Monetary Policy Announcement • Tuesday

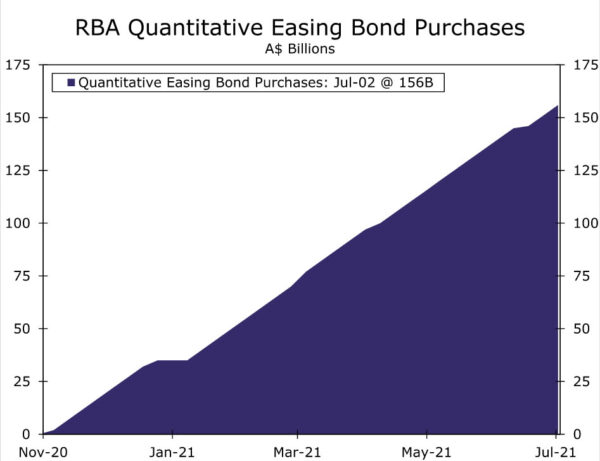

The Reserve Bank of Australia (RBA) announces its latest monetary policy decision next Tuesday, an announcement that will likely be followed more closely than usual, given the RBA has previously signaled it would provide an update on its bond purchase plans.

With respect to its policy interest rate, we see no change and expect the Cash Rate to remain at 0.10%. Regarding the bond purchase plans, we expect the RBA to also maintain the target for three-year government bond yields at 0.10% but to shift the targeted purchase bond for that target to the November 2024 bond. Tactically, we believe it is sensible for the central bank to continue with this program as it is somewhat flexible and contingent in nature and obligates the central bank to an ongoing steady series of bond purchases.

Regarding the central quantitative easing program, we do not expect the RBA to expand purchases beyond the current A$200 billion limit. The economy has shown solid growth during early 2021, and even with multiple COVID outbreaks in recent weeks that could weigh on growth temporarily, we do not see Australia’s economy needing support from ongoing quantitative easing. Our base case is for the RBA to announce the end of quantitative easing by September 2021, as scheduled. We also acknowledge there is a (relatively slight) risk that the central bank could slow the pace of bond purchases, such that the program could continue slightly longer, perhaps until December 2021. In either case, we do not expect the RBA to announce further bond purchases beyond the current A$200 billion target.

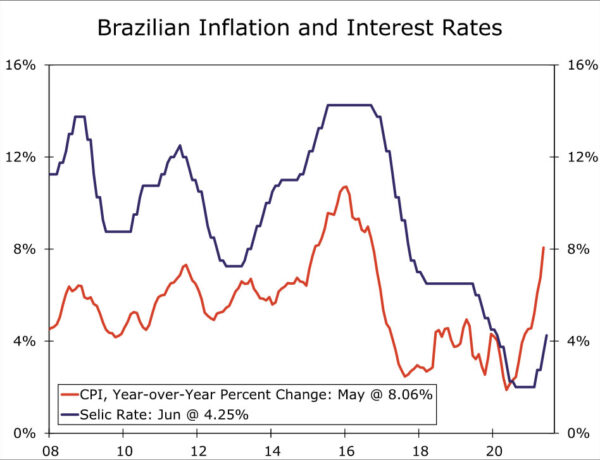

Brazil CPI Inflation • Thursday

Next week’s CPI inflation figures from Latin America will likely support the case for further interest rate increases from the region’s central banks. In Brazil, CPI inflation has risen sharply this year, reaching 8.06% year-over-year in May. Higher prices for electricity and fuel, food, and household goods, have been important drivers of the pickup of inflation. Given the relatively modest increase seen in June 2020, base effects hint at a further quickening in year-over-year inflation in June 2021. Against that backdrop and considering the hawkish bias of Brazil’s central bank, we currently anticipate a 75-bp rate increase, and perhaps more, from the central bank at its early August meeting.

Mexico’s CPI inflation has also been elevated this year, albeit not quite to the same extent. The May CPI rose 5.89% year-over-year, with higher energy prices and core inflation for both food and non-food goods contributing. For June, Mexico’s CPI inflation could ease slightly but will likely remain elevated. Those elevated inflation readings contributed to the Bank of Mexico’s surprise with a 25-bp rate increase at its June announcement. While we expect further tightening in 2021, it’s not clear the next increase will come as soon as the Bank of Mexico’s August meeting.

