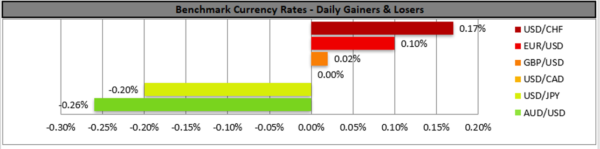

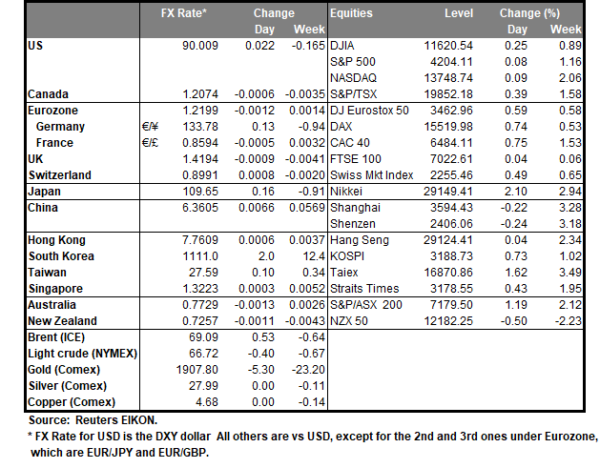

The USD strengthened temporarily on Friday against a basket of other currencies, after higher-than-expected inflation measures were released and thus expectations for the Fed to taper its QE program intensified with attention now turning to May’s US employment report, due out on Friday. Aussie traders turn their attention to the release of the RBA’s interest rate decision and the bank is widely expected to remain on hold at 0.10%, should the bank’s tone be tilted to the dovish side in Governor Lowe’s accompanying statement, we may see the Aussie weakening. The Looney tended to resist USD’s strengthening yet CAD traders turn their attention to today’s financial releases and OPECs meeting tomorrow. Oil prices tend to remain high ahead of the OPEC meeting tomorrow, where a possible easing of production quotas is to be discussed. Gold prices reach an almost 5-month high benefiting from the weak USD and given that US yields seem to retreat as the 10-year reached 1.581%.

EUR/USD dropped on Friday as the USD strengthened, yet recovered its losses, floating over the 1.2175 (S1) support line. We would require a clear breaking of the upward trendline incepted since the 1st of April in order to fully adopt a sideways bias, and it seems about to happen, given also the low volatility of the pair for the past two days, with the exception of Friday’s American session. Should the bulls regain control over the pair’s direction we may see it breaking the 1.2275 (R1) resistance line and aim for the 1.2350 (R2) level. Should the bears take over, we may see the pair breaking the 1.2175(S1) support line and aim for the 1.2100 (S2) support level.

USD/CAD continued to test the 1.2060 (S1) support line without being able to break it and the pair remained comfortably in a sideways motion between the 1.2060 (S1) support line and the 1.2140 (R1) resistance line. We intend to maintain our bias for a sideways movement as long as the pair remains between the prementioned levels and given that the RSI indicator below our four-hour chart runs along the reading of 50, implying a rather indecisive market. Should the pair find fresh buying orders along its path, we may see it breaking the 1.2140 (R1) resistance line and aim for the 1.2230 (R2) level. On the other hand, should a selling interest be displayed by the market, we may see the pair breaking the 1.2060 (S1) support line and aim for the 1.1995 (S2) level.

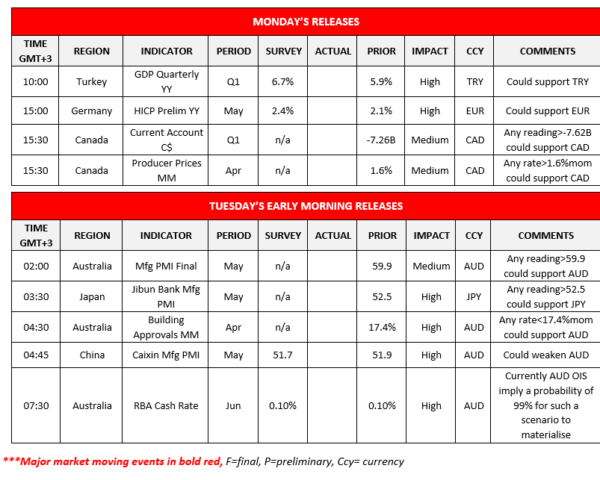

Other economic highlights today and the following Asian session:

Please note that during today’s European session, we get Germany’s preliminary HICP rate for May. In the American session, we get from Canada the current account balance for Q1 and the producer prices for April. During tomorrow’s Asian session, we note Australia’s final PMI figures for May, Japan’s Jibun bank manufacturing PMI for May, Australia’s Building approvals growth rate for April, China’s Caixin manufacturing PMI for May and finally from Australia RBA’s interest rate decision.

As for the rest of the week:

On Tuesday, we get UK’s nationwide house prices for May, Switzerland’s GDP rate for Q1, Eurozone’s final HICP rate for May, Canada’s GDP rate for Q1 and from the US the ISM manufacturing PMI for May. On Wednesday, we get Australia’s GDP rate for Q1, Germany’s retail sales, Eurozone’s producer prices and Canada’s building permits, all for April. On Thursday, we get Australia’s retail sales and trade balance both for April, China’s Caixin services PMI for May, France’s, Eurozone’s, Germany’s and UK’s final services and composite PMI readings for May, the US ADP employment figure for May, the US weekly initial jobless claims figure and the ISM non-manufacturing PMI for May. On Friday, we get Eurozone’s retail sales for April, the US Employment report for May and Canada’s employment data for May as well as the US factory orders for April, while the Fed’s Chairman Jerome Powell is scheduled to speak.

Support: 1.2175 (S1), 1.2100 (S2), 1.1990 (S3)

Resistance: 1.2275 (R1), 1.2350 (R2), 1.2445 (R3)

Support: 1.2060 (S1), 1.1995 (S2), 1.1920 (S3)

Resistance: 1.2140 (R1), 1.2230 (R2), 1.2320 (R3)