Summary

The 1.3% drop in durable goods orders in April reflected supply chain issues continuing to snarl up auto production and a sharp drop in defense spending. Hidden under the headline was an impressive 2.3% increase in core capital goods orders in a sign that broad capacity constraints are supporting new investment. That could take the edge off some recent inflationary pressures and support the Fed’s view that the current pace of inflation is temporary, and that the supply side of the economy will adjust to meet the impressive demand environment.

Defense Spending Cuts & Motor Vehicles to Blame for Decline

Durable goods orders were pulled lower by a sharp 25.8% decline in defense spending along with some weakness in sectors that might be feeling the pinch from various supply chain shortages like motor vehicles as well as electrical equipment. That said, the supply chain headaches are having a mixed effect on durable goods orders.

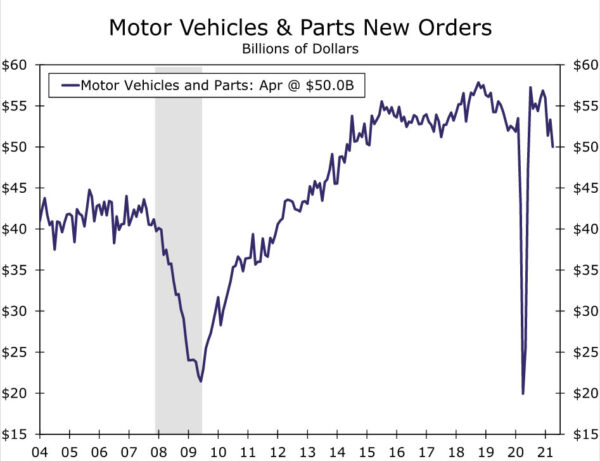

While many sectors struggle to source the materials they need, the shortages of semiconductors is one of the most prevalent. Electrical equipment orders slipped another 0.9% in April after a modest decline in March. Because these chips have long production times and serve specific functions, they can quickly gum up production. Without the ability to substitute and differing approaches to inventories, some industries are more vulnerable than others. Take autos, for example; in a recent report we found that semiconductors comprise just 1.3% of the overall inputs for motor vehicles, but that small share can halt production as recent announcements about stoppages from major domestic automakers have been in the news in recent week. Orders for motor vehicles & parts fell 6.2% in April and auto shipments fell 6.5%.

Working the Core

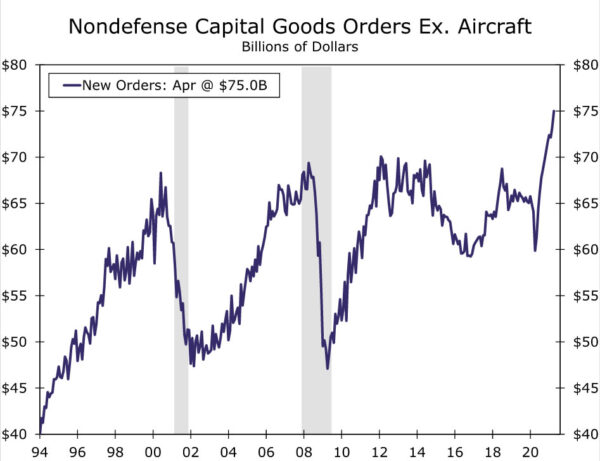

Struggles to secure parts and materials has generated an acute blow to the auto sector, but broad concerns over capacity and the ability of the supply-side of the economy to meet demand appears to be spurring new investment. Beneath today’s disappointing headline was an impressive beat in core capital goods spending. Nondefense capital goods orders excluding aircraft rose 2.3% in April, and was made all the more impressive by the gain coming on top of an upward revision to March. Rather than easing up as we move further away from the mechanical bounce of an initial recovery, the pace of core capital goods orders is picking up, and orders have blown well past the highs of previous cycles.

The strong performance of capex spending should contribute to current inflation pressures dissipating ahead, and support the Fed’s current thinking that the supply-side of the economy will adjust and bottlenecks should ease over time.

Good Problems to Have…But Frustrating for Production Outlook

The fact that both core capital goods orders and shipments are growing is a positive development, although orders outpacing shipments may also be another clue that material, parts and labor shortages could be holding up deliveries.

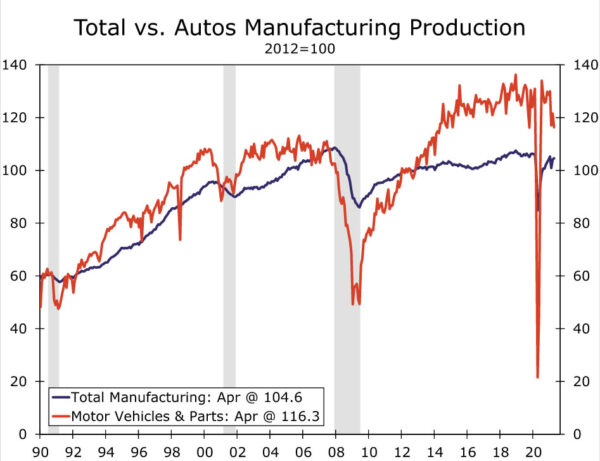

The coming months will likely highlight the shortages and imbalances in our view and cause some of these bottlenecks to hold up production. Once again, motor vehicles production is likely to be the poster-child of this dynamic. Steady demand has led autos to outpace broader manufacturing output in recent years and particularly over the past year amid the pandemic. The stoppages this summer could have the opposite effect.

To the extent that the recent quickening in core capital goods orders signals a ramping up in equipment investment to address supply constraints, there may be a broadening in the base of manufacturing output which could offset some of the expected drag from motor vehicle production.