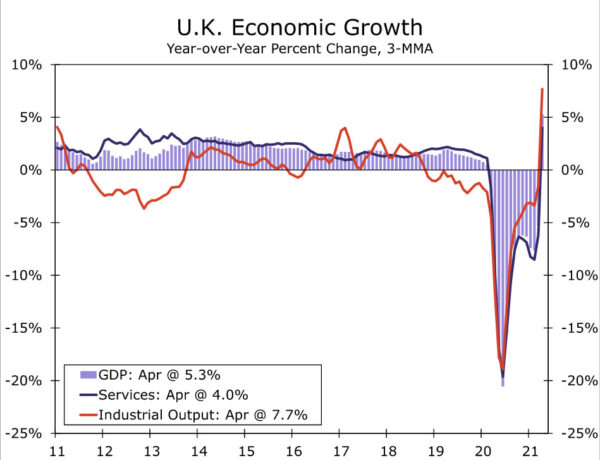

United Kingdom GDP • Friday

After a stumble at the beginning of 2021, the U.K. economy has enjoyed an impressive rebound in recent months, an expansion we think likely continued in May. Since the most recent low in January, U.K. GDP has risen a cumulative 5.2%, including a 2.3% month-over-month gain in April. For May, the consensus forecast is for a further increase in GDP, by a relatively solid 1.9% month-over-month. An expected fall in U.K. May retail sales does point to a somewhat smaller rise in services activity in May than the previous month of 2.0%. Meanwhile, May industrial output is expected to rise by 1.8%.

More recently, the U.K. government paused its reopening plans by around a month, from late June to late July. While that pause could also weigh temporarily on growth, we believe any impact would be modest. In fact, for full-year 2021, we believe the risks to our U.K. GDP growth forecast of 7.0% are tilted to the upside, and we still think the Bank of England is on course to slow the pace of its bond purchases further at its August meeting.

Credit Market Insights

C&I Lending Declines: Not Worth Losing Sleep Over

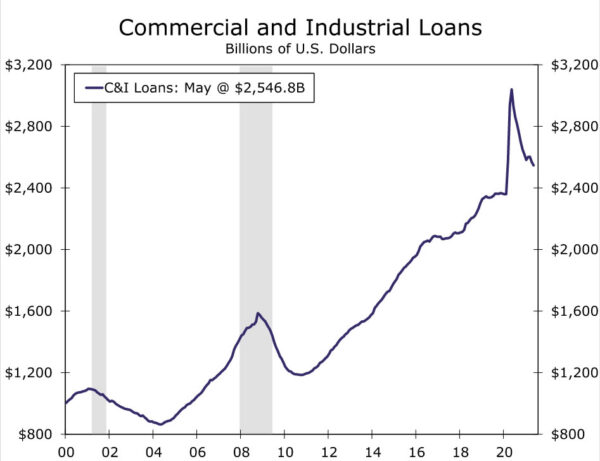

After experiencing double-digit growth in three out of four quarters in 2020, the year-over-year declines seen in commercial & industrial (C&I) lending in April (-12.6%) and May (-16.2%) may look disappointing, but there is no reason to worry yet. Due to base effects, these year-over-year measures are somewhat distorted. The summer months last year saw a surge in lending as businesses rushed to receive Payment Protection Program (PPP) loans. These loans were designed to keep businesses afloat by offering government forgiveness as long as the money was used to keep employees on, pay mortgage interest, rent and utilities. The first round of loans ran from April to August 8, 2020, but through the end of May, SBA data show around 97% of the total first round funding was already distributed. C&I lending data moved in-step with these swings, with the two largest month-over-month gains in its history. Lending in March 2020 jumped 9.2% and surged 14% in April. For reference, the biggest monthly gain before last year was 5.6%, which occurred almost 70 years ago in January 1952. The current level of loans remains elevated at almost 8% above that of February 2020 (see chart).

Unflattering base effects are not the only factor driving the recent declines in C&I lending, as demand has also decreased. According to the Senior Loan Officer Opinion Survey (SLOOS), a modest share of banks reported weaker demand from large and middle-market firms, while demand from small firms was relatively stable. The transition away from bank loans can largely be attributed to healthy balance sheets for small & medium-sized businesses and alternative means of raising capital through the wide-open corporate bond market for larger businesses. Small & medium-sized businesses still have ample liquidity, as checking deposits and currency as well as total time and savings deposits have soared for non-financial non-corporate businesses, and respectively sit at 26.7% and 10.1% above Q1-2020 levels. SLOOS also cited decreases in customer investment in plants or equipment, precautionary demand for liquidity and account receivable needs as reasons for the lower demand.

