With the Fed’s bombshell still resonating in the markets, all eyes will be on the next edition of nonfarm payrolls. It could single-handedly determine whether investors spend the summer positioning for a withdrawal of cheap money, or whether all that is premature. In the big picture, we seem headed for a period of ECB/Fed divergence, which could ultimately spill over into euro/dollar.

Fed throws a curveball

The Fed caught markets sleeping last week, unleashing all sorts of havoc after it signalled that the era of cheap money is coming to an end. The US economy is strong thanks to the spending packages, with consumption booming and inflation running hot. That’s why policymakers want to get the taper ball rolling, fearful of overheating the economy and being forced to slam on the brakes even harder later.

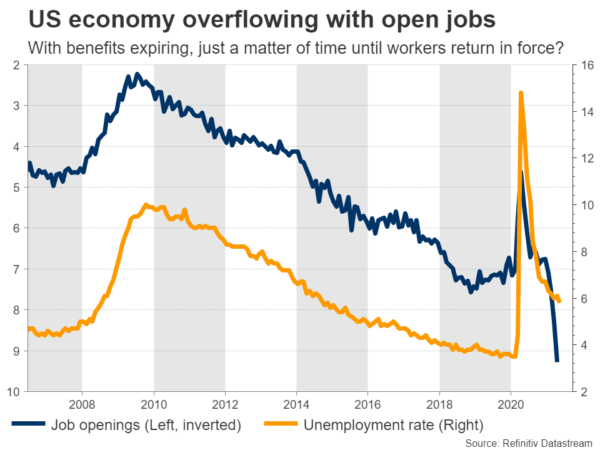

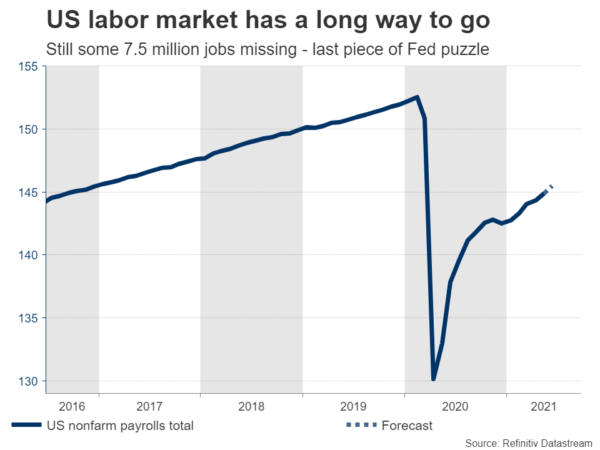

The only worrisome spot is the labor market, which is still far from its pre-crisis glory. Some 7.5 million jobs still need to return for a full recovery. This is the missing piece of the normalization puzzle. That said, the Fed thinks it’s only a matter of time. The economy is overflowing with open jobs and millions of workers could return now that some states have started to cut unemployment benefits.

As things stand, a realistic timeline is that the Fed sends the first major signal for dialing down bond purchases at the Jackson Hole in August, before officially announcing in the autumn that the tapering process will begin by the turn of the year. Of course, all this depends on lost jobs coming back quickly.

So the Fed is trying to take its foot off the accelerator and markets seem to agree, currently pricing in three rate increases by the end of 2023. Meanwhile in Europe, the ECB is moving in the opposite direction. Recent reports suggest the ECB might raise its inflation target, which would essentially signal it intends to keep its foot heavy on the monetary gas for a long time.

All told, we seem to be headed for a period of monetary policy divergence across the major economies. The central banks of America, the United Kingdom, Canada, and New Zealand have all taken baby steps towards exiting cheap money. Ultimately, that could allow their currencies to shine against the low-yielding currencies whose central banks won’t move anytime soon – namely the euro, yen, and franc.

All about nonfarm payrolls

The main event of the week will be the US employment report on Friday. Nonfarm payrolls are expected to clock in at 675k, pushing the unemployment rate slightly lower. Normally this would be a fantastic print, but admittedly, anything below 1 million is unlikely to cause market panic about Fed tightening.

In fact, the tea leaves so far point to some downside risks around the forecast. The Markit composite PMI for June suggested job creation was the slowest in three months as companies struggled to find suitable workers, while initial jobless claims rose during the NFP survey week.

We’ll get a better sense of how the labor market performed on Wednesday, when the ADP jobs report is out. Then on Thursday, the ISM manufacturing index will hit the markets. The ISM services index won’t be released until after the payrolls report, so traders will have one fewer jobs indicator at their disposal this time.

