- Fed’s normally dovish Bullard sees 2022 rate hike, Wall Street crumbles

- Rout stretches on but dollar rally eases, gold catches a bid

- Markets dreading key Fed speakers this week including Powell

US yield curve flattens, roils markets

The US yield curve flattened further on Monday as investors continued to adjust their rate hike bets, steepening the short end of the curve while pushing long-term borrowing costs sharply lower. Markets are still coming to terms with last week’s FOMC bombshell when Fed policymakers signalled two rate hikes in 2023 – a massive shift compared to earlier projections when no rate increases were forecast before 2024.

But the cherry on the cake came on Friday when St. Louis Fed President James Bullard told CNBC that he’s pencilling in an even earlier rate hike – for late 2022. Bullard, who is considered to be one of the Fed’s more dovish policymakers, is not a voting FOMC member this year but will be in 2022. His comments sent shares on Wall Street spinning lower, pulling the Dow Jones down by 1.6% at the close and the S&P 500 by 1.3%. However, the tech-heavy Nasdaq Composite took comfort by the slump in long-term yields, falling by a more moderate 0.9%.

After a knee-jerk spike on Wednesday, the yields on 10- and 30-year Treasury notes have since tumbled as investors have become less concerned about persistently high inflation following the Fed’s hawkish turn. Inflation expectations have declined substantially since the FOMC meeting and the moves at the long end of the curve reflect this.

The fallout from the possibility of a Fed rate hike in 2022 spread to Asia on Monday, with Tokyo’s Nikkei 225 index plunging by 3.3%. However, there are already signs that the panic is subsiding and US stock futures turned positive as European trading got underway, lifting most of Europe’s major bourses.

Dollar slips from highs, gold perks up

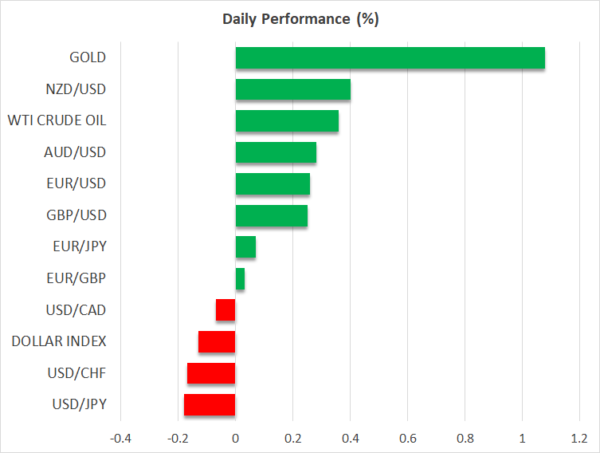

In the currency markets, the US dollar’s near 2% surge post the Fed meeting lost some steam on Monday, providing some respite for its heavily battered peers. The dollar index edged slightly below Friday’s two-month highs as the euro and pound gained about 0.2%. The safe-haven yen and Swiss franc were mixed, suggesting the rebound in risk appetite was weak contrary to the positive signals from US equity futures.

Nevertheless, the risk-sensitive Australian and New Zealand dollars bounced back quite solidly today even as some commodities like iron ore came under pressure.

However, it was a positive day for oil and gold. WTI and Brent crude futures extended their gains on Monday as the chances of the United States and Iran striking a new nuclear deal were seen as lessening after a hardliner was elected as Iran’s president on Friday.

Meanwhile, the precious metal jumped by more than 1%, climbing above $1,780/oz as it was boosted from the dollar’s slight pullback as well as of course by long-dated Treasury yields getting crushed.

Fed speakers could direct the next moves

Whether gold’s rebound can turn into something more sustainable will depend a lot on which way the greenback goes in the coming days and that will likely be determined by what Fed officials lined up to speak this week say.

Dallas Fed President Robert Kaplan is due to join Bullard in an Official Monetary and Financial Institutions Forum at 13:30 GMT. New York Fed President John Williams will also speak today at 19:00 GMT. But all eyes will be on Chair Jerome Powell when he testifies before the House Select Subcommittee on the coronavirus crisis tomorrow at 18:00 GMT.

Ahead of all that, ECB President Christine Lagarde might stir the euro when she testifies before the European Parliament at 14:15 GMT, while the pound may struggle to find any momentum of its own before the Bank of England policy meeting on Thursday.