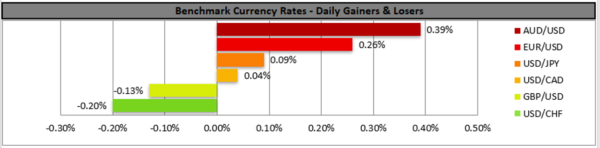

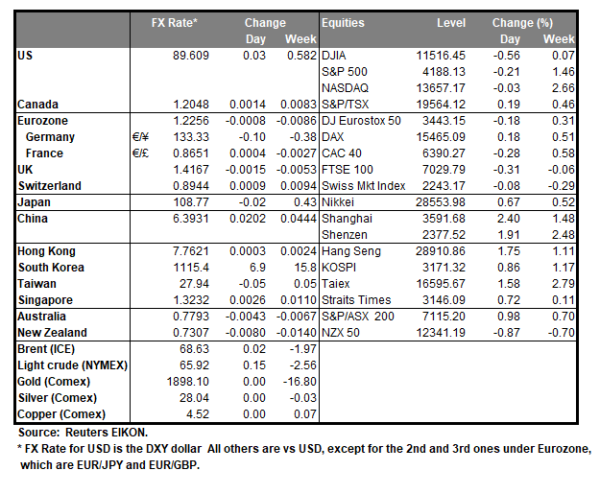

USD continued to remain near a 4 month low level against a basket of other currencies yesterday, as the Fed’s dovish tone was ever present while US Stockmarkets tended to weaken, given the drop of all three major indexes (Dow Jones, S&P 500 and Nasdaq), while gold prices continued to benefit from a weaker greenback. Fed’s policymakers maintained the bank’s dovish tone, viewing inflationary pressures as transient, keeping the USD under selling pressure. It’s characteristic that Chicago Fed President Evans stated that he has not seen anything yet that would persuade him to change his full support for the Fed’s accommodative stance, while San Francisco Fed President Daly stated that monetary policy is in a good place and we need to be patient. It should be noted that US yields remained at rather low levels and the US 10-year yield almost reached May’s lowest point, undermining USD. In the lack of US high impact financial releases today we expect fundamentals to take the lead in shaping the market’s mood.

EUR/USD continued to rise yet seems to find some resistance as it approaches the 1.2275 (R1) resistance line. We tend to maintain our bullish outlook for the pair as long as it remains above the upward trendline formed since the 5th of April. Please note that the RSI indicator is above the reading of 50 in our 4-hour chart, confirming the presence of the bulls, yet there is also a slightly downward inclination, which if continued could imply a reversal of the market’s mood. Should the bulls continue to dominate the pair’s price action, we may see EUR/USD breaking the 1.2275 (R1) resistance line and aim for the 1.2350 (R2) level. If the bears take over, we may see the pair breaking the 1.2175 (S1) line and aim for the 1.2100 (S2) support level.

Kiwi jumps at RBNZ’s interest rate decision

NZD jumped around 44 pips against the USD, upon release of RBNZ’s interest rate decision and continued higher for the next 2 hours. The bank maintained its official cash rate (OCR) unchanged as was widely expected at 0.25% as well as its Large Scale Asset Purchase and Funding for Lending programs. In its accompanying statement the bank stated that it will maintain its current stimulatory monetary settings until it is confident that consumer price inflation will be sustained near the 2 percent per annum target midpoint, and that employment is at its maximum sustainable level. Yet it seems that the bank’s economic projections may imply that the OCR may rise in the second half of 2022, according to some analysts, which may have taken the markets by surprise. It should be noted though that RBNZ Governor Adrian Orr downplayed the importance of the projections in his press conference by stating that they are highly conditional, and also noted that inflationary pressures are expected to be temporary. We expect that the monetary policy outlook as formed after the decision may continue to support the Kiwi on a fundamental level.

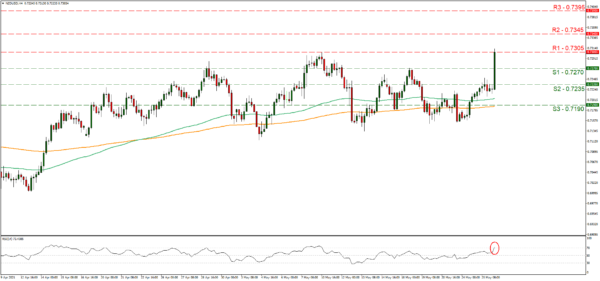

NZD/USD jumped during today’s Asian session, breaking consecutively the 0.7235 (S2) and the 0.7270 (S1) resistance line, both now turned to support and continued higher to test the 0.7305 (R1) resistance level. The bullish tendencies may be continued yet the RSI indicator below our 4-hour chart, has reached the reading of 70, which may imply that the trading instrument is overbought and a correction lower is possible. Should the pair find fresh buying orders along tis path we may see NZD/USD breaking the 0.7305 (R1) resistance line, which capped the pair’s upward movement on the 10th of May and start aiming for the 0.7345 (R2) resistance level. Should a correction lower take place and be transformed to a selling interest, we may see the pair breaking the 0.7270 (S1) support line and aim for the 0.7235 (S2) level.

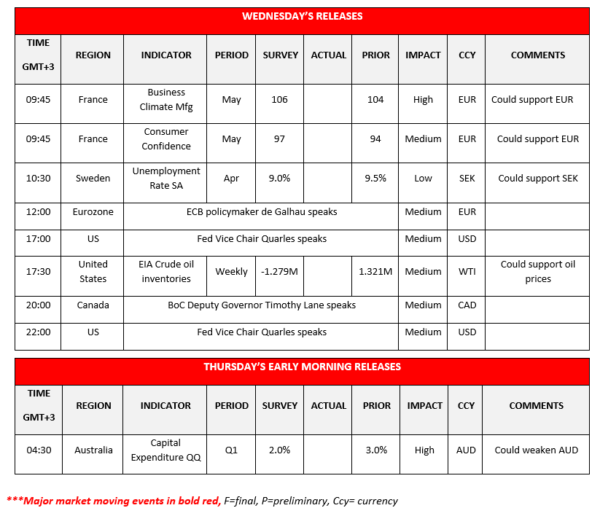

Other economic highlights today and the following Asian session:

Today during the European session, we note the release of the France’s Business climate and consumer confidence for May while in the American session, we get the US EIA crude oil inventories figure. During tomorrow’s Asian session we get Australia’s Cap. Ex. Growth rate for Q1.

Support: 1.2175 (S1), 1.2100 (S2), 1.1990 (S3)

Resistance: 1.2275 (R1), 1.2350 (R2), 1.2445 (R3)

Support: 0.7270 (S1), 0.7235 (S2), 0.7190 (S3)

Resistance: 0.7305 (R1), 0.7345 (R2), 0.7395 (R3)