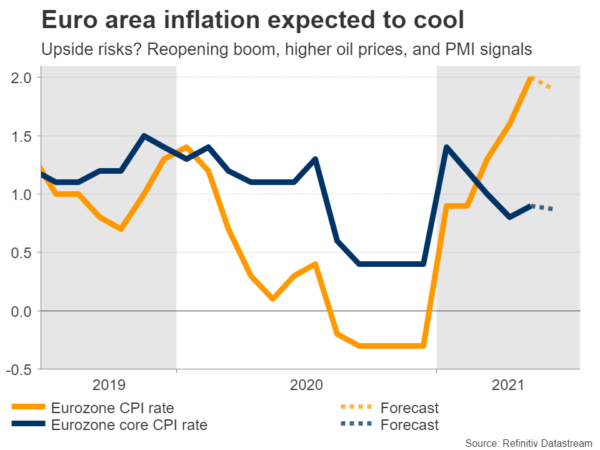

Euro area inflation on the radar

Over in Europe, Germany’s inflation numbers for June out on Tuesday will give us a taste of what to expect from the Eurozone-wide data on Wednesday. Then the bloc’s latest unemployment stats will see the light on Thursday.

Forecasts point to a minor slowdown in annual inflation, which would be strange. Oil prices have risen substantially and the European economy is currently enjoying a reopening boom, with PMI surveys pointing to phenomenally strong inflationary pressures in June.

Even in case of an upside surprise though, the ECB is unlikely to get excited. Policymakers have stressed that like everywhere, Europe will experience higher inflation because of supply problems, which are likely to fade in time. In fact, the central bank is seriously considering raising its inflation target to signal it will tolerate higher inflation.

As things stand, the ECB will probably be among the last to exit negative rates. The economy is currently riding the reopening momentum, but it is unclear whether that boost will persist. Fiscal spending in Europe hasn’t been as impressive as in America this year, and with another US infrastructure bill coming, this divergence could grow further.

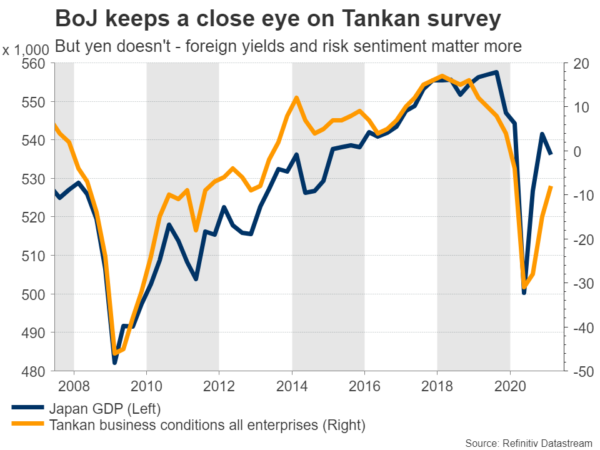

Japan’s Tankan survey unlikely to shake yen

In the land of the rising sun, there’s a flurry of data coming up, starting with employment and retail sales numbers for May on Tuesday. Then on Thursday, all eyes will turn to the Bank of Japan’s Tankan business survey for Q2.

All of the Tankan indices are expected to have risen significantly, signalling greater business confidence, which will be great news for the BoJ. That said, the yen doesn’t react to economic data anymore.

Instead, the currency’s fate hangs on two variables – foreign interest rates and the mood in financial markets. As such, it seems like a difficult environment for the yen going forward. Several foreign central banks have started teasing normalization, yet the BoJ won’t follow, and stock markets are currently in a euphoric mood.

Loonie turns its sights to OPEC meeting

Finally, it will be an interesting week for the Canadian dollar. The nation’s GDP growth data for April will see the light on Wednesday, before the OPEC+ meeting on Thursday that will decide the fortunes of oil prices.

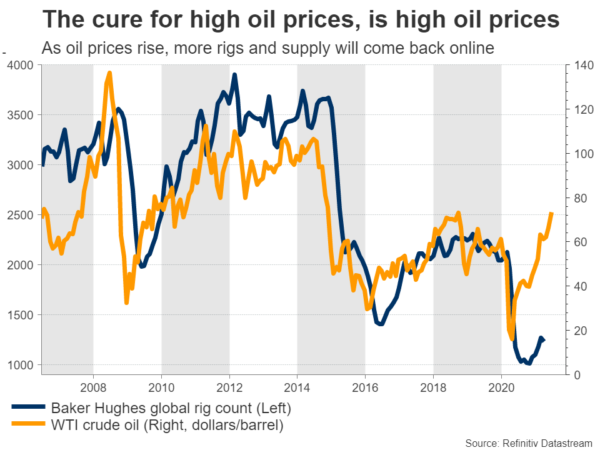

Recent reports suggest the oil cartel will signal further production increases, bringing back online around 500k more barrels per day from August onwards. The relentless rally in oil prices is giving the producers confidence that the market can absorb some targeted supply increases.

The question for crude prices and the oil-sensitive loonie is exactly how big the production increase will be. If it’s just the 500k that’s already been reported, oil prices could even rise. If it’s significantly more, the market might stumble, but perhaps not for long. Demand is strong and with another US infrastructure bill coming, the picture seems positive.

Instead, what happens with the US-Iran nuclear negotiations may be more important. Those talks have stalled lately but there’s still a possibility of a diplomatic breakthrough over the summer, which represents the real risk for crude.