- Fed’s Quarles joins Clarida in signalling taper debate may start soon, but yields rise only slightly

- Prospect of less stimulus keeps dollar supported near one-week high as stocks struggle

- Taper signals thwart gold’s bid above $1,900/oz, Oil weighed by possible Iran supply boost

No tantrum but markets take note of Fed shift

Speculation that the Federal Reserve is edging closer to discussing a reduction in the pace of asset purchases dampened the market mood slightly on Thursday, though the lack of fresh catalysts also contributed to the lacklustre trading.

Fed Governor Randal Quarles became the latest senior Fed official to suggest that policymakers may soon have to stop ‘thinking about thinking about’ and actually start thinking about tapering. It follows similar comments by Vice Chair Clarida on Tuesday. However, Quarles did also clarify that the Fed is still “significantly short on measures for substantial further progress”, reinforcing the view that any shift in policy is several meetings away at the earliest.

His comments helped US yields move further away from yesterday’s lows, with the 10-year Treasury yield reaching 1.59% at the start of European trading on Thursday. But nevertheless, long-term yields remain far below their March peaks and there’s no sense of panic at all in bond markets about a soon-to-have taper debate at the Fed.

Mixed day for stocks

Hence, there’s limited fallout at this stage in the broader markets and a mostly positive open for European equities indicated risk sentiment might be improving after a mixed session in Asia. US stock futures were in the red, however, dragged lower by tech shares, which have been underperforming lately.

Rising inflation and the possibility of less central bank stimulus in the next few months could continue to dent the appeal of big tech stocks suffering from exorbitant valuations. E-mini futures for the Nasdaq Composite were last down 0.4%, while S&P 500 futures were trading 0.15% lower.

On the whole, investors have so far been able to manage their concerns about surging inflation and QE tapering and are putting their faith in the Fed when it says that the price spikes will be temporary.

US-China trade back in focus; oil eyes Iran deal

However, there is also some renewed unease about US-China ties, which have come back in the spotlight as Trump’s Phase 1 trade deal is set to expire at the end of this year. Representatives from both sides held talks on Wednesday and while there doesn’t seem to be much of a risk of a major flare-up in trade tensions in the near term, neither is there any sign of relations heading in the right direction. The White House’s top official for Asian affairs on Wednesday said the US is entering a period of “intense competition” with China, signalling there will be no let-up in the trade dispute under the Biden administration.

Fears of escalating tensions may be providing some support to gold, which has slipped back below the $1,900/oz level as Treasury yields rebound. However, the precious metal’s upward trajectory is safe for now, though the same cannot be said for oil. WTI futures have been capped below $67 a barrel since March and with the possibility that Iran may increase its supply soon, it’s doubtful if the rise in demand from the reopening of the world economy will be able to offset that.

The outcome of the talks between Iran and the US on salvaging the nuclear deal will likely affect the OPEC+ decision next week if there’s an announcement before then.

Dollar holds firm, euro steadier, fresh lockdown woes for aussie

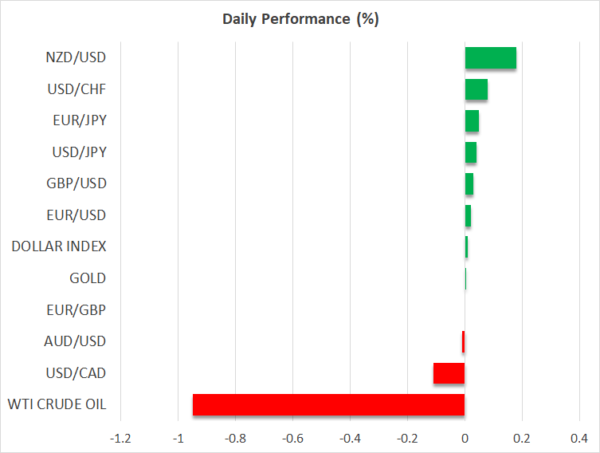

In currency markets, the US dollar was holding onto yesterday’s gains, with its index against a basket of currencies trading marginally higher. The euro, which came under pressure on Wednesday from fresh ECB comments downplaying a tapering move in June, steadied around $1.2190, while the pound was struggling to halt its downward drift and was last quoted at $1.4117.

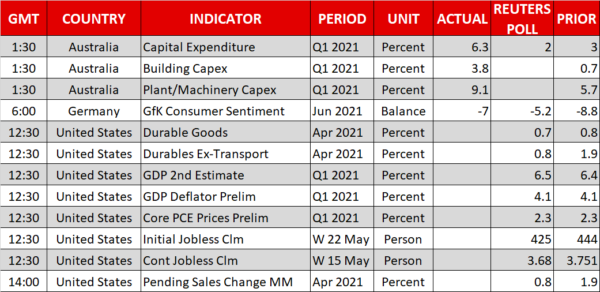

The New Zealand dollar was testing the $0.73 level again today, having jumped on Wednesday after the RBNZ hinted that it will normalize policy next year. But the aussie was flat, handing back earlier gains on the back of better-than-expected capital expenditure numbers for Q1 out of Australia, as it was weighed by a fresh 7-day lockdown for the state of Victoria.