As firms chip away at savings and need additional funds, there should be a shift to more typical lending patterns. Banks have become significantly more willing to lend this year, with almost 25% reporting an increased willingness to lend in Q1. A moderate share of banks also saw a higher number of inquiries from potential borrowers around availability and terms for new credit lines or increasing existing credit lines.

Topic of the Week

Fourth of July Means Elevated Spirits…and Prices

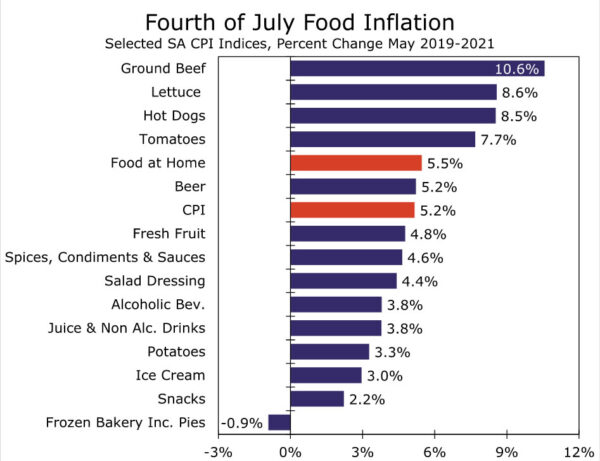

This Independence Day marks the first large gathering for many families and friends after over a year of social distancing. But continuing with the theme of 2021, it will not come cheap. Compared to last year, this year’s cookout may seem like somewhat of a bargain—the American Farm Bureau Federation estimated the average cookout cost for 10 people to be $59.50 in 2021, whereas the 2020 cost was $59.66. However, the more apt comparison is to the pre-pandemic barbecues of 2019, since supply-chain woes started in the spring of 2020, and there were limited gatherings last summer. By this measure, it is clear that prices for cookout essentials remain notably above their pre-pandemic levels, with America’s favorite, the hamburger, topping the list (see chart). Another summer staple, hot dogs, also will cost 8.5% more than pre-pandemic levels. Prices for toppings such as lettuce and tomatoes are elevated as well. Washing down your meal with a cold one will also cost more than pre-COVID, as beer prices have risen by 5.2%. The USDA estimated the cost of a fully-dressed cheeseburger to be $1.89 this May compared to $1.78 in May 2019. Eleven cents may seem small, but it is big in percentage terms and adds up when including extended family, friends and, of course, second helpings.

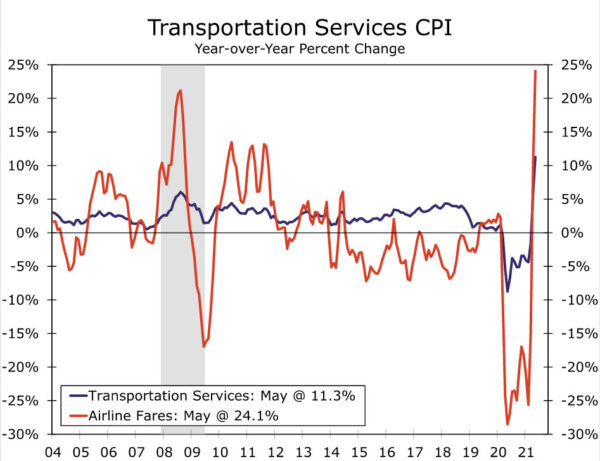

It is not just the celebration itself that will make a dent, but also getting there has become costly. Transportation services prices, which include items such as car rentals, motor vehicle upkeep, public transportation and airfare, have increased significantly since the start of the year and have surpassed pre-pandemic levels by 1.6%. Car and truck rentals have seen the largest increase, as prices were 56.3% higher in May than at the start of the year, but airline fares have also made a steady recovery with prices up 12.4% and have a more significant weighting for the category. The national average price of a gallon of gasoline was $3.13 on July 1 of this year, which is around 40 cents higher than a gallon two years ago. Even the entertainment this year may cost an extra couple of bucks. Disruptions in the global supply chain have left many fireworks suppliers not fully stocked, and increased shipping costs have also had to be passed on to consumers.

Many consumers are likely willing to pay these new prices, especially after having to forego plans last year, but an expensive Independence Day is just a symptom of the higher inflation seen throughout the economy. We expect the CPI to run above 4% year-over-year through the first quarter of 2022, so higher costs, and holidays, will likely stick around in the near-term. But as baseline comparisons and bottlenecks fade, we see a slowdown starting in Q2-2022.