Summary

Consumer price inflation continued to rip higher in May, with prices rising 0.6% and the year-over-year rate leaping to 5.0%. A handful of categories most closely tied to the reopening of the service sector and supply bottlenecks once again accounted for an outsized share of the rise. But don’t fully wave away May’s strength. The long awaited pickup in housing costs has arrived, which will support firm gains even after the current surge of pent-up demand and the most acute supply issues subside.

New Gain, Same Main Drivers

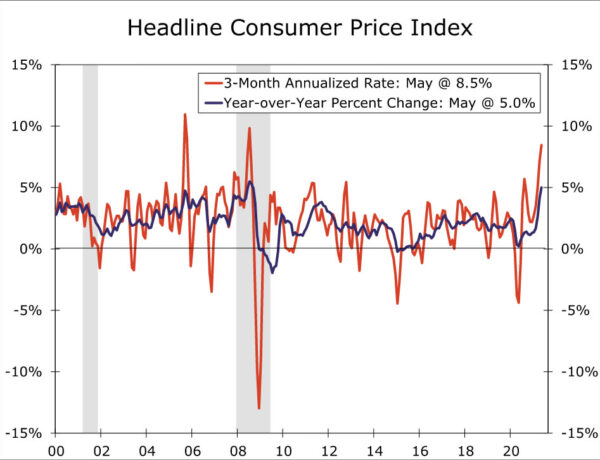

Consumer price inflation continued to tear higher in May, with prices up 0.6%. Over the past three months, prices are up at a 8.5% annualized rate and illustrate that the jump in the year-ago rate of inflation is being driven by more than easy base comparisons after last spring’s lockdowns. Headline CPI is up 5.0% over the past year, while core inflation, which excludes what is usually the most volatile components—food and energy, is up 3.8%. That’s the largest one-year gain in 28 years.

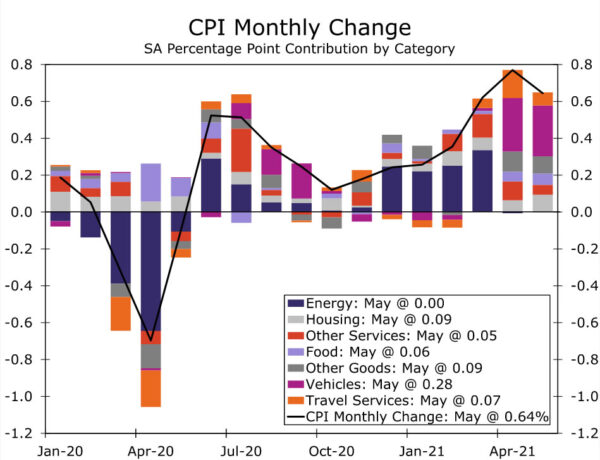

But similar to April, much of May’s increase in prices can be traced to a handful of small components currently at the center of reopenings and supply shortages (see chart). For example, airfares were up 7.0%, rental car prices jumped another 12.1% and hotel prices inched higher. Apparel prices rose 1.2% as we now have places to go but nothing fit to wear. And new and used vehicle prices were up 1.6% and 7.3%, respectively, as semiconductor shortages have continued to impact new production and ripple down stream.

The outsized gains in a few select sectors support the Fed’s view that the current degree of price pressures are temporary. However, we see signs of inflationary pressures broadening out, which we believe will keep monthly price gains from merely falling back to their pre-pandemic trend after the current flurry of activity.

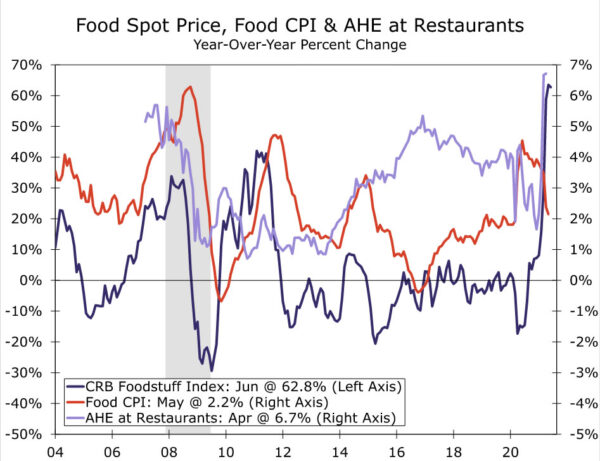

Food prices rose 0.4% last month and further strength lies ahead. Restaurants and groceries are facing a double whammy with food and labor costs. Agricultural commodity prices are up about 60% over the past year and are sitting at a decade high, while average hourly earnings at restaurants has soared at a 24.4% annualized rate the past three months (see chart).

The long awaited pickup in housing costs after scorching price increases in the purchase market is also starting to manifest. Owner’s equivalent rent (OER) rose 0.3%, which was the largest gain since mid-2019. OER accounts for 30% of the core CPI and 24% of the headline measure, so a sustained turnaround in this component will supply another sizable boost to inflation. There were signs of firming in rental prices as well. Rents rose 0.2% (0.24%), the strongest monthly increase since the pandemic struck and consistent with the continued rise in market measures of daily asking rents beginning to feed into the Consumer Price Index.

More to Come

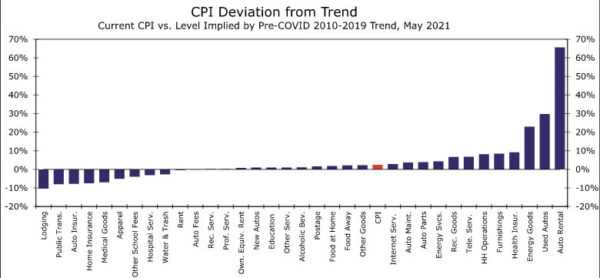

The head-turning monthly gains in inflation are not done, in our view. The price level for some categories benefiting hugely from social distancing falling by the wayside, such as airfares, hotels, apparel and auto insurance, remain below levels predicted by their pre-COVID trends (see chart). That comes as the overall price level is 2.5% above its pre-pandemic trendline, suggesting that there has already been a shift to a higher inflation environment and recent gains are more than simply “catch up.”

We expect headline CPI to run over 4% on a year-ago basis between now and the first quarter of next year. Tougher base comparisons after this spring’s leap along with easing bottlenecks as demand cools and supply chains adjust should lead to a slowdown beginning in the second quarter of next year. Yet we expect inflation to continue on at a pace that would be consistent with the core PCE deflator remaining “moderately above 2%” through the end of 2022. Longer-term inflation expectations have moved higher in light of the recent spurt in price growth and, along with the Fed’s more patient policy framework, point to inflation settling somewhat higher than the past cycle.

The recent onslaught of consumer price inflation and strengthening wage gains will likely push the FOMC to “talk about talking about” tapering at its meeting next week. But that doesn’t mean plans to scale back asset purchases are imminent. Given the unique factors currently driving up inflation, we believe the Fed still wants a clearer view on how the dust will settle—or will not settle—on inflation later this year, and see the recovery in payrolls move further along.